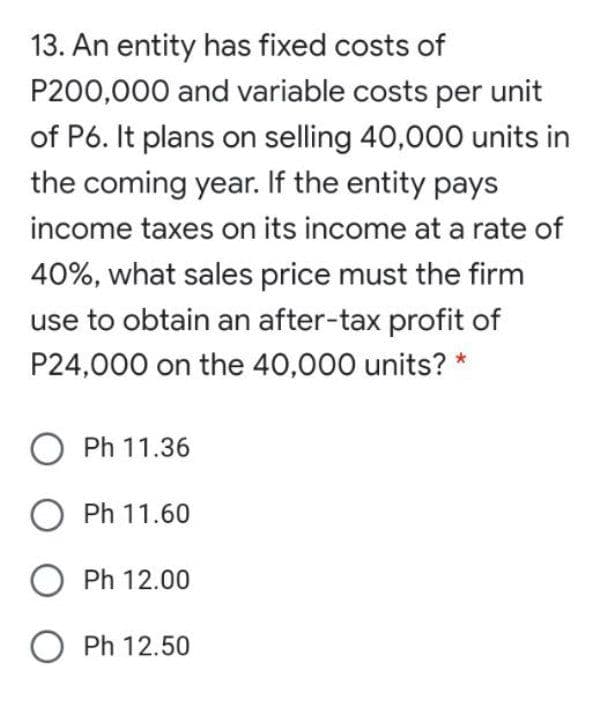

An entity has fixed costs of p0,000 and variable costs per unit P6. It plans on selling 40,000 units in e coming year. If the entity pays ome taxes on its income at a rate of %, what sales price must the firm e to obtain an after-tax profit of 4,000 on the 40,000 units? * Ph 11.36

Q: 1. Given the inverse demand equation P = 10 – 0.05Q and the inverse supply equation P = 1 + 0.10Q: ...

A: Given; Demand Function; P=10-0.05Q Supply Function; P=1+0.10Q 1) Supply and Demand curve:-

Q: Consider the Nash Bargaining game. There are 2 players who have to decide how to split one dollar. T...

A: Equilibrium in the market occurs where the price is equal to the marginal cost. It means the market ...

Q: Which of the following could lead to increases in health care expenditures? (Please choose all that ...

A: In the healthcare market, the expenditure on healthcare services depends upon various demand factors...

Q: Consider a Cournot equilibrium where each of the (n) firms faces a constant marginal cost of (m), th...

A: Given information Cournot demand curve P=a-bQ lets take 2 firm Q=q1+q2 Marginal cost=C

Q: 1. A capital budgeting project is acceptable if the rate of return required for such a project is gr...

A: A rate of return (RoR) is the net gain or loss of an investment over a specified time period, expres...

Q: 1) Under which of the following scenarios would an expansionary fiscal policy be more effective? Gr...

A: In an economy, expansionary fiscal policy refers to the situation when government tries to increase ...

Q: A telephone switchboard 100 pair cable can be made up with either enameled wire or tinned wire. Ther...

A: We have: Total soldered connections = 400 The cost of soldering a connection on the enameled wire = ...

Q: What would happen if the government imposes a price ceiling on oil and gas prices, how would this af...

A: At a marketplace, when government intervenes to influence the market price z it is known as price co...

Q: Assuming Prunella has only 2 units of land, how much extra output does she get from adding an extra ...

A:

Q: TRISTAN WALKER is the founder of Walker & Company, which makes health and beauty products for people...

A: On got some information about the best guidance he at any point got he referenced: Actor and maker T...

Q: 4. Historically, money has become more and more important - the technological developments made spe...

A: During older days, there was barter system, in which goods were exchanged for goods. Then metals suc...

Q: Give an example of an Elastic product, what makes it elastic? What can make it become inelastic? Gi...

A: The demand for the product is elastic when the change in quantity demanded of the good is more than ...

Q: Consider a firm that produces output (y) using only two inputs (A and B). The firm has a perfect sub...

A: Two inputs are perfect substitutes when only one of them is enough to produce output.

Q: Which measures the changes in the prices of a "market basket" of some 100 goods produced by typical ...

A: Price index is defined as the average of a price compared to given class of goods and services. They...

Q: Is it possible to solve this question for an industrial economics? How can the cross elasticity of ...

A: The Cross elasticity of demand is the proportional change in the quantity of X good demanded resulti...

Q: Games 2. Consider the following game. Bob R Ann U (2,2) (20,0) D (0,20) (19,19) L a. Find all Nash e...

A: a. Nash Equilibria is a decision-making theorem where a player can achieve the maximum outcome by no...

Q: Three voters vote over two candidates (A and B), and each voter has two pure strategies: vote for A ...

A: Given, There are Three Players : Voter 1, Voter 2 and Voter 3The three Voters vote for two candidat...

Q: Why is it easier to identify the costs than the benefits of international trade?

A: International trade refers to the exchange of goods and services between nations. It includes export...

Q: according to wray, why must the government spend before it collects taxes? Do taxes ans bonds financ...

A: Bonds is the instrument that is used for lending purpose. It is inversely related to the price of th...

Q: Define privatization in 30 to 40 words.

A: Privatization means:

Q: A firm’s average cost (AC) per unit of output depends on the number of hours of skilled labor (S) an...

A: The average cost curve is the Total Cost curve divided by quantity. The average cost curve is U-shap...

Q: 1- Solve the set of simultaneous equations below: a- 2x-4y=-24 9x-3y=-3 b- 2x+3y=27 6x+9y=81

A: "Since you have asked multiple questions, we will solve first question for you .. If you want any sp...

Q: What is Microeconomics? What is the price elasticity of demand? What are the various methods of comp...

A: Economics is a study that has a broader scope and includes all the factors that affect the economic/...

Q: The price elasticity of demand for a product is estimated to be -2.3. At the initial price of $20, t...

A: Elasticity of demand measures the quantitative change in the demand in response to change in the pri...

Q: What is Microeconomics?

A: Economics is concerned with the production, distribution, and consumption of goods and services. It ...

Q: React to the statement below: “The glory of globalization could also be its downfall.”

A: Globalization refers to the process of integration of the economies of world. This integration invol...

Q: Discuss whether there is a conflict between economic growth,price stability and full employment

A: Meaning of Macroeconomics: The term macroeconomics refers to the situation of economic and scarcit...

Q: am trying to find the simplest way to solve the question if Im using a cas calculator) (Formulas an...

A: *Answer:

Q: A large chocolate production facility is having trouble disposing of the tons of cocoa bean shells t...

A: A major chocolate factory is having problems getting rid of the tonnes of cocoa bean shells it produ...

Q: First Player can invest $1.00 with Second Player. Second Player chooses whether to cooperate and mak...

A: This is an example of game theory where each player seeks to maximize his payoff provided the strate...

Q: Which of the following is NOT TRUE about bond valuation? * a. Bonds can sell either for a discount ...

A: A bond is a fixed-income security that represents an investor's debt to a borrower (typically corpor...

Q: Which of the following statements conceming the changes that occur is corret if you were to make a $...

A: Given: Deposit=$200 Reserve ratio=0.10

Q: A firms production function is Q (L) = 15L2 - 0.1L3 = where output (Q) is a function of a single in...

A: (i) Total Product=Output=15L2 - 0.1L3 FOC: Maximizing TP : Differentiating TP function wrt L and equ...

Q: Ashortage is when there is more demand than there is supply. You can find it by subtracting the quan...

A: Market Equilibrium when the market demand is equal to the market supply. In the table, quantity dem...

Q: 5. ) In industries with exogenous sunk costs, industry concentration decreaseses and apporaches zero...

A: "Since you have asked multiple questions, we will solve first question for you .. If you want any sp...

Q: Use the below table to answer this question: Marginal Opportunity Cost Number of Forklifts Total Ben...

A: Marginal Opportunity Cost is the additional cost incurred by buying an additional forklift . It is g...

Q: mand for organs increases from qa to qE. mand for organs doesn't change with the imposition of a zer...

A: All answers given below,

Q: You borrow $100 from one friend. You sell another friend an old cell phone case for $30. You give a ...

A: As given $100 borrow from one friend and $30 recieve after selling an old cell phone case and $80 gi...

Q: Instructions: Enter your answer as a whole number. If you are entering a negative number include a m...

A: The aggregate supply is the total amount of services and commodities that firms in an economic plan ...

Q: Explain production function to a non-academic audience.

A: The markets are the place where the buyers and the sellers tend to interact with each other. The dem...

Q: Refer to the graph to the right. The shift from AS, to AS, shown in the diagram is referred to as a(...

A: Aggregate supply curve is a positively sloped curve which shows the relationship between price level...

Q: Consider the situation below: You were involved in an accident with the other car, and the accident...

A: Introduction Suppose you were involved in a accident and it was only my fault. Then the car owner as...

Q: A prescriptive model of the BGS relationship would be one that tells us how that relationship does w...

A: Business-wide term incorporating a reach of actions and foundations. Government - alludes to designs...

Q: You won a prize in a contest! There are two choices: take the $500 prize today or wait one year and ...

A:

Q: Suppose a nation’s firms make heavy use of factors of production owned by residents of foreign count...

A: GDP refers to the money value of all final goods and services that are produced within the country d...

Q: What acts are considered as a violations of the Intellectual Property Code?

A: Violations of protected innovation can be an enormous worry for a business because of the way that p...

Q: Consider two lotteries: • Lottery 1: The gamble (0.1,0.6,0.3) over the final wealth levels ($1, $2, ...

A: People who prioritise capital preservation over the possibility of a higher-than-average return are ...

Q: Bid 1: 9% per year, compounded quarterly Bid 2: 3% per quarter, compounded quarterly Bid 3: 8.8% per...

A: When compounding effects are considered, the real return on a savings account or other interest-payi...

Q: The table below indicates the current valuos of various money accounts. All figures are denominated ...

A: Given: Currency outside banks=$357 Travelers cheques=$30

Step by step

Solved in 2 steps with 1 images

- A firm has the opportunity to invest in a project having an initial outlay of $20,000. Net cash inflows (before depreciation and taxes) are expected to be $5,000 per year for five years. The firm uses the straight-line depreciation method with a zero salvage value and has a (marginal) income tax rate of 40 percent. The firms cost of capital is 12 percent. Compute the IRR and the NPV. Should the firm accept or reject the project?A process plant making 5000kg /day of a product selling for $1.75 per kg has annual directproduction costs of $2 million at 100 percent capacity and other fixed costs of $700,000. What isthe fixed charge per kg at the break-even point? If the selling price of the product is increased by10 percent, what is the dollar increase in net profit at full capacity if the income tax rate is 35percent of gross earnings?A firm is considering purchasing a machinethat costs $65,000. It will be used for six years, andthe salvage value at that time is expected to be zero.The machine will save $35,000 per year in labor, butit will incur $12,000 in operating and maintenancecosts each year. The machine will be depreciatedaccording to five-year MACRS. The firm’s tax rateis 40%, and its after-tax MARR is 15%. Should themachine be purchased?

- The following are data from a production, calculate; The Break-even point in terms of sales value and in . The production demand is at 20,000 units. What is the cw1ent production profit? If the management decides to lower dow11its selling price by 50% given the same demand, will this be a sound decision? Justify. Monthly Fixed Factory Overhead Cost = P600,000 Monthly Fixed Selling Overhead Cost = Pl20,000 Va1iable Manufacturing Cost per Unit = P220 Va1iable Selling Cost per Unit = P30 Variable Distribution Cost per Units = P50 Selling Price per limit = P400A Civil Engineer is considering establishing his own company. An investment of $4,000,000 will berequired, which will be recovered in 15 years.It is estimated that revenue will be $8,000,000 per year and that operating expenses will be as follows:Materials $1,600,000 per yearLabor $2,800,000 per yearOverhead $400,000 + 10% of the yearly revenueOther expenses $600,000 per yearThe engineer will give up his regular job paying $2,160,000 per year and devote his time fulltime to theoperation of the business; this will result in decreasing labor costs by $400,000 per year, material costs by$280,000 per year and overhead cost by $320,000 per year. If the man expects to earn at least 20% ofhis capital, should he invest? NOTE: Use Annual Worth Method.Consider a five-year MACRS asset, which can be purchased at $80.000. Thesalvage value of this asset is expected to be $42,000 at the end of three years.What is the amount of gain (or loss) when the asset is disposed of at the end of three years?(a) Gain $11,280(b) Gain $9,860(c) Loss $9,860(d) Gain $18,960

- You've estimated the following cash flows (in $ million) for two mutually exclusive projects: Year Project A Project B 0 -27 -43 1 30 45 2 40 50 What is the crossover rate, i.e., the discount rate at which both projects have the same NPV? What is project A's NPV at the crossover rate? What is project B's NPV at the crossover rate?Green Management Company is consideringthe acquisition of a new eighteen-wheeler.• The truck’s base price is $80,000, and it will costanother $20,000 to modify it for special use by thecompany.• This truck falls into the MACRS five-year class. Itwill be sold after three years for $30,000.• The truck purchase will have no effect on revenues, but it is expected to save the firm $45,000per year in before-tax operating costs, mainly inleasing expenses.• The firm’s marginal tax rate (federal plus state) is40%, and its MARR is 15%.(a) Is this project acceptable, based on the mostlikely estimates given in the problem?(b) If the truck’s base price is $95,000, what wouldbe the required savings in leasing so that the project would remain profitable?The Monty Corporation has a staff of sales people who are paid a monthly salary of $1,400.00 plus an incremental commission based on the table below. If Sally sells $25,700.00, what is her total gross pay for the month? Level Sales Volume CommissionRate 1 9,100–17,600 3.1% 2 Over 17,600 4% $2,269.60 $2,369.60 $2,469.60 $2,569.60

- Engr. Roque owner of the HarRoq’s Ice Plant is monitoring the cashflow of the plant. Based on the following information, how many ice blocks must produce and able to sell per month in order to break even? Ice block price Php 50.00/ice block Cost of electricity Php 30.00/ice block Tax to be paid Php 3.00/ice block Real estate Tax Php 4,500.00/month Salaries and wages Php 30,000.00/month Others Php 15,000.00/monthGiven - Qd=525−3pQs=265+2pTC=23Q2+150Q A)What is the equilibrium price and quantity? B)What is the new equilibrium price if there is 5 peso tax per unit? C)What is the new equilibrium if there is a 2 peso subsidy per unit? (no tax applied here) D)Solve for Price and Quantity that maximizes profit. What is the max profit? E)What are the break-even quantities?4- As a prospective owner of a club known as the Red Rose, you are interested in determining the volume of salesdollars necessary for the coming year to reach the break-even point. You have decided to break down the salesfor the club into four categories, the first category being beer. Your estimate of the beer sales is that 30,000 drinkswill be served. The selling price for each unit will average $1.50; the cost is $.75. The second major category ismeals, which you expect to be 10,000 units with an average price of $10.00 and a cost of $5.00. The third majorcat- egory is desserts and wine, of which you also expect to sell 10,000 units, but with an average price of $2.50per unit sold and a cost of $1.00 per unit. The final category is lunches and inexpensive sandwiches, which youexpect to total 20,000 units at an average price of $6.25 with a food cost of $3.25. Your fixed cost (i.e., rent,utilities, and so on) is $1,800 per month plus $2,000 per month for entertainment.a) What is your…