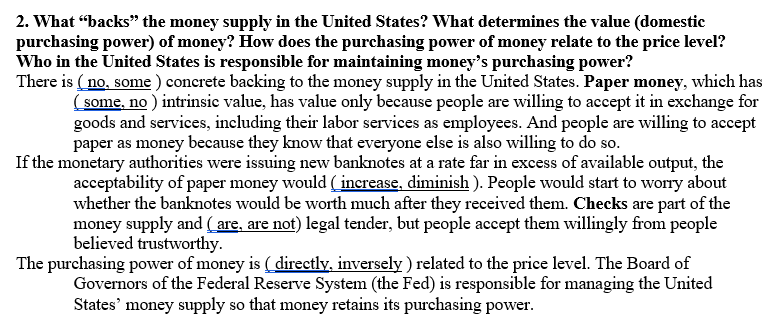

2. What “backs" the money supply in the United States? What determines the value (domestic purchasing power) of money? How does the purchasing power of money relate to the price level? Who in the United States is responsible for maintaining money's purchasing power? There is ( no, some ) concrete backing to the money supply in the United States. Paper money, which has (some, no ) intrinsic value, has value only because people are willing to accept it in exchange for goods and services, including their labor services as employees. And people are willing to accept paper as money because they know that everyone else is also willing to do so. If the monetary authorities were issuing new banknotes at a rate far in excess of available output, the acceptability of paper money would ( increase, diminish ). People would start to worry about whether the banknotes would be worth much after they received them. Checks are part of the money supply and ( are, are not) legal tender, but people accept them willingly from people believed trustworthy. The purchasing power of money is ( directly, inversely ) related to the price level. The Board of Governors of the Federal Reserve System (the Fed) is responsible for managing the United States' money supply so that money retains its purchasing power.

2. What “backs" the money supply in the United States? What determines the value (domestic purchasing power) of money? How does the purchasing power of money relate to the price level? Who in the United States is responsible for maintaining money's purchasing power? There is ( no, some ) concrete backing to the money supply in the United States. Paper money, which has (some, no ) intrinsic value, has value only because people are willing to accept it in exchange for goods and services, including their labor services as employees. And people are willing to accept paper as money because they know that everyone else is also willing to do so. If the monetary authorities were issuing new banknotes at a rate far in excess of available output, the acceptability of paper money would ( increase, diminish ). People would start to worry about whether the banknotes would be worth much after they received them. Checks are part of the money supply and ( are, are not) legal tender, but people accept them willingly from people believed trustworthy. The purchasing power of money is ( directly, inversely ) related to the price level. The Board of Governors of the Federal Reserve System (the Fed) is responsible for managing the United States' money supply so that money retains its purchasing power.

Essentials of Economics (MindTap Course List)

8th Edition

ISBN:9781337091992

Author:N. Gregory Mankiw

Publisher:N. Gregory Mankiw

Chapter22: Money Growth And Inflation

Section: Chapter Questions

Problem 1PA

Related questions

Question

Transcribed Image Text:2. What “backs" the money supply in the United States? What determines the value (domestic

purchasing power) of money? How does the purchasing power of money relate to the price level?

Who in the United States is responsible for maintaining money's purchasing power?

There is ( no, some ) concrete backing to the money supply in the United States. Paper money, which has

( some, no ) intrinsic value, has value only because people are willing to accept it in exchange for

goods and services, including their labor services as employees. And people are willing to accept

paper as money because they know that everyone else is also willing to do so.

If the monetary authorities were issuing new banknotes at a rate far in excess of available output, the

acceptability of paper money would (increase, diminish ). People would start to worry about

whether the banknotes would be worth much after they received them. Checks are part of the

money supply and ( are, are not) legal tender, but people accept them willingly from people

believed trustworthy.

The purchasing power of money is ( directly, inversely ) related to the price level. The Board of

Governors of the Federal Reserve System (the Fed) is responsible for managing the United

States' money supply so that money retains its purchasing power.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics, 7th Edition (MindTap Cou…

Economics

ISBN:

9781285165875

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Macroeconomics (MindTap Course List)

Economics

ISBN:

9781285165912

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics (MindTap Course List)

Economics

ISBN:

9781305585126

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning