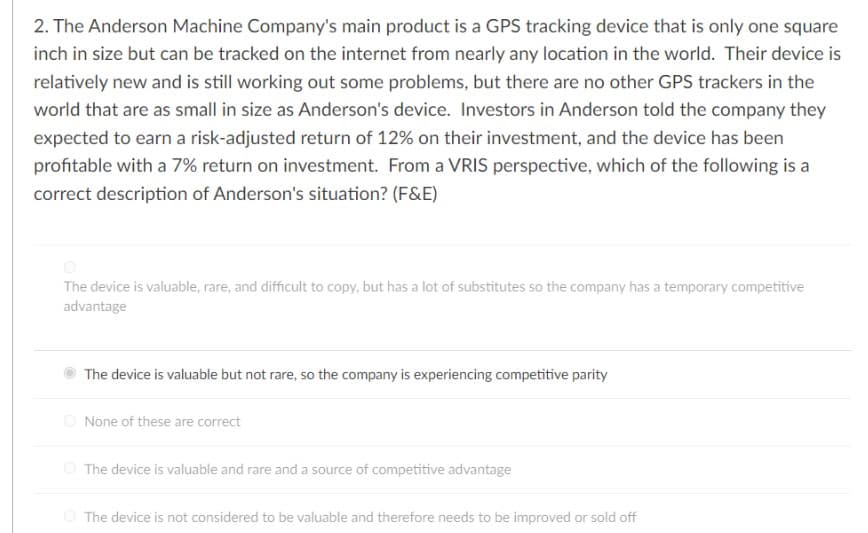

2. The Anderson Machine Company's main product is a GPS tracking device that is only one square inch in size but can be tracked on the internet from nearly any location in the world. Their device is relatively new and is still working out some problems, but there are no other GPS trackers in the world that are as small in size as Anderson's device. Investors in Anderson told the company they expected to earn a risk-adjusted return of 12% on their investment, and the device has been profitable with a 7% return on investment. From a VRIS perspective, which of the following is a correct description of Anderson's situation? (F&E)

2. The Anderson Machine Company's main product is a GPS tracking device that is only one square inch in size but can be tracked on the internet from nearly any location in the world. Their device is relatively new and is still working out some problems, but there are no other GPS trackers in the world that are as small in size as Anderson's device. Investors in Anderson told the company they expected to earn a risk-adjusted return of 12% on their investment, and the device has been profitable with a 7% return on investment. From a VRIS perspective, which of the following is a correct description of Anderson's situation? (F&E)

Chapter11: Capital Budgeting And Risk

Section: Chapter Questions

Problem 12P

Related questions

Question

Transcribed Image Text:2. The Anderson Machine Company's main product is a GPS tracking device that is only one square

inch in size but can be tracked on the internet from nearly any location in the world. Their device is

relatively new and is still working out some problems, but there are no other GPS trackers in the

world that are as small in size as Anderson's device. Investors in Anderson told the company they

expected to earn a risk-adjusted return of 12% on their investment, and the device has been

profitable with a 7% return on investment. From a VRIS perspective, which of the following is a

correct description of Anderson's situation? (F&E)

The device is valuable, rare, and difficult to copy, but has a lot of substitutes so the company has a temporary competitive

advantage

The device is valuable but not rare, so the company is experiencing competitive parity

O None of these are correct

The device is valuable and rare and a source of competitive advantage

The device is not considered to be valuable and therefore needs to be improved or sold off

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT