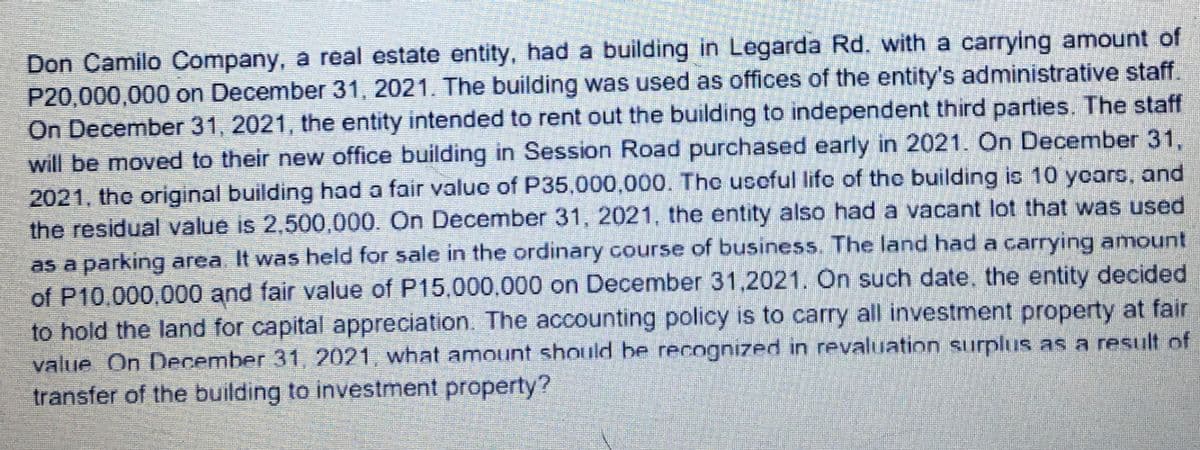

Don Camilo Company, a real estate entity, had a building in Legarda Rd. with a carrying amount of P20,000,000 on December 31, 2021. The building was used as offices of the entity's administrative staff. On December 31, 2021, the entity intended to rent out the building to independent third parties. The staff will be moved to their new office building in Session Road purchased early in 2021. On December 31, 2021, the original building had a fair value of P35,000,000. The usoful life of the building is 10 yoars, and the residual value is 2,500,000. On December 31, 2021, the entity also had a vacant lot that was used as a parking area. It was held for sale in the ordinary course of business. The land had a carrying amount of P10.000,000 and fair value of P15,000.000 on December 31,2021. On such date, the entity decided to hold the land for capital appreciation. The accounting policy is to carry all investment property at fair value On December 31, 2021, what amount should be recognized in revaluation surplus as a result of transfer of the building to investment property?

Don Camilo Company, a real estate entity, had a building in Legarda Rd. with a carrying amount of P20,000,000 on December 31, 2021. The building was used as offices of the entity's administrative staff. On December 31, 2021, the entity intended to rent out the building to independent third parties. The staff will be moved to their new office building in Session Road purchased early in 2021. On December 31, 2021, the original building had a fair value of P35,000,000. The usoful life of the building is 10 yoars, and the residual value is 2,500,000. On December 31, 2021, the entity also had a vacant lot that was used as a parking area. It was held for sale in the ordinary course of business. The land had a carrying amount of P10.000,000 and fair value of P15,000.000 on December 31,2021. On such date, the entity decided to hold the land for capital appreciation. The accounting policy is to carry all investment property at fair value On December 31, 2021, what amount should be recognized in revaluation surplus as a result of transfer of the building to investment property?

Chapter10: Cost Recovery On Property: Depreciation, Depletion, And Amortization

Section: Chapter Questions

Problem 55P

Related questions

Question

Transcribed Image Text:Don Camilo Company, a real estate entity, had a building in Legarda Rd. with a carrying amount of

P20,000,000 on December 31, 2021. The building was used as offices of the entity's administrative staff.

On December 31, 2021, the entity intended to rent out the building to independent third parties. The staff

will be moved to their new office building in Session Road purchased early in 2021. On December 31,

2021, the original building had a fair valuo of P35,000,000. The usoful lifo of the building is 10 yoars, and

the residual value is 2,500,000. On December 31, 2021, the entity also had a vacant lot that was used

as a parking area It was held for sale in the ordinary course of business. The land had a carrying amount

of P10,000,000 and fair value of P15,000,000 on December 31,2021. On such date, the entity decided

to hold the land for capital appreciation. The accounting policy is to carry all investment property at fair

value On December 31, 2021, what amount should he recognized in revaluation surplus as a result of

transfer of the building to investment property?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning