2. Now, reestimate the model using the log of netinc and salary: return = -36.30 + .327dkr + .069eps - 4.74log(netinc) + 7.24log(salary) (39.37) (.203) (.080) (3.39) (6.31) n = 142 R2 = .0330 %3D Do any of your conclusions from part (1.) change?

2. Now, reestimate the model using the log of netinc and salary: return = -36.30 + .327dkr + .069eps - 4.74log(netinc) + 7.24log(salary) (39.37) (.203) (.080) (3.39) (6.31) n = 142 R2 = .0330 %3D Do any of your conclusions from part (1.) change?

Managerial Economics: Applications, Strategies and Tactics (MindTap Course List)

14th Edition

ISBN:9781305506381

Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Chapter4A: Problems In Applying The Linear Regression Model

Section: Chapter Questions

Problem 2E

Related questions

Question

Just number 2 please. Thankyou

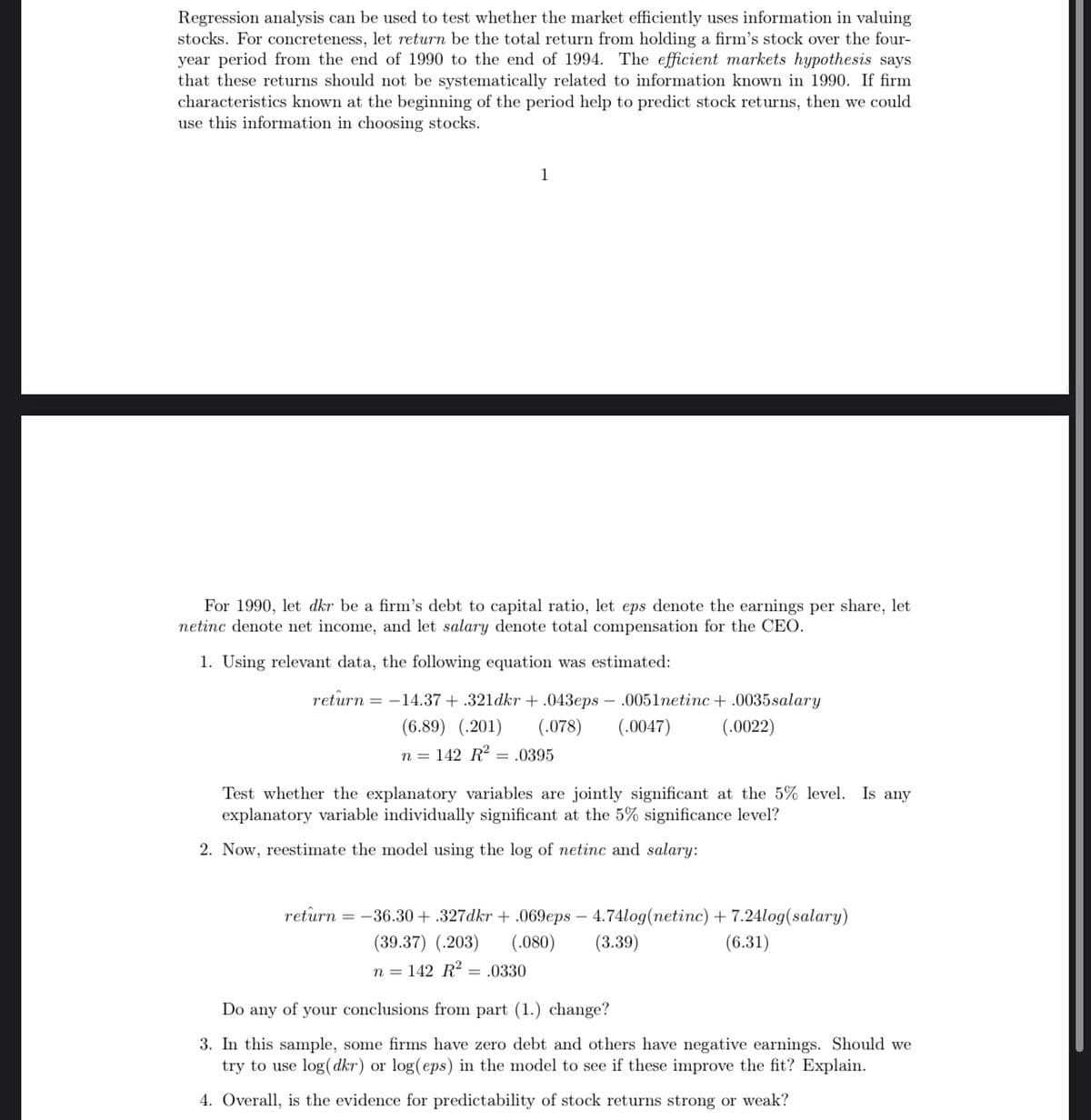

Transcribed Image Text:Regression analysis can be used to test whether the market efficiently uses information in valuing

stocks. For concreteness, let return be the total return from holding a firm's stock over the four-

year period from the end of 1990 to the end of 1994. The efficient markets hypothesis says

that these returns should not be systematically related to information known in 1990. If firm

characteristics known at the beginning of the period help to predict stock returns, then we could

use this information in choosing stocks.

1

For 1990, let dkr be a firm's debt to capital ratio, let eps denote the earnings per share, let

netinc denote net income, and let salary denote total compensation for the CEO.

1. Using relevant data, the following equation was estimated:

return = -14.37 + .321dkr + .043eps – .0051etinc + .0035salary

(6.89) (.201)

(.078)

(.0047)

(.0022)

n = 142 R2 = .0395

Test whether the explanatory variables are jointly significant at the 5% level. Is any

explanatory variable individually significant at the 5% significance level?

2. Now, reestimate the model using the log of netinc and salary:

return = -36.30 + .327dkr + .069eps – 4.74log(netinc) + 7.24log(salary)

(.080)

(39.37) (.203)

(3.39)

(6.31)

n = 142 R2 = .0330

Do any of your conclusions from part (1.) change?

3. In this sample, some firms have zero debt and others have negative earnings. Should we

try to use log(dkr) or log(eps) in the model to see if these improve the fit? Explain.

4. Overall, is the evidence for predictability of stock returns strong or weak?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning