The management of Blue Spruce Corp. is reevaluating the appropriateness of using its present inventory cost flow method, which is average-cost. The company requests your help in determining the results of operations for 2022 if either the FIFO or the LIFO method had been used. For 2022, the accounting records show these data: Inventories Purchases and Sales Beginning ( 10,500 units) $ 21,000 Total net sales ( 270,000 units) $ 1,120,500 Ending ( 25,500 units) Total cost of goods purchased ( 285,000 units) 645,750 Purchases were made quarterly as follows. Quarter Units Unit Cost Total Cost 1 75,000 $2.05 $ 153,750 60,000 2.15 129,000 3 60,000 2.30 138,000 90,000 2.50 225,000 285,000 $645,750 Operating expenses were $ 130,000, and the company's income tax rate is 40%. 2.

The management of Blue Spruce Corp. is reevaluating the appropriateness of using its present inventory cost flow method, which is average-cost. The company requests your help in determining the results of operations for 2022 if either the FIFO or the LIFO method had been used. For 2022, the accounting records show these data: Inventories Purchases and Sales Beginning ( 10,500 units) $ 21,000 Total net sales ( 270,000 units) $ 1,120,500 Ending ( 25,500 units) Total cost of goods purchased ( 285,000 units) 645,750 Purchases were made quarterly as follows. Quarter Units Unit Cost Total Cost 1 75,000 $2.05 $ 153,750 60,000 2.15 129,000 3 60,000 2.30 138,000 90,000 2.50 225,000 285,000 $645,750 Operating expenses were $ 130,000, and the company's income tax rate is 40%. 2.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter22: Accounting For Changes And Errors.

Section: Chapter Questions

Problem 11RE: At the end of 2019, Manny Company recorded its ending inventory at 350,000 based on a physical...

