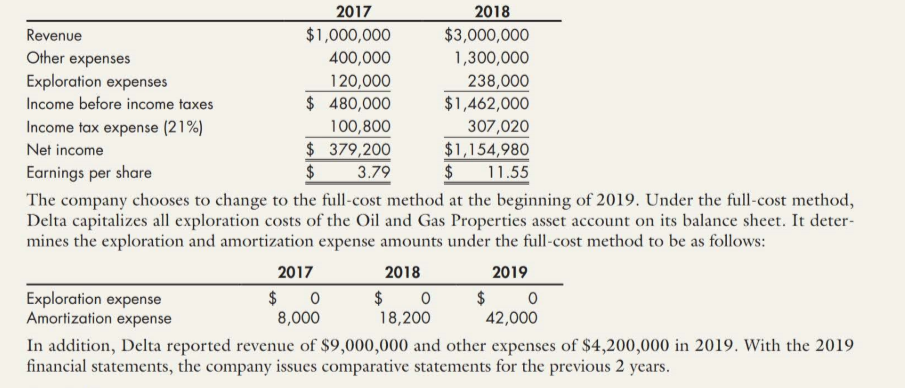

2017 $1,000,000 2018 $3,000,000 Revenue Other expenses Exploration expenses 400,000 1,300,000 120,000 238,000 $1,462,000 Income before income taxes $ 480,000 Income tax expense (21%) 100,800 307,020 $379,200 $1,154,980 11.55 Net income Earnings per share 3.79 The company chooses to change to the full-cost method at the beginning of 2019. Under the full-cost method, Delta capitalizes all exploration costs of the Oil and Gas Properties asset account on its balance sheet. It deter- mines the exploration and amortization expense amounts under the full-cost method to be as follows: 2017 2018 2019 Exploration expense Amortization expense $ 0 8,000 $ 0 18,200 $ 0 42,000 In addition, Delta reported revenue of $9,000,000 and other expenses of $4,200,000 in 2019. With the 2019 financial statements, the company issues comparative statements for the previous 2 years.

2017 $1,000,000 2018 $3,000,000 Revenue Other expenses Exploration expenses 400,000 1,300,000 120,000 238,000 $1,462,000 Income before income taxes $ 480,000 Income tax expense (21%) 100,800 307,020 $379,200 $1,154,980 11.55 Net income Earnings per share 3.79 The company chooses to change to the full-cost method at the beginning of 2019. Under the full-cost method, Delta capitalizes all exploration costs of the Oil and Gas Properties asset account on its balance sheet. It deter- mines the exploration and amortization expense amounts under the full-cost method to be as follows: 2017 2018 2019 Exploration expense Amortization expense $ 0 8,000 $ 0 18,200 $ 0 42,000 In addition, Delta reported revenue of $9,000,000 and other expenses of $4,200,000 in 2019. With the 2019 financial statements, the company issues comparative statements for the previous 2 years.

Fundamentals of Financial Management (MindTap Course List)

15th Edition

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Eugene F. Brigham, Joel F. Houston

Chapter4: Analysis Of Financial Statements

Section: Chapter Questions

Problem 24P: Income Statement for Year Ended December 31, 2018 (Millions of Dollars) Net sales 795.0 Cost of...

Related questions

Question

Delta Oil Company uses the successful-efforts method to accout for oil exploration cost. Delta started business in 2017 and prepared the following income statements:

1. Prepare the

Transcribed Image Text:2017

$1,000,000

2018

$3,000,000

Revenue

Other expenses

Exploration expenses

400,000

1,300,000

120,000

238,000

$1,462,000

Income before income taxes

$ 480,000

Income tax expense (21%)

100,800

307,020

$379,200

$1,154,980

11.55

Net income

Earnings per share

3.79

The company chooses to change to the full-cost method at the beginning of 2019. Under the full-cost method,

Delta capitalizes all exploration costs of the Oil and Gas Properties asset account on its balance sheet. It deter-

mines the exploration and amortization expense amounts under the full-cost method to be as follows:

2017

2018

2019

Exploration expense

Amortization expense

$ 0

8,000

$ 0

18,200

$ 0

42,000

In addition, Delta reported revenue of $9,000,000 and other expenses of $4,200,000 in 2019. With the 2019

financial statements, the company issues comparative statements for the previous 2 years.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning