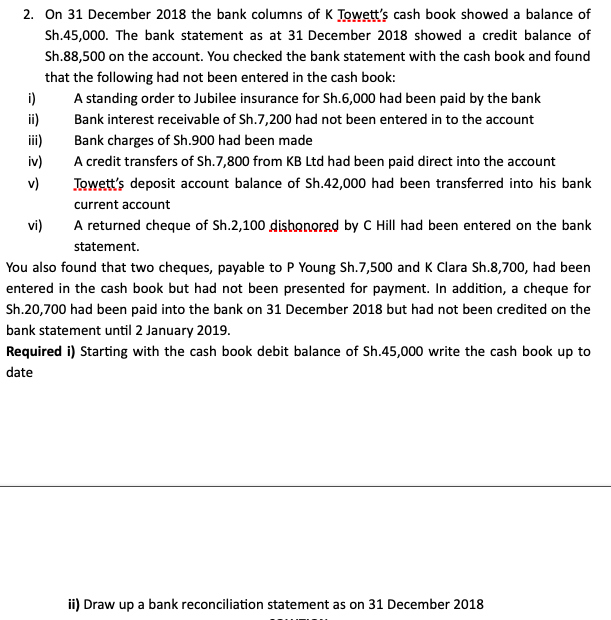

2. On 31 December 2018 the bank columns of K Towett's cash book showed a balance of Sh.45,000. The bank statement as at 31 December 2018 showed a credit balance of Sh.88,500 on the account. You checked the bank statement with the cash book and found that the following had not been entered in the cash book: i) A standing order to Jubilee insurance for Sh.6,000 had been paid by the bank ii) Bank interest receivable of Sh.7,200 had not been entered in to the account Bank charges of Sh.900 had been made A credit transfers of Sh.7,800 from KB Ltd had been paid direct into the account v) Jowett's deposit account balance of Sh.42,000 had been transferred into his bank current account vi) A returned cheque of Sh.2,100 dishonored by C Hill had been entered on the bank statement. You also found that two cheques, payable to P Young Sh.7,500 and K Clara Sh.8,700, had been entered in the cash book but had not been presented for payment. In addition, a cheque for Sh.20,700 had been paid into the bank on 31 December 2018 but had not been credited on the bank statement until 2 January 2019. Required i) Starting with the cash book debit balance of Sh.45,000 write the cash book up to date ii) Draw up a bank reconciliation statement as on 31 December 2018

2. On 31 December 2018 the bank columns of K Towett's cash book showed a balance of Sh.45,000. The bank statement as at 31 December 2018 showed a credit balance of Sh.88,500 on the account. You checked the bank statement with the cash book and found that the following had not been entered in the cash book: i) A standing order to Jubilee insurance for Sh.6,000 had been paid by the bank ii) Bank interest receivable of Sh.7,200 had not been entered in to the account Bank charges of Sh.900 had been made A credit transfers of Sh.7,800 from KB Ltd had been paid direct into the account v) Jowett's deposit account balance of Sh.42,000 had been transferred into his bank current account vi) A returned cheque of Sh.2,100 dishonored by C Hill had been entered on the bank statement. You also found that two cheques, payable to P Young Sh.7,500 and K Clara Sh.8,700, had been entered in the cash book but had not been presented for payment. In addition, a cheque for Sh.20,700 had been paid into the bank on 31 December 2018 but had not been credited on the bank statement until 2 January 2019. Required i) Starting with the cash book debit balance of Sh.45,000 write the cash book up to date ii) Draw up a bank reconciliation statement as on 31 December 2018

College Accounting (Book Only): A Career Approach

13th Edition

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:Scott, Cathy J.

Chapter6: Bank Accounts, Cash Funds, And Internal Controls

Section: Chapter Questions

Problem 5E

Related questions

Question

Transcribed Image Text:2. On 31 December 2018 the bank columns of K Towett's cash book showed a balance of

Sh.45,000. The bank statement as at 31 December 2018 showed a credit balance of

Sh.88,500 on the account. You checked the bank statement with the cash book and found

that the following had not been entered in the cash book:

i)

ii)

ii)

iv)

A standing order to Jubilee insurance for Sh.6,000 had been paid by the bank

Bank interest receivable of Sh.7,200 had not been entered in to the account

Bank charges of Sh.900 had been made

A credit transfers of Sh.7,800 from KB Ltd had been paid direct into the account

v)

Jowett's deposit account balance of Sh.42,000 had been transferred into his bank

current account

vi)

A returned cheque of Sh.2,100 dishonored by C Hill had been entered on the bank

statement.

You also found that two cheques, payable to P Young Sh.7,500 and K Clara Sh.8,700, had been

entered in the cash book but had not been presented for payment. In addition, a cheque for

Sh.20,700 had been paid into the bank on 31 December 2018 but had not been credited on the

bank statement until 2 January 2019.

Required i) Starting with the cash book debit balance of Sh.45,000 write the cash book up to

date

ii) Draw up a bank reconciliation statement as on 31 December 2018

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,