Related questions

Question

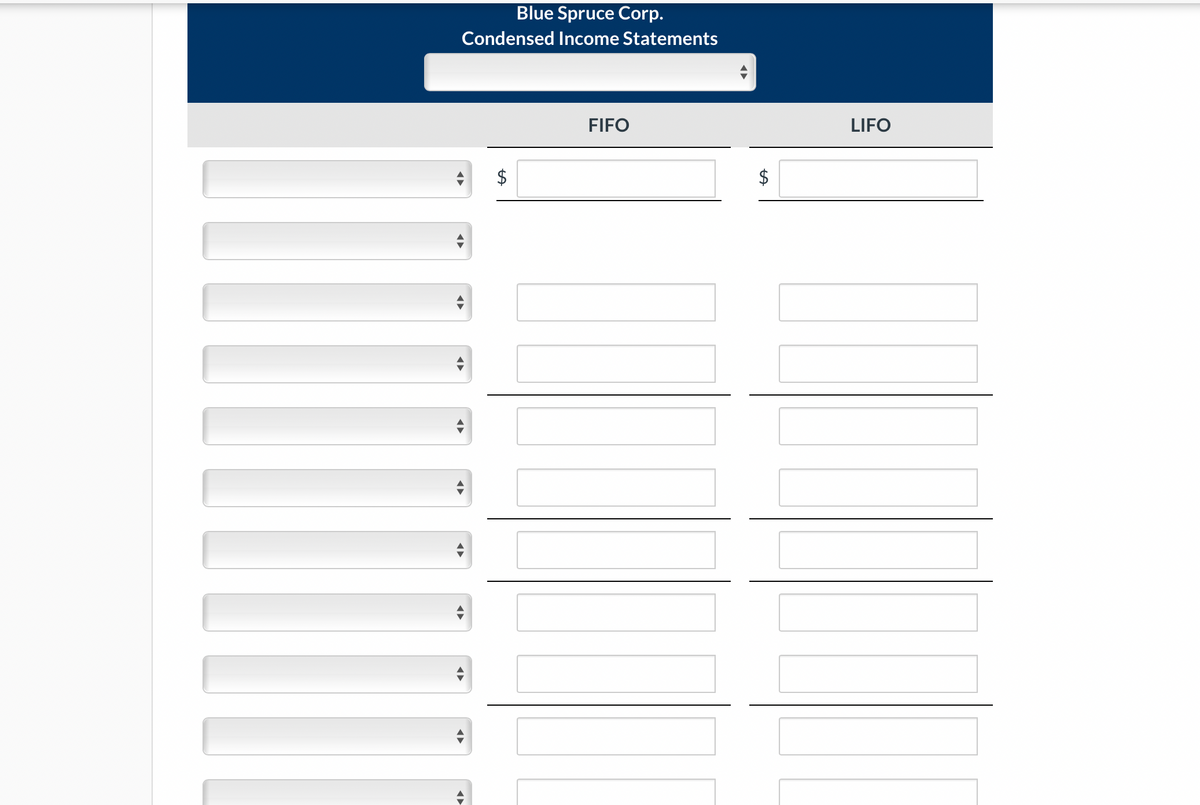

Transcribed Image Text:Blue Spruce Corp.

Condensed Income Statements

FIFO

LIFO

%24

%24

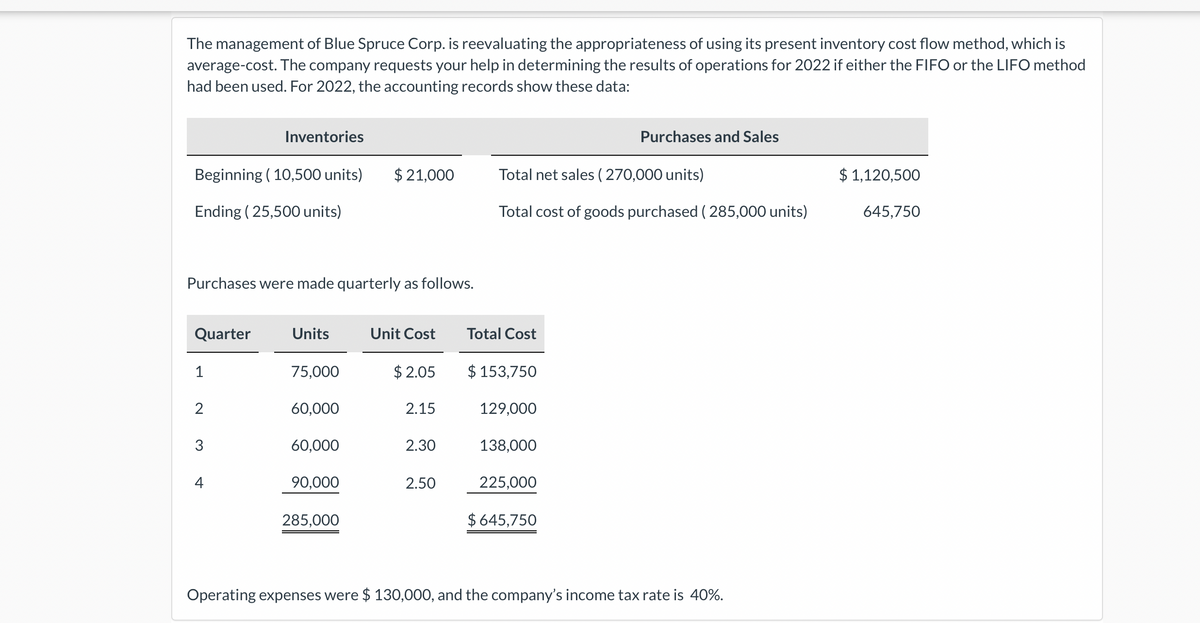

Transcribed Image Text:The management of Blue Spruce Corp. is reevaluating the appropriateness of using its present inventory cost flow method, which is

average-cost. The company requests your help in determining the results of operations for 2022 if either the FIFO or the LIFO method

had been used. For 2022, the accounting records show these data:

Inventories

Purchases and Sales

Beginning ( 10,500 units)

$ 21,000

Total net sales ( 270,000 units)

$ 1,120,500

Ending ( 25,500 units)

Total cost of goods purchased ( 285,000 units)

645,750

Purchases were made quarterly as follows.

Quarter

Units

Unit Cost

Total Cost

1

75,000

$ 2.05

$ 153,750

2

60,000

2.15

129,000

60,000

2.30

138,000

4

90,000

2.50

225,000

285,000

$ 645,750

Operating expenses were $ 130,000, and the company's income tax rate is 40%.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 4 images

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning