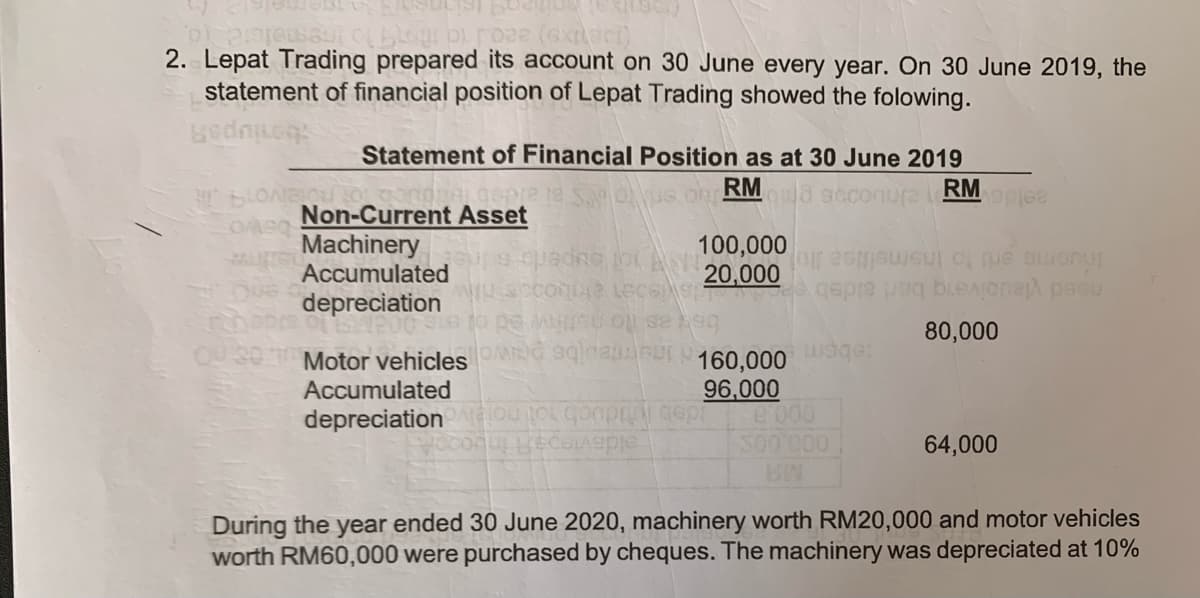

2. Lepat Trading prepared its account on 30 June every year. On 30 June 2019, the statement of financial position of Lepat Trading showed the folowing. Statement of Financial Position as at 30 June 2019 ous on RM gd scconure RM opjee Non-Current Asset Machinery Accumulated 100,000 20,000 gepre g biejona pasu Iuome erd to Insmsltioe llo conte LECES depreciation bey as to nutiow ed Motor vehicles u160,000age: 80,000 Accumulated 96,000 depreciation S00 000 64,000 During the year ended 30 June 2020, machinery worth RM20,000 and motor vehicles worth RM60,000 were purchased by cheques. The machinery was depreciated at 10%

2. Lepat Trading prepared its account on 30 June every year. On 30 June 2019, the statement of financial position of Lepat Trading showed the folowing. Statement of Financial Position as at 30 June 2019 ous on RM gd scconure RM opjee Non-Current Asset Machinery Accumulated 100,000 20,000 gepre g biejona pasu Iuome erd to Insmsltioe llo conte LECES depreciation bey as to nutiow ed Motor vehicles u160,000age: 80,000 Accumulated 96,000 depreciation S00 000 64,000 During the year ended 30 June 2020, machinery worth RM20,000 and motor vehicles worth RM60,000 were purchased by cheques. The machinery was depreciated at 10%

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter5: The Income Statement And The Statement Of Cash Flows

Section: Chapter Questions

Problem 7E: Multiple-Step and Single-Step Income Statements, and Statement of Comprehensive Income On December...

Related questions

Question

Transcribed Image Text:2. Lepat Trading prepared its account on 30 June every year. On 30 June 2019, the

statement of financial position of Lepat Trading showed the folowing.

edn

Statement of Financial Position as at 30 June 2019

RM

od scconure te

RM

Non-Current Asset

Machinery

Accumulated

100,000

स

depreciation

bek as to new ed ol

OMO n ur 160,000

80,000

Motor vehicles

Accumulated

96,000

depreciation

300 000

64,000

During the

worth RM60,000 were purchased by cheques. The machinery was depreciated at 10%

year

ended 30 June 2020, machinery worth RM20,000 and motor vehicles

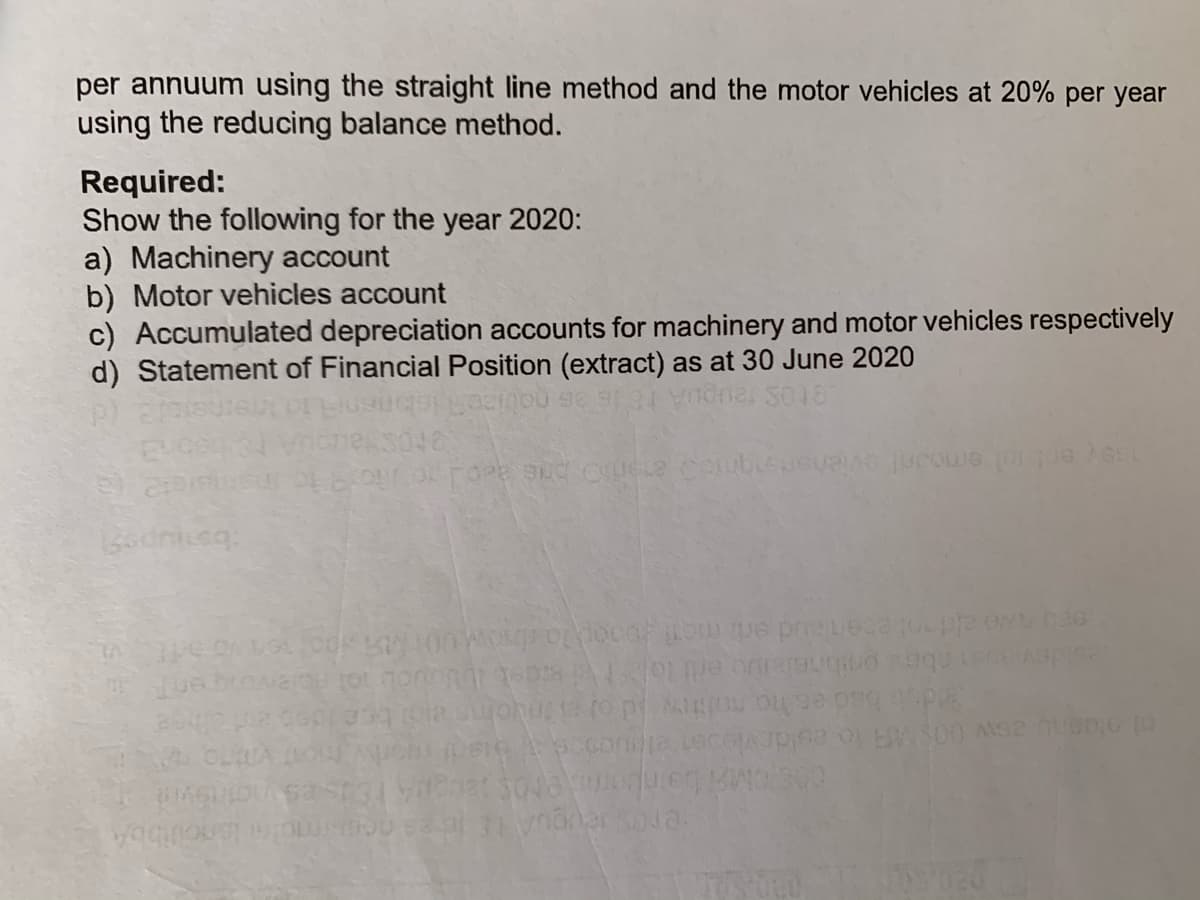

Transcribed Image Text:per annuum using the straight line method and the motor vehicles at 20% per year

using the reducing balance method.

Required:

Show the following for the year 2020:

a) Machinery account

b) Motor vehicles account

c) Accumulated depreciation accounts for machinery and motor vehicles respectively

d) Statement of Financial Position (extract) as at 30 June 2020

S018

3046

abe onbheleuo ert lo sdeb lbUuuob ol RolenogenT

dub bad es ho noltry id o chs a bee ideb hee

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 10 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning