2018 January 2 Paid $88,000 cash to purchase storage shed components. January 3 Paid $4,000 cash to have the storage shed erected. The storage shed has an estimated life of 10 years and a residual value of $7,000. April May July 1 13 1 Paid $31,000 cash to purchase a pickup truck for use in the business. The truck has an estimated useful life of five years and a residual value of $5,000. Paid $300 cash for minor repairs to the pickup truck's upholstery. Paid $27,000 cash to purchase patent rights on a new paper bag manufacturing process. The patent is estimated to have a remaining useful life of five years.

2018 January 2 Paid $88,000 cash to purchase storage shed components. January 3 Paid $4,000 cash to have the storage shed erected. The storage shed has an estimated life of 10 years and a residual value of $7,000. April May July 1 13 1 Paid $31,000 cash to purchase a pickup truck for use in the business. The truck has an estimated useful life of five years and a residual value of $5,000. Paid $300 cash for minor repairs to the pickup truck's upholstery. Paid $27,000 cash to purchase patent rights on a new paper bag manufacturing process. The patent is estimated to have a remaining useful life of five years.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter22: Accounting For Changes And Errors.

Section: Chapter Questions

Problem 8P: At the beginning of 2020, Holden Companys controller asked you to prepare correcting entries for the...

Related questions

Question

DO NOT GIVE SOLUTION IN IMAGE

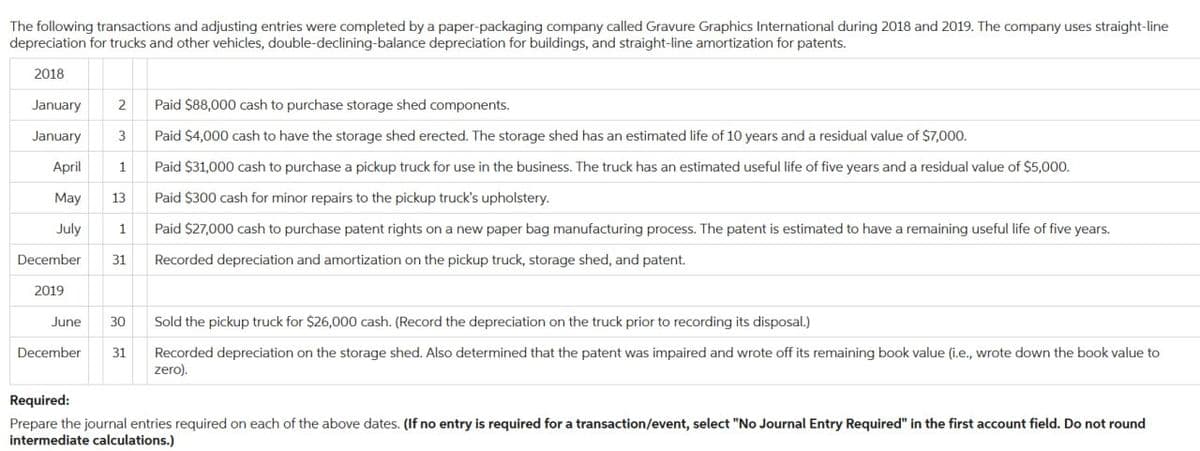

Transcribed Image Text:The following transactions and adjusting entries were completed by a paper-packaging company called Gravure Graphics International during 2018 and 2019. The company uses straight-line

depreciation for trucks and other vehicles, double-declining-balance depreciation for buildings, and straight-line amortization for patents.

2018

January 2

Paid $88,000 cash to purchase storage shed components.

January

3

Paid $4,000 cash to have the storage shed erected. The storage shed has an estimated life of 10 years and a residual value of $7,000.

April

Paid $31,000 cash to purchase a pickup truck for use in the business. The truck has an estimated useful life of five years and a residual value of $5,000.

Paid $300 cash for minor repairs to the pickup truck's upholstery.

May

13

July 1

Paid $27,000 cash to purchase patent rights on a new paper bag manufacturing process. The patent is estimated to have a remaining useful life of five years.

December 31 Recorded depreciation and amortization on the pickup truck, storage shed, and patent.

2019

June

1

30

December 31

Sold the pickup truck for $26,000 cash. (Record the depreciation on the truck prior to recording its disposal.)

Recorded depreciation on the storage shed. Also determined that the patent was impaired and wrote off its remaining book value (i.e., wrote down the book value to

zero).

Required:

Prepare the journal entries required on each of the above dates. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field. Do not round

intermediate calculations.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 6 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage