2.1 2.2 Calculate the VAT amount that is payable to SARS on the 31 July 2022. During August, the accountant came across a document for furniture bought by Phillip Mosena for his personal home, for R46 000 cash. Phillip said that R6 000 VAT included in this amount must be regarded as input VAT. Further investigation revealed that similar documents were regularly entered in the books over the past year. Advise the Phillip on how to deal with this matter. State TWO points. INFORMATION

2.1 2.2 Calculate the VAT amount that is payable to SARS on the 31 July 2022. During August, the accountant came across a document for furniture bought by Phillip Mosena for his personal home, for R46 000 cash. Phillip said that R6 000 VAT included in this amount must be regarded as input VAT. Further investigation revealed that similar documents were regularly entered in the books over the past year. Advise the Phillip on how to deal with this matter. State TWO points. INFORMATION

College Accounting, Chapters 1-27

23rd Edition

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:HEINTZ, James A.

Chapter12: Special Journals

Section: Chapter Questions

Problem 1CE

Related questions

Question

Transcribed Image Text:10:19

x

SEASON

REQUIRED:

2.1

2.2

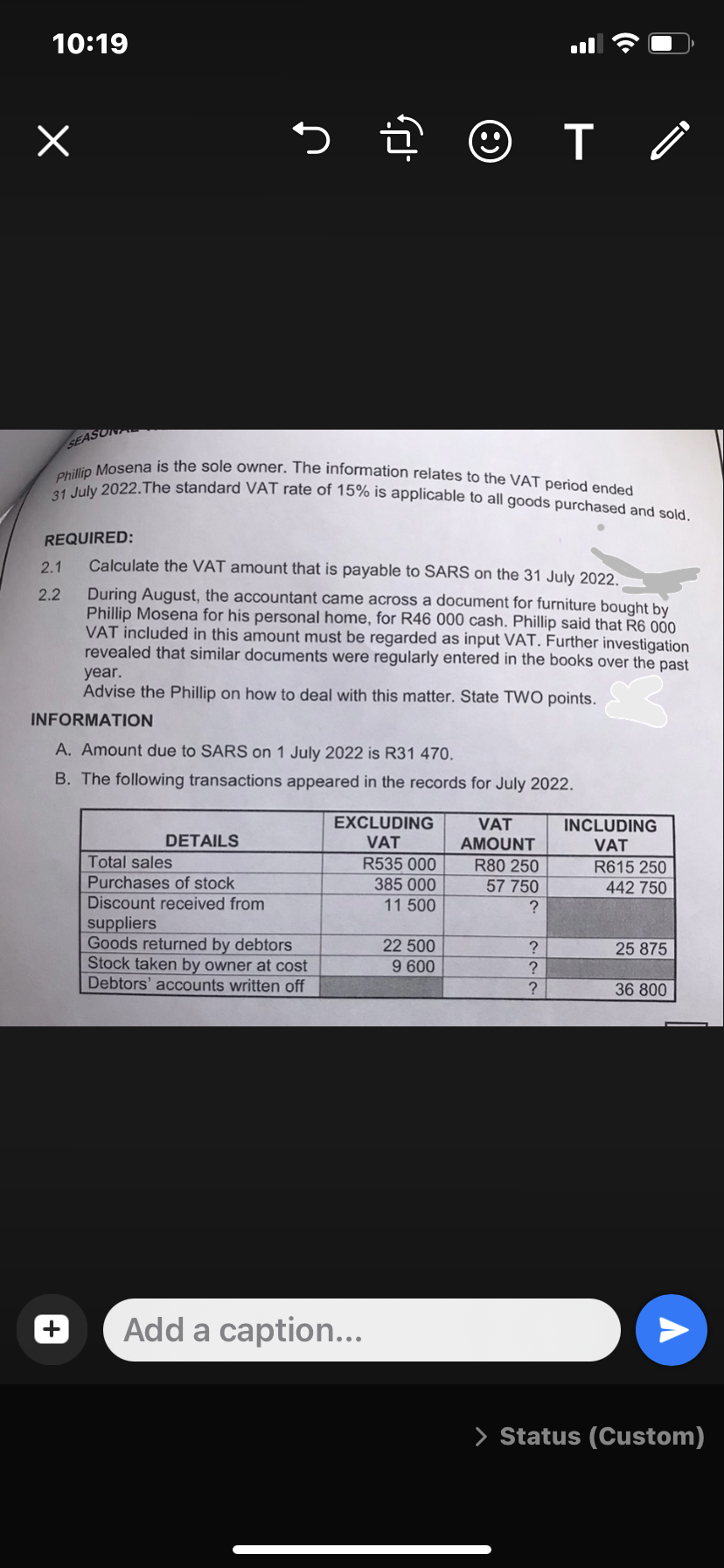

Phillip Mosena is the sole owner. The information relates to the VAT period ended

31 July 2022. The standard VAT rate of 15% is applicable to all goods purchased and sold.

sü •

INFORMATION

Calculate the VAT amount that is payable to SARS on the 31 July 2022.

During August, the accountant came across a document for furniture bought by

Phillip Mosena for his personal home, for R46 000 cash. Phillip said that R6 000

VAT included in this amount must be regarded as input VAT. Further investigation

revealed that similar documents were regularly entered in the books over the past

year.

Advise the Phillip on how to deal with this matter. State TWO points.

DETAILS

A. Amount due to SARS on 1 July 2022 is R31 470.

B. The following transactions appeared in the records for July 2022.

Total sales

Purchases of stock

Discount received from

suppliers

Goods returned by debtors

Stock taken by owner at cost

Debtors' accounts written off

EXCLUDING

VAT

R535 000

385 000

11 500

T

Add a caption...

22 500

9 600

VAT

AMOUNT

R80 250

57 750

?

Ò

?

?

?

INCLUDING

VAT

R615 250

442 750

25 875

36 800

> Status (Custom)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,