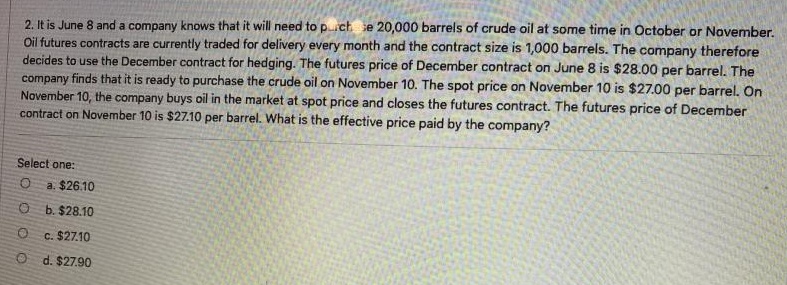

2. It is June 8 and a company knows that it will need topch e 20,000 barrels of crude oil at some time in October or November. Oil futures contracts are currently traded for delivery every month and the contract size is 1,000 barrels. The company therefore decides to use the December contract for hedging. The futures price of December contract on June 8 is $28.00 per barrel. The company finds that it is ready to purchase the crude oil on November 10. The spot price on November 10 is $27.00 per barrel. On November 10, the company buys oil in the market at spot price and closes the futures contract. The futures price of December contract on November 10 is $27.10 per barrel. What is the effective price paid by the company? Select one: O a $26.10 O b.$28.10 c. $27.10 O d. $27.90

2. It is June 8 and a company knows that it will need topch e 20,000 barrels of crude oil at some time in October or November. Oil futures contracts are currently traded for delivery every month and the contract size is 1,000 barrels. The company therefore decides to use the December contract for hedging. The futures price of December contract on June 8 is $28.00 per barrel. The company finds that it is ready to purchase the crude oil on November 10. The spot price on November 10 is $27.00 per barrel. On November 10, the company buys oil in the market at spot price and closes the futures contract. The futures price of December contract on November 10 is $27.10 per barrel. What is the effective price paid by the company? Select one: O a $26.10 O b.$28.10 c. $27.10 O d. $27.90

Chapter21: Risk Management

Section: Chapter Questions

Problem 2P

Related questions

Question

please help fast

Transcribed Image Text:2. It is June 8 and a company knows that it will need to pich e 20,000 barrels of crude oil at some time in October or November.

Oil futures contracts are currently traded for delivery every month and the contract size is 1,000 barrels. The company therefore

decides to use the December contract for hedging. The futures price of December contract on June 8 is $28.00 per barrel. The

company finds that it is ready to purchase the crude oil on November 10. The spot price on November 10 is $27.00 per barrel. On

November 10, the company buys oil in the market at spot price and closes the futures contract. The futures price of December

contract on November 10 is $27.10 per barrel. What is the effective price paid by the company?

Select one:

a. $26.10

O b.$28.10

O c. $27.10

O d. $27.90

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT