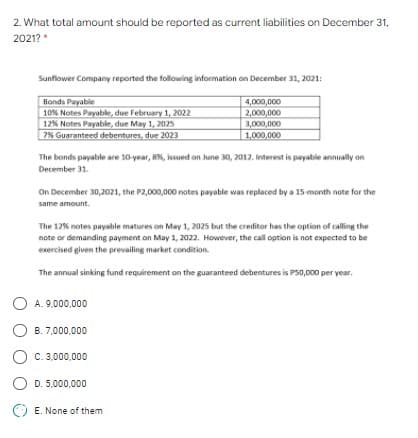

2. What total amount should be reported as current liabilities on December 31, 2021? Sunflower Company reported the following information on December 31, 2021: Bonds Payable 10% Notes Payable, due February 1, 2022 12% Notes Payable, due May 1, 2025 7% Guaranteed debentures, due 2023 4,000,000 2,000,000 3,000,000 1,000,000 The bonds payable are 10-year, BN, issued on June 30, 2012. Interest is payable annually on December 31. On December 30,2021, the P2,000,000 nates payable was replaced by a 15 month note for the same amount. The 12% notes payable matures on May 1, 2025 but the creditor has the option of calling the note or demanding payment on May 1, 2022. However, the call option is not expected to be exercised given the prevailing market condition. The annual sinking fund requirement on the guaranteed debentures is PS0,000 per year. O A. 9,000.000 O B. 7,000,000 C. 3,000,000 O D. 5,000,000 E. None of them

2. What total amount should be reported as current liabilities on December 31, 2021? Sunflower Company reported the following information on December 31, 2021: Bonds Payable 10% Notes Payable, due February 1, 2022 12% Notes Payable, due May 1, 2025 7% Guaranteed debentures, due 2023 4,000,000 2,000,000 3,000,000 1,000,000 The bonds payable are 10-year, BN, issued on June 30, 2012. Interest is payable annually on December 31. On December 30,2021, the P2,000,000 nates payable was replaced by a 15 month note for the same amount. The 12% notes payable matures on May 1, 2025 but the creditor has the option of calling the note or demanding payment on May 1, 2022. However, the call option is not expected to be exercised given the prevailing market condition. The annual sinking fund requirement on the guaranteed debentures is PS0,000 per year. O A. 9,000.000 O B. 7,000,000 C. 3,000,000 O D. 5,000,000 E. None of them

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter9: Long-term Liabilities

Section: Chapter Questions

Problem 91PSB

Related questions

Question

Transcribed Image Text:2. What total amount should be reported as current liabilities on December 31.

2021? *

Sunflower Company reported the following information on December 31, 2021:

Ronds Payable

10% Notes Payable, due February 1, 2022

12% Notes Payable, due May 1, 2025

7% Guaranteed debentures, due 2023

4,000,000

2,000,000

3,000,000

1,000,000

The bonds payable are 10-year, 8%, issued on June 30, 2012. Interest is payable annually on

December 31.

On December 30,2021, the P2,000,000 notes payable was replaced by a 15 month note for the

same amount.

The 12% notes payable matures on May 1, 2025 but the creditor has the option of calling the

note or demanding payment on May 1, 2022. However, the call option is not expected to be

exercised given the prevailing market condition.

The annual sinking fund requirement on the guaranteed debentures is PS0,000 per year.

A. 9.000,000

B. 7,000,000

O C. 3,000,000

O D. 5,000,000

E. None of them

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College