2. Two employees have earned taxable pay of $ 2,700 and $ 2,400 Both are within limits and 3.4% Hence SUTA tax will be computed as follows, SUTA Tax= (2,700+2,400) * 3.4% SUTA Tax=$ 173.40 PSb 5-4 Calculate SUTA Tax For each of the following independent circumstances calculate the SUTA tax owed by the employer. Assume a SUTA tax rate of 3.4% and a taxable earnings threshold of $8,500. NO TE: For simplicity, all calculations throughout this exercise, both intermediate and final, should be rounded to two decimal places at each calculation. 2: Mrs. Fix-lt Corp. employs two workers who, as of the beginning of the current pay period, have earned $4,200 and $6,500. Calculate SUTA tax for the current pay period if these employees eam taxable pay of $2,700 and $2,400, respectively. SUTA tax = $ 173.40

2. Two employees have earned taxable pay of $ 2,700 and $ 2,400 Both are within limits and 3.4% Hence SUTA tax will be computed as follows, SUTA Tax= (2,700+2,400) * 3.4% SUTA Tax=$ 173.40 PSb 5-4 Calculate SUTA Tax For each of the following independent circumstances calculate the SUTA tax owed by the employer. Assume a SUTA tax rate of 3.4% and a taxable earnings threshold of $8,500. NO TE: For simplicity, all calculations throughout this exercise, both intermediate and final, should be rounded to two decimal places at each calculation. 2: Mrs. Fix-lt Corp. employs two workers who, as of the beginning of the current pay period, have earned $4,200 and $6,500. Calculate SUTA tax for the current pay period if these employees eam taxable pay of $2,700 and $2,400, respectively. SUTA tax = $ 173.40

PFIN (with PFIN Online, 1 term (6 months) Printed Access Card) (New, Engaging Titles from 4LTR Press)

6th Edition

ISBN:9781337117005

Author:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Chapter3: Preparing Your Taxes

Section: Chapter Questions

Problem 2FPE: ESTIMATING TAXABLE INCOME, TAX LIABILITY, AND POTENTIAL REFUND. Hannah Owens is 24 years old and...

Related questions

Question

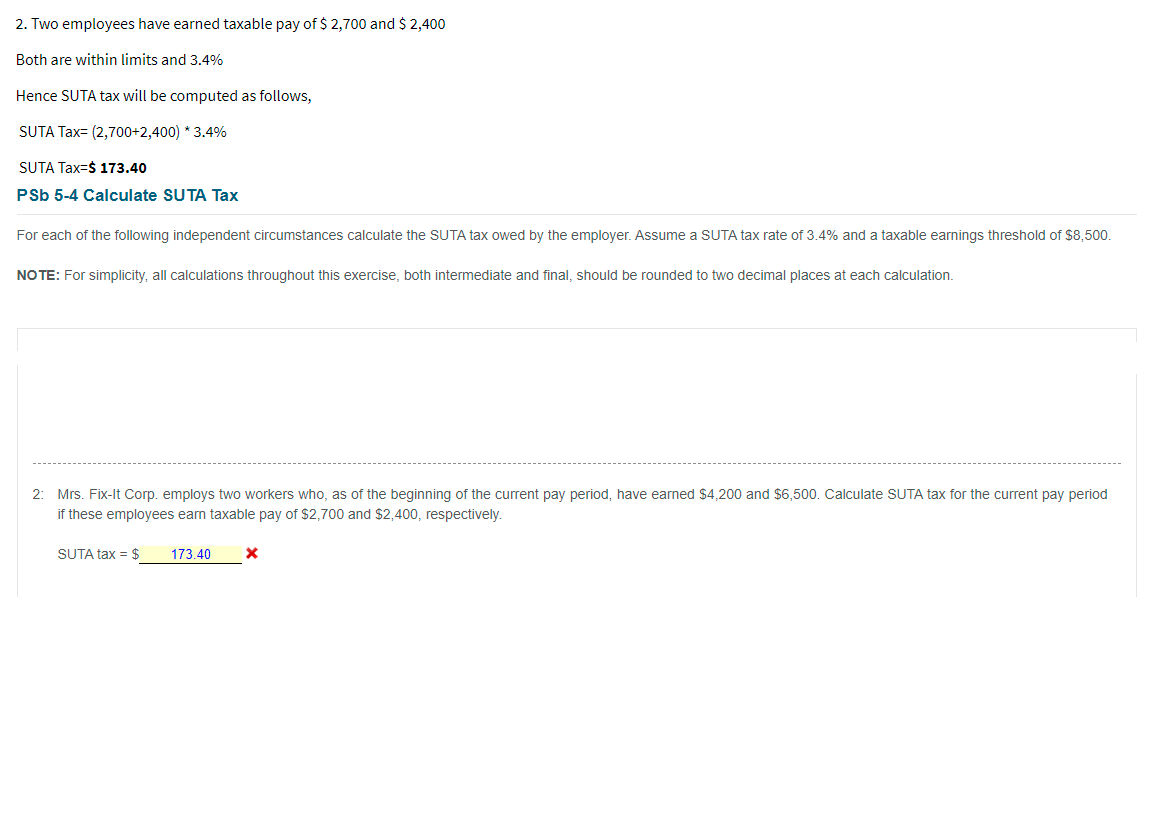

Transcribed Image Text:2. Two employees have earned taxable pay of $ 2,700 and $ 2,400

Both are within limits and 3.4%

Hence SUTA tax will be computed as follows,

SUTA Tax= (2,700+2,400) * 3.4%

SUTA Tax=$ 173.40

PSb 5-4 Calculate SUTA Tax

For each of the following independent circumstances calculate the SUTA tax owed by the employer. Assume a SUTA tax rate of 3.4% and a taxable earnings threshold of $8,500.

NO TE: For simplicity, all calculations throughout this exercise, both intermediate and final, should be rounded to two decimal places at each calculation.

2: Mrs. Fix-It Corp. employs two workers who, as of the beginning of the current pay period, have earned $4.200 and $6,500. Calculate SUTA tax for the current pay period

if these employees eam taxable pay of $2,700 and $2,400, respectively.

SUTA tax = $

173.40

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT