1. Which of the following is not a component of factory overhead? a. Payroll taxes share of the employer b. Payroll taxes share of the employee-laborer c. Indirect labor d. Supervision

1. Which of the following is not a component of factory overhead? a. Payroll taxes share of the employer b. Payroll taxes share of the employee-laborer c. Indirect labor d. Supervision

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter2: Job Order Costing

Section: Chapter Questions

Problem 9E: Eclipse Solar Company operates two factories. The company applies factory overhead to jobs on the...

Related questions

Question

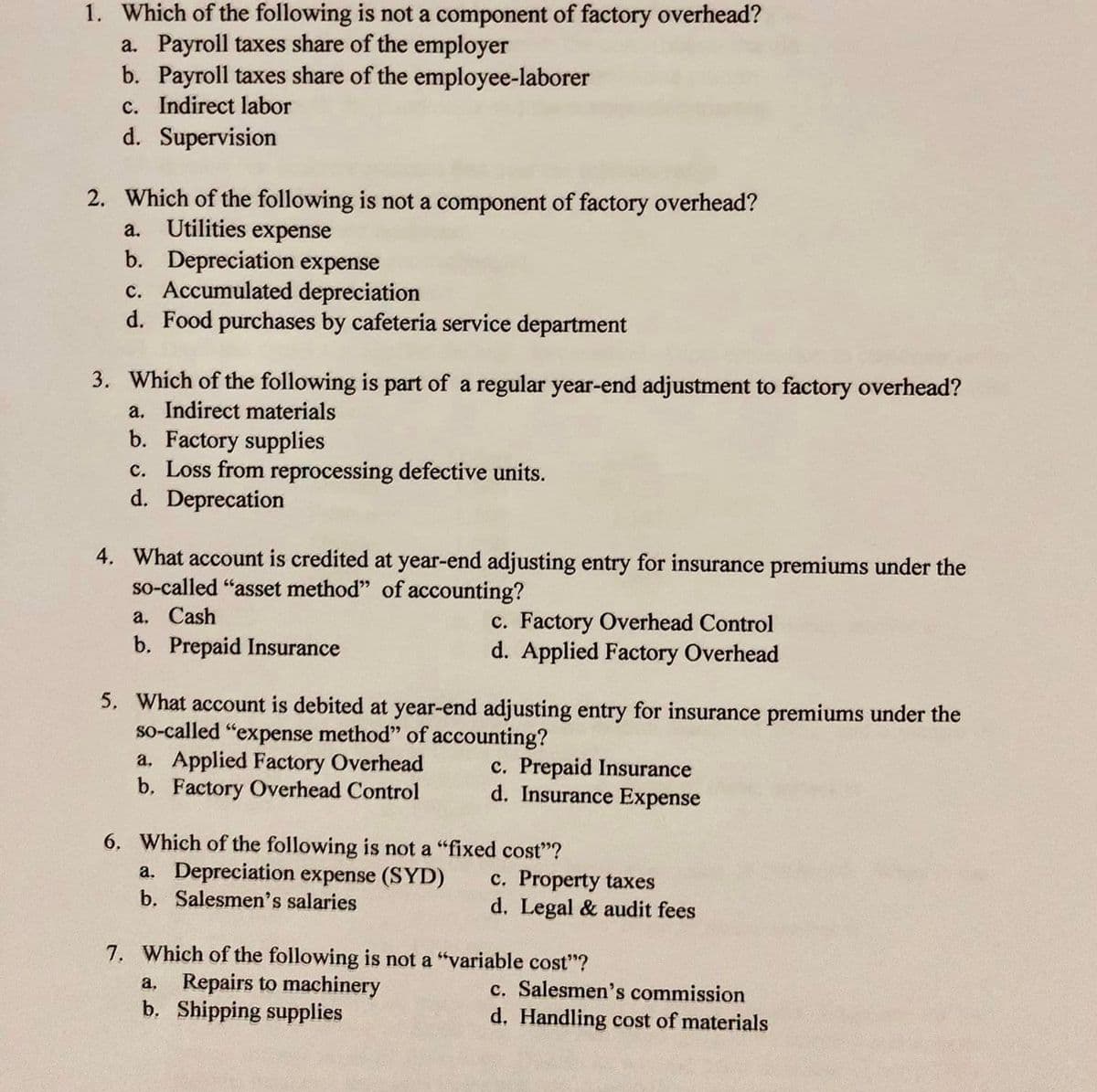

Transcribed Image Text:1. Which of the following is not a component of factory overhead?

a. Payroll taxes share of the employer

b. Payroll taxes share of the employee-laborer

c. Indirect labor

d. Supervision

2. Which of the following is not a component of factory overhead?

Utilities expense

b. Depreciation expense

c. Accumulated depreciation

d. Food purchases by cafeteria service department

a.

3. Which of the following is part of a regular year-end adjustment to factory overhead?

a. Indirect materials

b. Factory supplies

c. Loss from reprocessing defective units.

d. Deprecation

4. What account is credited at year-end adjusting entry for insurance premiums under the

so-called "asset method" of accounting?

а. Cash

b. Prepaid Insurance

c. Factory Overhead Control

d. Applied Factory Overhead

5. What account is debited at year-end adjusting entry for insurance premiums under the

so-called "expense method" of accounting?

a. Applied Factory Overhead

b, Factory Overhead Control

c. Prepaid Insurance

d. Insurance Expense

6. Which of the following is not a "fixed cost"?

a. Depreciation expense (SYD)

b. Salesmen's salaries

c. Property taxes

d. Legal & audit fees

7. Which of the following is not a "variable cost"?

a, Repairs to machinery

b. Shipping supplies

c. Salesmen's commission

d. Handling cost of materials

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT