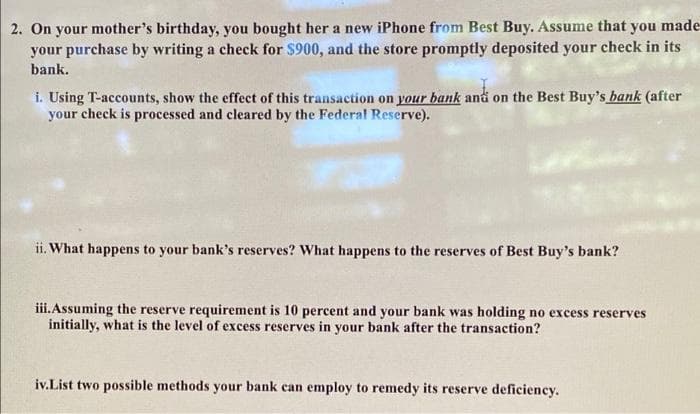

2. On your mother's birthday, you bought her a new iPhone from Best Buy. Assume that you mad your purchase by writing a check for $900, and the store promptly deposited your check in its bank. i. Using T-accounts, show the effect of this transaction on your bank and on the Best Buy's bank (after your check is processed and cleared by the Federal Reserve). ii. What happens to your bank's reserves? What happens to the reserves of Best Buy's bank? iii.Assuming the reserve requirement is 10 percent and your bank was holding no excess reserves initially, what is the level of excess reserves in your bank after the transaction? iv.List two possible methods your bank can employ to remeody ite

2. On your mother's birthday, you bought her a new iPhone from Best Buy. Assume that you mad your purchase by writing a check for $900, and the store promptly deposited your check in its bank. i. Using T-accounts, show the effect of this transaction on your bank and on the Best Buy's bank (after your check is processed and cleared by the Federal Reserve). ii. What happens to your bank's reserves? What happens to the reserves of Best Buy's bank? iii.Assuming the reserve requirement is 10 percent and your bank was holding no excess reserves initially, what is the level of excess reserves in your bank after the transaction? iv.List two possible methods your bank can employ to remeody ite

Century 21 Accounting Multicolumn Journal

11th Edition

ISBN:9781337679503

Author:Gilbertson

Publisher:Gilbertson

Chapter5: Cash Control Systems

Section: Chapter Questions

Problem 1CP

Related questions

Question

Transcribed Image Text:2. On your mother's birthday, you bought her a new iPhone from Best Buy. Assume that you made-

your purchase by writing a check for $900, and the store promptly deposited your check in its

bank.

i. Using T-accounts, show the effect of this transaction on your bank and on the Best Buy's hank (after

your check is processed and cleared by the Federal Reserve).

ii. What happens to your bank's reserves? What happens to the reserves of Best Buy's bank?

iii. Assuming the reserve requirement is 10 percent and your bank was holding no excess reserves

initially, what is the level of excess reserves in your bank after the transaction?

iv.List two possible methods your bank can employ to remedy its reserve deficiency.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT