Q: 7. Compute for the number of blocks that an ice plant must be able to sell per month to break-even…

A: Hi, thanks for the question. As per the guidelines we are allowed to attempt the first question. If…

Q: Define the term Salvage value and gains tax?

A: Depreciation: The term depreciation refers to the fall in monetary value of assets due to its use,…

Q: The two largest sources of tax revenue for theU.S. federal government area. personal and corporate…

A: ANS According to the data available US federal govt. collects about 50% of its tax revenue from…

Q: Determine the amount of any DR, CG, or CL generated by each event described below. Use the result to…

A: a. Land is a natural resource, which does not depreciate over a period of time. The value of capital…

Q: An entity has fixed costs of p0,000 and variable costs per unit P6. It plans on selling 40,000 units…

A: The total profit is difference between total revenue and total cost of production.

Q: 2. A tax and duty free importation of a 30 HP sandmill cost P 360,000. Bank charges arrastre and…

A: Below we used SLM to solve the given problem. The straight-line premise is a strategy for working…

Q: Personal income tax rates in South Africa, 2015/16 Taxable income Tax Payable Rand 0-181 900 18% of…

A: Income tax is the tax that the government imposed on the public as a direct tax. Income does not…

Q: Price $20 18 16 14 12 10 4 Der 10 20 30 40 50 60 70 80 90 Quantity The amount of the tax per unit is

A: The amount paid per unit= 14-8 = 6

Q: Tax System A Marginal Tax Rate Tax Sy Income Range 0- $20,000 $20,001-$40,000 $40,001 - $80,000…

A: Average tax rate is the share of income a tax payer pay in taxes. A taxpayer's marginal tax rate is…

Q: en based on the following data: ust of electricity der block - P20.00 x to be paid per block - P2.00…

A: The break even point in financial matters, business and explicitly cost accountingis where complete…

Q: If value of output is $300 million, net value added at factor cost is $160 million, depreciation is…

A: The information being given to us is:- value of output is $300 million value added at factor cost is…

Q: Given the date for a real property: Value Description Amount Market Value P1,000,000 Assessment…

A: According to the question, The market value of the real property = $1,000,000 Assessment Level =…

Q: Theoretically and graphically explain the incidence of ad-valorem tax on the equilibrium price and…

A:

Q: 3 Alberta-based ACME used a depletion factor of $ 2,500 per 100 tonnes to fully recoup the $ 35…

A: On the basis of given data:Remaining balance =$35million - $24.8 million Remaining balance =$10.2…

Q: Y S G X-IM 935 -250 320 40 70 2,100 320 140 40 3,220 250 320 200 -150 4,800 375 320 240 -185 5,320…

A: Equilibrium in the economy occurs where aggregate expenditure is equal to production.

Q: A Government Organization purchase furniture from ABC Organization of worth 10,0000,in this case who…

A: Taxes will be imposed on the sale and purchase of any goods and services in the economy,…

Q: harp Inc. a wholly Ghanaian owned company specializes in the production of hand sanitizers branded…

A: The equilibrium price and quantity in a competitive market are determined by the forces of demand…

Q: Imagine a firm with a marginal abatement cost (MAC) function equal to: MAC = 27 - 3E. The…

A: Given, MAC = 27 - 3E Emission tax = $6

Q: Acustomer has purchased one pack of 100 pairs of disposable face masks The price of the second…

A: In a market, a consumer's buying decision depends upon their individual behavior and a rational…

Q: The W-4 tax form is used to determine how much your gross pay should be. avoid paying income taxes…

A: In an economy, taxation is considered as the complex economic system because it is different for…

Q: 4 8 12 16

A: A grant could be a government-provided profit to a private, business, or establishment. It will be…

Q: p> 600 -0.05x, losxs 12 here e denotes the wholesale unit price in

A: The revenue function of R'(x) = 600 - 0.018x

Q: Meena earns Tk. 9000 from her poultry firm. Over the day, equipments of egg hatcheries depreciate in…

A: Since we only answer upto three sub parts, we will answer the first three only. Please resubmit the…

Q: Meena earns Tk. 9000 from her poultry firm. Over the day, equipments of egg hatcheries depreciate in…

A: Personal income: It can be defined as the money which is earned from employment, investments,…

Q: Elya's construction company is charged 150 pesos per ton for hauling its raw materials by ABC…

A: Given that; Elya's construction company is charged 150 pesos per ton for hauling its raw materials…

Q: ociated NNP is equal to– (A) GNP- depreciationqon (B) GNP + depreciation qong (C) GNP– net export on…

A: According to the given question NNP stands for net national product is the actual amount of the…

Q: f Qd = 25 - 1.25P and Qs = -50 + 5P and a per unit tax is imposed on suppliers, the burden of the…

A: In economics, economic equilibrium is a situation in which economic forces such as supply and demand…

Q: Marginal tax rate in KS for single filter is T(I)= 3.1% $0 ≤ I ≤ 15,000 5.25% $15,000 ≤ I ≤ 30,000…

A: We are going to calculate taxes in dollars to answer this question.

Q: Aside from paying penalties what other reasons (at least 3), on why we need to be BIR compliant or…

A: BIR compliant stands for Bureau of Internal Revenue. For tax purposes, general simple things may…

Q: @0 (3) (d) 9. C I a foodien 6. Troy buys a sound system priced at $8,820.00 but paid $9,702.00 with…

A: It is given that the price of the product is $8,820.00 and the consumer purchases the commodity at…

Q: Taxable Income Total Tax $1000 $500 $2000 $600 $3000 $700 $4000 $800 $5000 $900 $6000 $1000 Refer to…

A: Answer; Option (b) is Correct answer

Q: (1D) Cameron lives in an apartment building and gets a $700 benefit from playing his stereo. Renee,…

A: "As per Bartleby guidelines, we will solve the first multiple-choice question for you. If you want…

Q: An unmarried, recent engineering graduate of Utech earned $52,000 during the previous tax year. The…

A: Income tax is a kind of tax levied by governments on the earnings of businesses and individuals…

Q: 2. Compute for the number of blocks that an ice plant must be able to sell per month to break-even…

A: Here Given , Cost of electricity 20.00/block. Tax to be paid 2.00/block. Real state…

Q: If the federal tax rate is 36% and the state tax rate is 7%, the effective tax rate is closest to:…

A: The federal tax rate = 36% Sate tax rate = 7%

Q: property tax you pay? From the township, you must have received a letter indicating how much…

A: *Answer: Property tax refers to the amount of tax paid by an individual or corporation on the…

Q: (a) Differentiate between income tax and sales tax. Explain both of these types with the help of…

A: The government imposes taxes on the population which are a ratio of income paid by the people to the…

Q: Y S G X-IM 935 -250 320 40 70 2,100 320 140 40 3,220 250 320 200 -150 4,800 375 320 240 -185 5,320…

A: Aggregate expenditure is the sum of consumption ,investment, government spending and net exports in…

Q: Aq . Compute for the following equations( Ay A. 0.5Y = 100-0.25QX. %3D

A: Given, 0.5Y = 100 - 0.25QX

Q: 1Od = 55-2.5P and Qs =-50 5P and a per unit tax is imposed on suppliers, the burden of the tax on…

A: Given information: Qd=55-2.5P Qs=-50+5P tax of per unit on supplier.

Q: While studying for engineering economy mid-term exam, you and two friends find yourselves craving a…

A: Since you have posted a question with multiple sub-parts, we will solve the first 3 sub-parts for…

Q: Explain the income and substitution etfects of a fuel tax (carbon tax).

A: Carbon tax is paid by businesses and industries that end up greenhouse emission through their…

Q: Al-AMEERAT firm revealed a large gold mine expected to produce 100 tom of gold The fam invests…

A: Given : Total investment=120000 OMR Total Production=100 tons Extraction of gold=30 tons

Q: A contractor who files as unmarried (single) to the IRS has an effective tax rate of 28%. His gross…

A: Taxable income is calculated as follows.

Q: Qs = 0.5P Qd = 45 - 0.25p Suppose a per-unit tax is imposed that reduces the quantity of this…

A: Tax can be imposed on sellers or buyers but effect on quantity will remain the same. Suppose tax is…

Q: While studying for the engineering economy final exam, you and two friends find yourselves craving a…

A: Engineering economics deals with the analysis and evaluation of engineering problems on the basis of…

Q: Businesses that offer repayment plans for purchases are required by law to disclose the interest…

A: Given : Area of the space = 312 sq foot. Rate of carpet = 1.36 dollars per sq foot. Tax rate = 6.9%.…

Step by step

Solved in 3 steps with 3 images

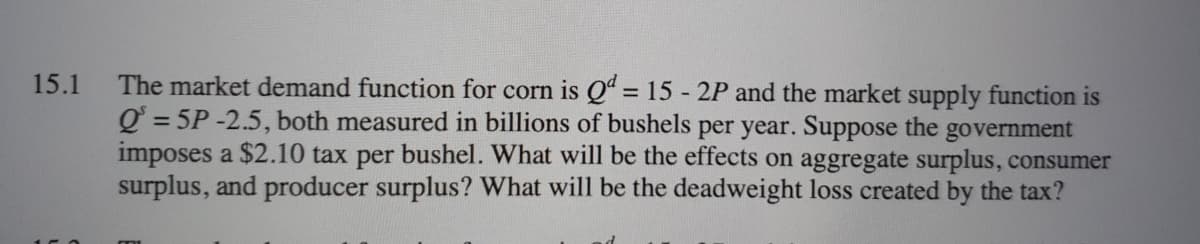

- Q2. Suppose the following demand and supply function of a commodity. 15 Qd = 220 - 20P Qs = -200 + 40P After imposing tax, the new supply function is Qs = -240 + 40P Find out the equilibrium price and quantity before tax. Find consumer and producer surplus before tax. Determine government revenue and dead weight loss after tax.given the following information QD=240-5p and QS=P, where QD is the quantity demanded, and QS is the quantity supplied and P is the price. Suppose the government decides to impose a tax of $12 per unit on sellers in the market. Determine: Total surplus after taxAlgebraically, solve for the after tax equilibrium price and quantity in the corn market, if the government collects a specific tax of t=$2.40 from customers. The before-tax linear demand function for U.S. corn is given as Q=15.6-0.5p and the original supply curve is given as Q=9.6+0.25p. Please show with a diagram.

- Assume that the demand function for a commodity is given by Qd = 3 – 0.1P and that the supply function is given by Qs = 1 + 0.05P, where P is the price, Qd is the quantity demanded and Qs is the quantity supplied. Suppose the government levies a tax of t cedis per unit sold. If the market is in equilibrium and the tax is increased, show how the price, quantity and tax revenue will change once the new equilibrium has been attained.In a competitive market in which P = 100 − 2Q is the inverse demand for fuel and P = 10 + Q is the inverse supply of fuel. Calculations are preferred, but you may use a graph for partial Without a tax, what is the market-clearing price and output, P and Q? What is the consumer surplus and producer surplus (with no tax) If a tax on fuel is set at $15, how much fuel will be purchased? You can assume that the buyers pay the tax (but it doesn’t matter). What is the deadweight loss of the tax? Thanks!In Figure 3.7, applying a $1.05 specific tax causes the equilibrium price to rise by 70¢ and the equilibrium quantity to fall by 14 million kg of pork per year. Using the pork supply function and the original and after-tax demand functions, derive these results using algebra. Figure 3.7

- In the market for a good, the aggregate demand and supply are summarized by the following expressions: Qd (p) = 20−p & Qs (p) = 2p−4 Assume the government charges a per-unit tax of τ dollars on each unit of the good purchased by the consumers. If the resulting equilibrium quantity is 8 units of the good, what must be the value of the tax?The short-run market demand and supply curves for good X are as follows: QD = 20 - 4P QS = 7 + 2.5P Find the equilibrium price and quantity before the imposition of the tax. What is the price actually paid by the demanders (Pd) due to a quantity or specific tax of $1 per unit collected from the buyers? What is the price actually received by the suppliers (Ps) due to a quantity or specific tax of $1 per unit collected from the buyers? What is the after- or post-tax quantity? What is the total revenue after the imposition of the quantity or specific tax? How much of the tax do consumers pay (in percent)? How much of the tax do producers pay (in percent)?Consider a market where the demand and supply for the good are described by the following equations: QD= 225-3P and QS=-22.5 +1.5P If there is a $3 per unit tax on the good, what is the revenue from the tax?

- Suppose the following demand and supply function of a commodity. 15 Qd = 55 - 5P Qs = -50 + 10P After imposing tax, the new supply function is Qs = -60 + 10P Find out the equilibrium price and quantity before tax.Suppose legislation is passed stating that a per unit tax of $.50 per gallon of gasoline must be paid by energy suppliers. Assuming demand for gasoline is more inelastic than supply of gasoline, then the economic burden of this tax? a. Will be equally experienced by energy suppliers and consumers. b. Gasoline prices will be disrupted by the tax and this disruption will harm consumers more than energy suppliers. c. Gasoline prices will be disrupted by the tax but this disruption will harm only energy suppliers since they are ordered by law to pay the tax. d. Gasoline prices will be disrupted by the tax and this disruption will harm suppliers more so than consumers.In a closed economy, the demand and the supply function for a given commodity are QD =150-2p and QS = - 50+2p, respectively. Suppose that the government provides a subsidy equal to16 Euros per unit of quantity supplied. Determine the price the producers receive, the price the consumers pay, the total sales, and the cost to the taxpayers in the industry equilibrium with the subsidy.