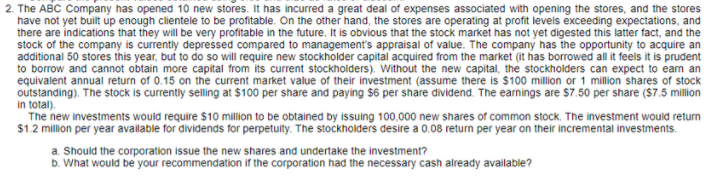

2. The ABC Company has opened 10 new stores. It has incurred a great deal of expenses associated with opening the stores, and the stores have not yet built up enough clientele to be profitable. On the other hand, the stores are operating at profit levels exceeding expectations, and there are indications that they will be very profitable in the future. It is obvious that the stock market has not yet digested this latter fact, and the stock of the company is currently depressed compared to management's appraisal of value. The company has the opportunity to acquire an additional 50 stores this year, but to do so will require new stockholder capital acquired from the market (it has borrowed all it feels it is prudent to borrow and cannot obtain more capital from its current stockholders). Without the new capital, the stockholders can expect to earn an equivalent annual return of 0.15 on the current market value of their investment (assume there is $100 million or 1 million shares of stock outstanding). The stock is currently selling at $100 per share and paying $6 per share dividend. The earnings are $7.50 per share ($7.5 million in total). The new investments would require $10 million to be obtained by issuing 100.000 new shares of common stock. The investment would return $1.2 million per year available for dividends for perpetuity. The stockholders desire a 0.08 return per year on their incremental investments. a. Should the corporation issue the new shares and undertake the investment? b. What would be your recommendation if the corporation had the necessary cash already available?

2. The ABC Company has opened 10 new stores. It has incurred a great deal of expenses associated with opening the stores, and the stores have not yet built up enough clientele to be profitable. On the other hand, the stores are operating at profit levels exceeding expectations, and there are indications that they will be very profitable in the future. It is obvious that the stock market has not yet digested this latter fact, and the stock of the company is currently depressed compared to management's appraisal of value. The company has the opportunity to acquire an additional 50 stores this year, but to do so will require new stockholder capital acquired from the market (it has borrowed all it feels it is prudent to borrow and cannot obtain more capital from its current stockholders). Without the new capital, the stockholders can expect to earn an equivalent annual return of 0.15 on the current market value of their investment (assume there is $100 million or 1 million shares of stock outstanding). The stock is currently selling at $100 per share and paying $6 per share dividend. The earnings are $7.50 per share ($7.5 million in total). The new investments would require $10 million to be obtained by issuing 100.000 new shares of common stock. The investment would return $1.2 million per year available for dividends for perpetuity. The stockholders desire a 0.08 return per year on their incremental investments. a. Should the corporation issue the new shares and undertake the investment? b. What would be your recommendation if the corporation had the necessary cash already available?

Chapter3: Analysis Of Financial Statements

Section: Chapter Questions

Problem 1bM

Related questions

Question

Transcribed Image Text:2. The ABC Company has opened 10 new stores. It has incurred a great deal of expenses associated with opening the stores, and the stores

have not yet built up enough clientele to be profitable. On the other hand, the stores are operating at profit levels exceeding expectations, and

there are indications that they will be very profitable in the future. It is obvious that the stock market has not yet digested this latter fact, and the

stock of the company is currently depressed compared to management's appraisal of value. The company has the opportunity to acquire an

additional 50 stores this year, but to do so will require new stockholder capital acquired from the market (it has borrowed all it feels it is prudent

to borrow and cannot obtain more capital from its current stockholders). Without the new capital, the stockholders can expect to earn an

equivalent annual return of 0.15 on the current market value of their investment (assume there is $100 million or 1 million shares of stock

outstanding). The stock is currently selling at $100 per share and paying $6 per share dividend. The earnings are $7.50 per share ($7.5 million

in total).

The new investments would require $10 million to be obtained by issuing 100.000 new shares of common stock. The investment would return

$1.2 million per year available for dividends for perpetuity. The stockholders desire a 0.08 return per year on their incremental investments.

a. Should the corporation issue the new shares and undertake the investment?

b. What would be your recommendation if the corporation had the necessary cash already available?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning