2.1 REQUIRED Use the information provided below to calculate the total value of issues to the production department for May 2020 and value of closing inventory as at 31 May 2020 using the: 2.1.1 First-in-first-out (FIFO) method. 2.1.2 Weighted average cost method. (Note: Round off the weighted average cost per unit to the nearest cent.) INFORMATION The following information was extracted from the records of Oasis Limited, a manufacturing company, for an inventory item: Date Transaction details for May 2020 Opening inventory consisted of 9 000 units at R10 each (including carriage on purchases). An invoice was received for 35 000 units purchased from JH Manufacturers at R10 each. Carriage on purchases of R1 per unit was paid to GH Logistics. Returned 4 000 damaged units (purchased on 06 May 2020) to the supplier. A refund was received on the carriage on purchases. An invoice was received for 10 000 units purchased from JH Manufacturers at R11 each. Carriage on purchases of R1 per unit was paid to GH Logistics. Issues to the production department for May: 39 000 units. 01 06 08 31 20

2.1 REQUIRED Use the information provided below to calculate the total value of issues to the production department for May 2020 and value of closing inventory as at 31 May 2020 using the: 2.1.1 First-in-first-out (FIFO) method. 2.1.2 Weighted average cost method. (Note: Round off the weighted average cost per unit to the nearest cent.) INFORMATION The following information was extracted from the records of Oasis Limited, a manufacturing company, for an inventory item: Date Transaction details for May 2020 Opening inventory consisted of 9 000 units at R10 each (including carriage on purchases). An invoice was received for 35 000 units purchased from JH Manufacturers at R10 each. Carriage on purchases of R1 per unit was paid to GH Logistics. Returned 4 000 damaged units (purchased on 06 May 2020) to the supplier. A refund was received on the carriage on purchases. An invoice was received for 10 000 units purchased from JH Manufacturers at R11 each. Carriage on purchases of R1 per unit was paid to GH Logistics. Issues to the production department for May: 39 000 units. 01 06 08 31 20

Century 21 Accounting General Journal

11th Edition

ISBN:9781337680059

Author:Gilbertson

Publisher:Gilbertson

Chapter20: Accounting For Inventory

Section20.3: Estimating Inventory

Problem 1OYO

Related questions

Topic Video

Question

Transcribed Image Text:2.1

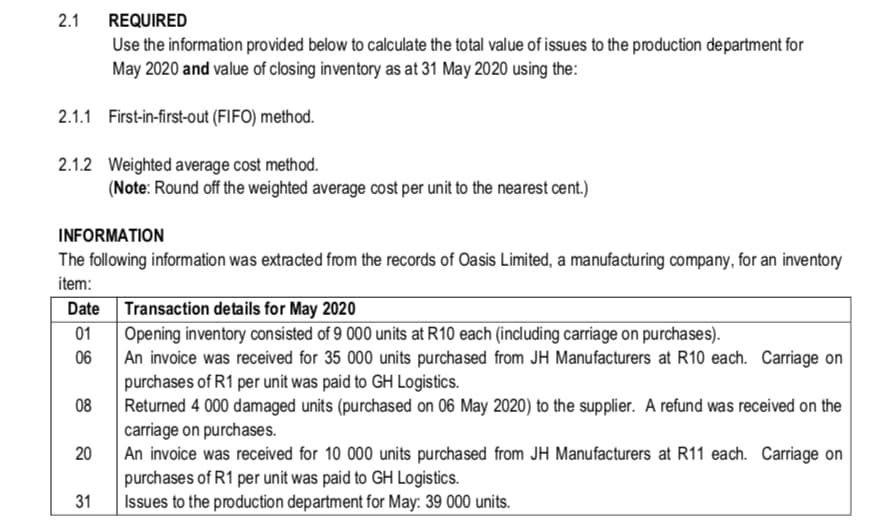

REQUIRED

Use the information provided below to calculate the total value of issues to the production department for

May 2020 and value of closing inventory as at 31 May 2020 using the:

2.1.1 First-in-first-out (FIFO) method.

2.1.2 Weighted average cost method.

(Note: Round off the weighted average cost per unit to the nearest cent.)

INFORMATION

The following information was extracted from the records of Oasis Limited, a manufacturing company, for an inventory

item:

Transaction details for May 2020

Opening inventory consisted of 9 000 units at R10 each (including carriage on purchases).

An invoice was received for 35 000 units purchased from JH Manufacturers at R10 each. Carriage on

purchases of R1 per unit was paid to GH Logistics.

Returned 4 000 damaged units (purchased on 06 May 2020) to the supplier. A refund was received on the

carriage on purchases.

An invoice was received for 10 000 units purchased from JH Manufacturers at R11 each. Carriage on

purchases of R1 per unit was paid to GH Logistics.

Issues to the production department for May: 39 000 units.

Date

01

06

08

20

31

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning