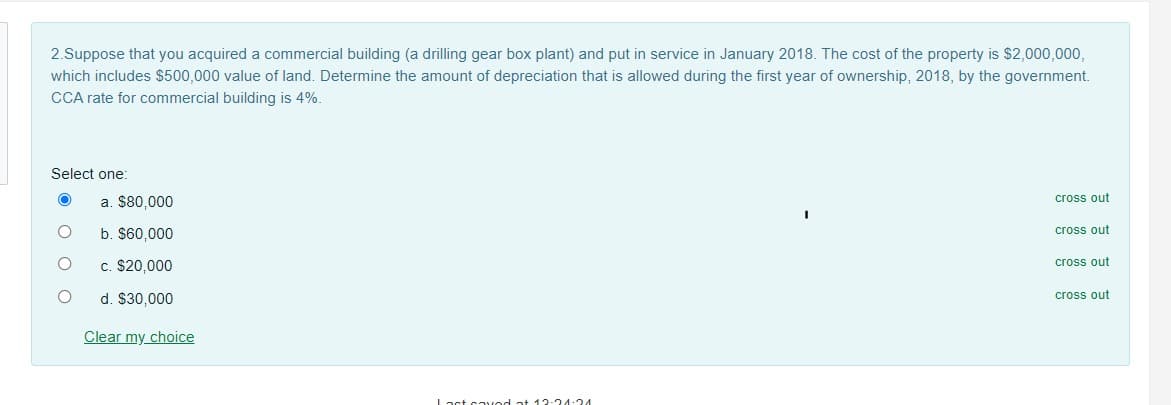

2.Suppose that you acquired a commercial building (a drilling gear box plant) and put in service in January 2018. The cost of the property is $2,000,000, which includes $500,000 value of land. Determine the amount of depreciation that is allowed during the first year of ownership, 2018, by the government. CCA rate for commercial building is 4%.

2.Suppose that you acquired a commercial building (a drilling gear box plant) and put in service in January 2018. The cost of the property is $2,000,000, which includes $500,000 value of land. Determine the amount of depreciation that is allowed during the first year of ownership, 2018, by the government. CCA rate for commercial building is 4%.

Chapter8: Depreciation And Sale Of Business Property

Section: Chapter Questions

Problem 7P: Calculate the following: The first year of depreciation on a residential rental building costing...

Related questions

Question

Transcribed Image Text:2.Suppose that you acquired a commercial building (a drilling gear box plant) and put in service in January 2018. The cost of the property is $2,000,000,

which includes $500,000 value of land. Determine the amount of depreciation that is allowed during the first year of ownership, 2018, by the government.

CCA rate for commercial building is 4%.

Select one:

a. $80,000

cross out

b. $60,000

cross out

c. $20,000

cross out

d. $30,000

cross out

Clear my choice

ast saved at 1 2-24:24

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College