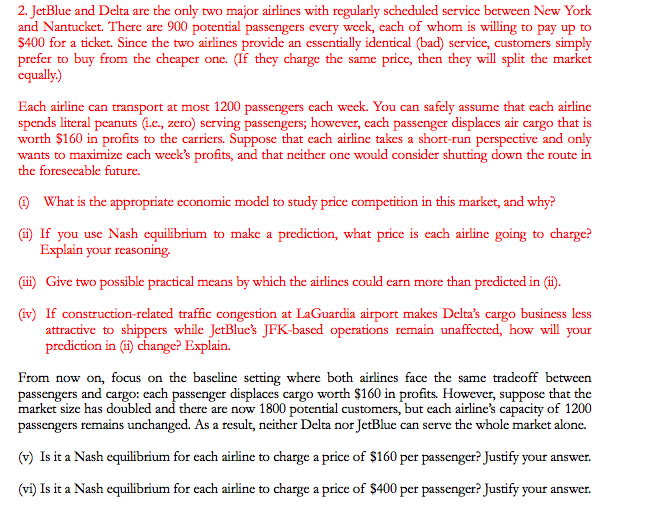

2. JetBlue and Delta are the only two major airlines with regularly scheduled service between New York and Nantucket. There are 900 potential passengers every week, each of whom is willing to pay up to $400 for a ticket. Since the two airlines provide an essentially identical (bad) service, customers simply prefer to buy from the cheaper one. (If they charge the same price, then they will split the market equally.) Each airline can transport at most 1200 passengers each week. You can safely assume that each airline spends literal peanuts (i.e., zero) serving passengers; however, each passenger displaces air cargo that is worth $160 in profits to the carriers. Suppose that each airline takes a short-run perspective and only wants to maximize each week's profits, and that neither one would consider shutting down the route in the foreseeable future. (1) What is the appropriate economic model to study price competition in this market, and why? (i) If you use Nash equilibrium to make a prediction, what price is each airline going to charge? Explain your reasoning. (iii) Give two possible practical means by which the airlines could earn more than predicted in (ii).

2. JetBlue and Delta are the only two major airlines with regularly scheduled service between New York and Nantucket. There are 900 potential passengers every week, each of whom is willing to pay up to $400 for a ticket. Since the two airlines provide an essentially identical (bad) service, customers simply prefer to buy from the cheaper one. (If they charge the same price, then they will split the market equally.) Each airline can transport at most 1200 passengers each week. You can safely assume that each airline spends literal peanuts (i.e., zero) serving passengers; however, each passenger displaces air cargo that is worth $160 in profits to the carriers. Suppose that each airline takes a short-run perspective and only wants to maximize each week's profits, and that neither one would consider shutting down the route in the foreseeable future. (1) What is the appropriate economic model to study price competition in this market, and why? (i) If you use Nash equilibrium to make a prediction, what price is each airline going to charge? Explain your reasoning. (iii) Give two possible practical means by which the airlines could earn more than predicted in (ii).

Managerial Economics: A Problem Solving Approach

5th Edition

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Chapter16: Bargaining

Section: Chapter Questions

Problem 16.1IP

Related questions

Question

Transcribed Image Text:2. JetBlue and Delta are the only two major airlines with regularly scheduled service between New York

and Nantucket. There are 900 potential passengers every week, each of whom is willing to pay up to

$400 for a ticket. Since the two airlines provide an essentially identical (bad) service, customers simply

prefer to buy from the cheaper one. (If they charge the same price, then they will split the market

equally.)

Each airline can transport at most 1200 passengers each week. You can safely assume that each airline

spends literal peanuts (i.e., zero) serving passengers; however, each passenger displaces air cargo that is

worth $160 in profits to the carriers. Suppose that each airline takes a short-run perspective and only

wants to maximize each week's profits, and that neither one would consider shutting down the route in

the foreseeable future.

(1) What is the appropriate economic model to study price competition in this market, and why?

(ii) If you use Nash equilibrium to make a prediction, what price is each airline going to charge?

Explain your reasoning.

(iii) Give two possible practical means by which the airlines could earn more than predicted in (ii).

(iv) If construction-related traffic congestion at LaGuardia airport makes Delta's cargo business less

attractive to shippers while JetBlue's JFK-based operations remain unaffected, how will your

prediction in (i) change? Explain.

From now on, focus on the baseline setting where both airlines face the same tradeoff between

passengers and cargo: each passenger displaces cargo worth $160 in profits. However, suppose that the

market size has doubled and there are now 1800 potential customers, but each airline's capacity of 1200

passengers remains unchanged. As a result, neither Delta nor JetBlue can serve the whole market alone.

(v) Is it a Nash equilibrium for each airline to charge a price of $160 per passenger? Justify your answer.

(vi) Is it a Nash equilibrium for each airline to charge a price of $400 per passenger? Justify your answer.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Economics: A Problem Solving Approach

Economics

ISBN:

9781337106665

Author:

Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:

Cengage Learning

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:

9781337106665

Author:

Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:

Cengage Learning

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning