Soon after December 31, 2019, the auditor requested a

The

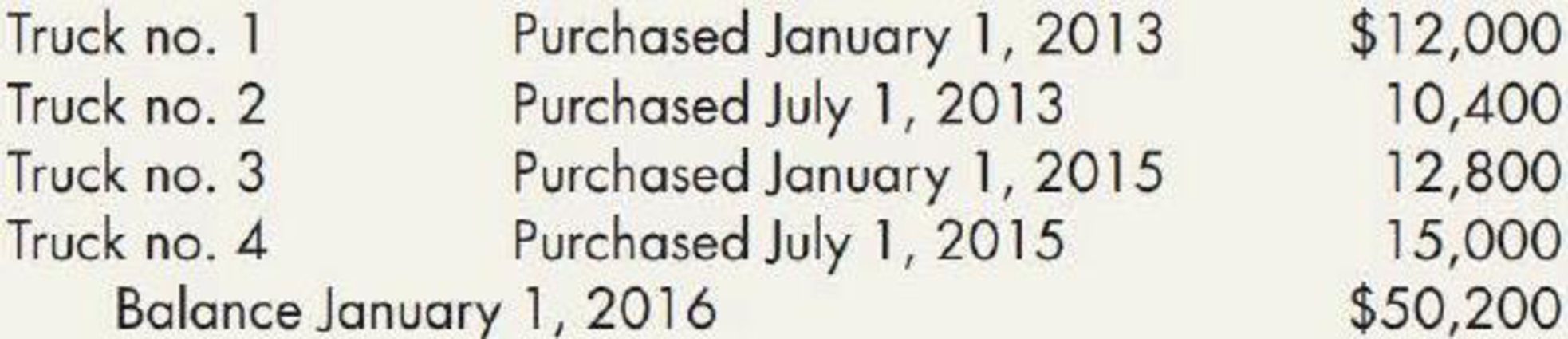

Transactions between January 1,2017, and December 31, 2019, and their record in the ledger were as follows:

- 1. July 1, 2016: Truck no. 1 was sold for $1,000 cash. The entry was a debit to Cash and a credit to Trucks, $1,000.

- 2. January 1, 2017: Truck no. 3 was traded for a larger one (no. 5) with a 5-year life. The agreed purchase price was $12,000. Jarrett paid the other company $1,780 cash on the transaction. The entry was a debit to Trucks, $1,780, and a credit to Cash, $1,780.

- 3. July 1, 2018: Truck no. 4 was damaged in a wreck to such an extent that it was sold as junk for $50 cash. Jarrett received $950 from the insurance company. The entry made by the bookkeeper was a debit to Cash, $1,000, and credits to Miscellaneous Revenue, $50, and Trucks, $950,

- 4. July 1, 2018: A new truck (no. 6) was acquired for $20,000 cash and debited at that amount to the Trucks account. The truck has a 5-year life.

Entries for depreciation had been made at the close of each year as follows: 2016, $8,840; 2017, $5,436; 2018, $4,896; 2019, $4,356.

Required:

- 1. Next Level For each of the 4 years, calculate separately the increase or decrease in earnings arising from the company’s errors in determining or entering depreciation or in recording transactions affecting trucks.

- 2. Prove your work by one compound

journal entry as of December 31, 2019; the adjustment of the Trucks account is to reflect the correct balances, assuming that the books have not been closed for 2019.

1.

Compute the effect of earnings (increase or decrease) of Company J that arise from the company’s error in determining the depreciation of the truck.

Explanation of Solution

Depreciation expense: Depreciation expense is a non-cash expense, which is recorded on the income statement reflecting the consumption of economic benefits of long-term asset on account of its wear and tear or obsolesces.

The effect of earnings that arise from the company’s error in determining the depreciation of the truck as follows:

| Year | Increase or decrease |

| 2016 | $(2,600) Decrease |

| 2017 | $496 Increase |

| 2018 | $(7,094) Decrease |

| 2019 | $(2,044) Decrease |

Table (1)

Compute the correct depreciation:

| Truck | 2016 | 2017 | 2018 | 2019 |

| 1. | $1,200 | - | - | - |

| 2. | $2,080 | $2,080 | $1,040 | - |

| 3. | $2,560 | - | - | - |

| 4. | $3,000 | $3,000 | $1,500 | - |

| 5. | - | $2,400 (5) | $2,400 (5) | $2,400 (5) |

| 6. | - | - | $2,000 | $4,000 (6) |

| Total | $8,840 | 7,480 | 6,940 | 6,400 |

| Depreciation recorded previously | 8,840 | 5,436 | 4,896 | 4,356 |

| Depreciation Corrected | 0 | $2,044 | $2,044 | $2,044 |

Table (2)

Compute the effort of earnings (increase or decrease) of Company J that arise from the company’s error in determining the depreciation of the truck as follows:

| Date | Account Title and Explanation | Post Ref |

Debit ($) | Credit ($) |

| Correct entry: | ||||

| July 1, 2016 | Cash | 1,000 | ||

| Accumulated Depreciation- Truck (2) | 8,400 | |||

| Loss on disposal of plant property, equipment | 2,600 | |||

| Truck (Number 1) | 12,000 | |||

| (To record the loss on disposal of plant, property and equipment) | ||||

| Entry made: | ||||

| Cash | 1,000 | |||

| Truck (Number 1) | 1,000 | |||

| (To record the sale of truck) | ||||

| Correcting entry: | ||||

| Accumulated Depreciation: Trucks (2) | 8,400 | |||

| Retained Earnings | 2,600 | |||

| Truck (Number 1) | 11,000 | |||

| (To record the accumulated depreciation) | ||||

| Correct entry: | ||||

| January 1, 2017 | Accumulated Depreciation: Trucks | 5,120 | ||

| Truck (Number 5) | 12,000 | |||

| Cash | 1,780 | |||

| Truck (Number 3) | 12,800 | |||

| Gain on Exchange (3) | 2,540 | |||

| (To record the gain on exchange) | ||||

| Entry made: | ||||

| Truck | 1,780 | |||

| Cash | 1,780 | |||

| (To record the cash paid for other company) | ||||

| Correcting entry: | ||||

| Accumulated Depreciation: Trucks | 5,120 | |||

| Truck | 2,580 | |||

| Retained Earnings (3) | 2,540 | |||

| (To record the accumulated depreciation) | ||||

| Correct entry: | ||||

| July 1, 2018 | Accumulated Depreciation –Truck (Number 4) (4) | 9,000 | ||

| Cash | 1,000 | |||

| Loss on disposal of plant property, equipment | 5,000 | |||

| Truck (Number 4) | 15,000 | |||

| (To record the loss on disposal of plant, property and equipment) | ||||

| Entry made: | ||||

| Cash | 1,000 | |||

| Miscellaneous Revenue | 50 | |||

| Truck (Number 4) | 950 | |||

| (To record the cash receipt from the damaged truck) | ||||

| Correcting entry: | ||||

| Accumulated Depreciation –Truck (Number 4) (4) | 9,000 | |||

| Retained Earnings | 5,050 | |||

| Truck (Number 4) | 14,050 | |||

| (To record the accumulated depreciation) |

Table (3)

Working note (1):

Compute the total accumulated depreciation of the trucks:

| Truck | Cost (a) | Life (b) | Annual Depreciation (c) | Years Owned (d) | Accumulated Depreciation |

| 1. | $12,000 | 5 | $2,400 | 3 | $7,200 |

| 2. | $10,400 | 5 | 2,080 | 2.5 | 5,200 |

| 3. | $12,800 | 5 | 2,560 | 1 | 2,560 |

| 4. | $15,000 | 5 | 3,000 | 0.5 | $1,500 |

| Total | $16,460 | ||||

Table (4)

Working note (2):

Compute the accumulated depreciation of the trucks for January 1, 2016:

Working note (3):

Compute the gain or loss on exchange:

Working note (4):

Compute the accumulated depreciation of Truck 4:

| Cost (a) | Life (b) | Annual Depreciation (c) | Years Owned (d) | Accumulated Depreciation |

| $15,000 | 5 | 3,000 | 0.5 (From July 1, 2015 to December 31, 2015) | $1,500 |

| $15,000 | 5 | 3,000 | 1 year (2016) | 3,000 |

| $15,000 | 5 | 3,000 | 1 year (2017) | 3,000 |

| $15,000 | 5 | 3,000 | 0.5 (From January 1, 2018 to July 1, 2018 | $1,500 |

| Total | 9,000 | |||

Table (5)

Working note (5):

Compute the depreciation expenses for truck 5:

Working note (6):

Compute the depreciation expenses of truck 6:

2.

Prepare a correcting compound journal entry as of December 31, 2019.

Explanation of Solution

Prepare a correcting compound journal entry as of December 31, 2019 as follows:

| Date | Account Title and Explanation | Post Ref |

Debit ($) | Credit ($) |

| December 31, 2019 | Retained Earnings (7) | 9,198 | ||

| Accumulated Depreciation of Trucks (8) | 16,388 | |||

| Depreciation expenses (Refer Table (2)) | 2,044 | |||

| Truck (9) | 27,630 | |||

| (To record the compound entry) |

Table (6)

- Retained earnings are the component of stockholder’s equity, and it decreases the value of equity. Hence, debit the retained earnings account with $9,198.

- Accumulated depreciation is a contra-asset, and it increases the value of assets. Hence, debit the accumulated depreciation account with $16,388.

- Depreciation expense is the component of stockholder’s equity, and it decreases the value of equity. Hence, debit the depreciation expense account with $2,044.

- Truck is an asset account, and it decreases the value of assets. Hence, credit the truck account with $27,630.

Working note (7):

Calculate the total retained earnings:

Working note (8):

Calculate the accumulated depreciation:

| Particulars | Amount ($) |

| Accumulated depreciation: | |

| 2016 | 8,400 |

| 2017 | 5,120 |

| 2018 | 9,000 |

| 22,520 | |

| Less: corrected depreciation | |

| 2017 | 2,044 |

| 2018 | 2,044 |

| 2019 | 2,044 |

| Total | 16,388 |

Table (6)

Working note (9):

Calculate the total cost of truck:

| Particulars | Amount ($) |

| Cost of truck: | |

| 2016 | 11,000 |

| 2017 | 2,580 |

| 2018 | 14,050 |

| Total | 27,630 |

Table (7)

Want to see more full solutions like this?

Chapter 11 Solutions

Intermediate Accounting: Reporting And Analysis

- On December 31, 2019, Vail Company owned the following assets: Vail computes depreciation and amortization expense to the nearest whole year. During 2020, Vail engaged in the following transactions: Required: 1. Check the accuracy of the accumulated depreciation balances at December 31, 2019. Round to the nearest whole dollar in all requirements. 2. Prepare journal entries to record the preceding events in 2020, as well as the year-end recording of depreciation expense. 3. Prepare an Accumulated Depreciation account for each category of assets, enter the beginning balance, post the journal entries from Requirement 2, and compute the ending balance.arrow_forwardShannon Corporation began operations on January 1, 2019. Financial statements for the years ended December 31, 2019 and 2020, contained the following errors: In addition, on December 31, 2020, fully depreciated machinery was sold for 10,800 cash, but the sale was not recorded until 2021. There were no other errors during 2019 or 2020, and no corrections have been made for any of the errors. Refer to the information for Shannon Corporation above. Ignoring income taxes, what is the total effect of the errors on the amount of working capital (current assets minus current liabilities) at December 31, 2020? a. working capital overstated by 4,200 b. working capital understated by 5,800 c. working capital understated by 6,000 d. working capital understated by 9,800arrow_forwardDuring 2019, Ryel Companys controller asked you to prepare correcting journal entries for the following three situations: 1. Machine A was purchased for 50,000 on January 1, 2014. Straight-line depreciation has been recorded for 5 years, and the Accumulated Depreciation account has a balance of 25,000. The estimated residual value remains at 5,000, but the service life is now estimated to be 1 year longer than estimated originally. 2. Machine B was purchased for 40,000 on January 1, 2017. It had an estimated residual value of 5,000 and an estimated service life of 10 years. it has been depreciated under the double-declining-balance method for 2 years. Now, at the beginning of the third year, Ryel has decided to change to the straight-line method. 3. Machine C was purchased for 20,000 on January 1, 2018, Double-declining-balance depreciation has been recorded for 1 year. The estimated residual value of the machine is 2,000 and the estimated service life is 5 years. The computation of the depreciation erroneously included the estimated residual value. Required: Prepare any necessary correcting journal entries for each situation. Also prepare the journal entry necessary for each situation to record depreciation expense for 2019.arrow_forward

- At the end of 2020, while auditing Sandlin Companys books, before the books have been closed, you find the following items: a. A building with a 30-year life (no residual value, depreciated using the straight-line method) was purchased on January 1, 2020, by issuing a 90,000 non-interest-bearing, 4-year note. The entry made to record the purchase was a debit to Building and a credit to Notes Payable for 90,000; 12% is a fair rate of interest on the note. b. The inventory at the end of 2020 was found to be overstated by 15,000. At the same time, it was discovered that the inventory at the end of 2019 had been overstated by 35,000. The company uses the perpetual inventory system. c. For the last 3 years, the company has failed to accrue salaries and w-ages. The correct amounts at the end of each year were: 2018, 12,000; 2019, 18,000; and 2020, 10,000. Required: 1. Prepare journal entries to correct the errors. Ignore income taxes. 2. Assume, instead, that the company discovered the errors after it had closed the books. Prepare journal entries to correct the errors. Ignore income taxes.arrow_forwardThe following are independent errors: a. In January 2019, repair costs of 9,000 were debited to the Machinery account. At the beginning of 2019, the book value of the machinery was 100,000. No residual value is expected, the remaining estimated life is 10 years, and straight-line depreciation is used. b. All purchases of materials for construction contracts still in progress have been immediately expensed. It is discovered that the use of these materials was 10,000 during 2018 and 12,000 during 2019. c. Depreciation on manufacturing equipment has been excluded from manufacturing costs and treated as a period expense. During 2019, 40,000 of depreciation was accounted for in that manner. Production was 15,000 units during 2019, of which 3,000 remained in inventory at the end of the year. Assume there was no inventory at the beginning of 2019. Required: Prepare journal entries for the preceding errors discovered during 2020. Ignore income taxes.arrow_forwardComprehensive: Balance Sheet, Schedules, and Notes The following is an alphabetical listing of Stone Boat Companys balances sheet accounts and account balances on December 31, 2019: Additional information: 1. The company reports on the balance sheet the net book value of property and equipment and long-term liabilities (known as control accounts). The related details are disclosed in the notes. 2. The straight-line method is used to depreciate property and equipment based upon cost, estimated residual value, and estimated life. The costs of the assets in this account are: land, 29,500; buildings, 164,600; store fixtures, 72,600; and office equipment, 30,000. 3. The accumulated depreciation breakdown is as follows: buildings, 54,600; store fixtures, 37,400; and office equipment, 17,300. 4. The long term debt includes 12%, 36,000 face value bonds that mature on December 31, 2024, and have an unamortized bond discount of 1,000; 11%, 48,000 face value bonds that mature on December 31, 2025, have a premium on bonds payable of 1,800, and whose retirement is being funded by a bond sinking fund; and a 13% note payable that has a face value of 6,200 and matures on January 1, 2022. 5. The non-interest-bearing note receivable matures on June 1, 2023. 6. Inventory is listed at lower of cost or market; cost is determined on the basis of average cost. 7. The investment in affiliate is carried at cost. The company has guaranteed the interest on 12%, 50,000, 15-year bonds issued by this affiliate, Jay Company. 8. Common stock has a 10 par value per share, 10,000 shares are authorized, and 1,000 shares were issued during 2019 at a price of 13 per share, resulting in 8,000 shares issued at year-end. 9. Preferred stock has a 50 par value per share, 2,000 shares are authorized, and 140 shares were issued during 2019 at a price of 55 per share, resulting in 640 shares issued at year-end. 10. On January 15, 2020, before the December 31, 2019, balance sheet was issued, a building with a cost of 20,000 and a book value of 7,000 was totally destroyed. Insurance proceeds will amount to only 5,000. 11. Net income and dividends declared and paid during the year were 50,500 and 21,000, respectively. Required: 1. Prepare Stone Boats December 31, 2019, balance sheet (including appropriate parenthetical notations). 2. Prepare a statement of shareholders equity for 2019. (Hint: Work back from the ending account balances.) 3. Prepare notes that itemize the balance sheet control accounts and those necessary to disclose any company accounting policies, contingent liabilities, and subsequent events. 4. Next Level Compute the debt-to-assets ratio at the cud of 2019. What is your evaluation of this ratio if it was 39% at the end of 2018? Use the following information for P415 and P416: McCormick Company, Inc. is one of the worlds leading producers of spices, herbs, seasonings, condiments, and other flavorings for foods. Its products are sold to consumers, with sonic of the leading brands of spices and seasonings, as well as to industrial producers of foods. McCormicks consolidated balance sheets for 20X2 and 20X3 follow.arrow_forward

- At the beginning of 2020, Holden Companys controller asked you to prepare correcting entries for the following three situations: 1. Machine X was purchased for 100,000 on January 1, 2015. Straight-line depreciation has been recorded for 5 years, and the Accumulated Depreciation account has a balance of 45,000. The estimated residual value remains at 10,000, but the service life is now estimated to be 1 year longer than originally estimated. 2. Machine Y was purchased for 40,000 on January 1, 2018. It had an estimated residual value of 4,000 and an estimated service life of 8 years. It has been depreciated under the sum-of-the-years-digits method for 2 years. Now, the company has decided to change to the straight-line method. 3. Machine Z was purchased for 80,000 on January 1, 2019. Double-declining-balance depreciation has been recorded for 1 year. The estimated residual value is 8,000 and the estimated service life is 5 years. The computation of the depreciation erroneously included the estimated residual value. Required: Prepare any necessary correcting journal entries for each situation. Also prepare the journal entry for each situation to record the depreciation for 2020. Ignore income taxes.arrow_forwardBalance Sheet and Notes Listed here in random order are Wicks Construction Limiteds balance sheet accounts and related ending balances as of December 31, 2019: Additional information: 1. The company reports on the balance sheet the total amount for inventories and the net book value of property, plant, and equipment, with the related details for each account disclosed in notes. 2. The straight line method is used to depreciate buildings, machinery, and equipment, based upon their cost and estimated residual values and lives. A breakdown of property, plant, and equipment shows the following: land at a cost of 32,000, buildings at a cost of 182,400 and a net book value of 120,200, machinery at a cost of 63,900, and related accumulated depreciation of 18,600, and equipment (40% depreciated) at a cost of 53,000. 3. Patents are amortized on a straight line basis directly to the Patent account. 4. Inventories are listed at the lower of cost or market value using an average cost. The inventories include raw-materials, 22,200; work in process, 34,700; and finished goods, 41,600. 5. Common stock has a 10 par value per share, 12,000 shares are authorized, and 6,280 shares have been issued. 6. Preferred stock has a 100 par value per share, 1,000 shares are authorized, and 400 shares have been issued. 7. The investment in bonds is carried at the original cost, which is the face value, and is being held to maturity. 8. Short-term investments in marketable securities were purchased at year-end. 9. The bonds payable mature on December 31, 2024. 10. The company attaches a 1-year warranty on all the products it sells. Required: 1. Prepare Wicks Constructions December 31, 2019, balance sheet (including appropriate parenthetical notations). 2. Prepare notes to accompany the balance sheet that itemize company accounting policies; inventories; and property, plant, and equipment. 3. Next Level Compute the current ratio and the quick ratio. How do these two ratios provide different information about the companys liquidity? Why are these ratios useful?arrow_forwardKling Company was organized in late 2019 and began operations on January 2, 2020. Prior to the start of operations, it incurred the following costs: Required: 1. What amount should the company expense in 2019? In 2020? 2. Next Level What is the justification of the accounting treatment of these costs?arrow_forward

- It is the end of 2019 and you are an accountant for Stone Company. During 2019, sales of the companys products slumped and the companys earnings are expected to be much less than those of 2018. The president comes to you with an idea. He says, Our companys property, plant, and equipment cost 300,000, and that is the amount we usually report on our balance sheet. However, I just had these assets appraised by an independent appraiser, and she says they are worth 400,000. I think that the company should report the property, plant, and equipment at this amount on its December 31, 2019, balance sheet and should report the 100,000 increase in value as a gain on the 2019 income statement. If we use this approach, it will show how much our company is really worth and increase our earnings. This will make our shareholders happy. What do you think? Required: Prepare a written response to the president.arrow_forwardReece Financial Services Co., which specializes in appliance repair services, is owned and operated by Joni Reece. Reece Financial Services accounting clerk prepared the following unadjusted trial balance at July 31, 2019: The data needed to determine year-end adjustments are as follows: Depreciation of building for the year, 6,400. Depreciation of equipment for the year, 2,800. Accrued salaries and wages at July 31, 900. Unexpired insurance at July 31, 1,500. Fees earned but unbilled on July 31, 10,200. Supplies on hand at July 31, 615. Rent unearned at July 31, 300. Instructions 1. Journalize the adjusting entries using the following additional accounts: Salaries and Wages Payable, Rent Revenue, Insurance Expense, Depreciation ExpenseBuilding, Depreciation ExpenseEquipment, and Supplies Expense. 2. Determine the balances of the accounts affected by the adjusting entries and prepare an adjusted trial balance.arrow_forwardIn 2021, internal auditors discovered that PKE Displays, Inc. had debited an expense account for the $356,000 cost of equipment purchased on January 1, 2018. The equipment’s life was expected to be five years with no residual value. Straight-line depreciation is used by PKE. Required:1. Determine the cumulative effect of the error on net income over the three-year period from 2018 through 2020, and on retained earnings by the end of 2020.2. Prepare the correcting entry assuming the error was discovered in 2021 before the adjusting and closing entries. (Ignore income taxes.)3. Assume instead that the equipment was disposed of in 2022 and the original error was discovered in 2023 after the 2022 financial statements were issued. Prepare the correcting entry in 2023.arrow_forward

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Auditing: A Risk Based-Approach (MindTap Course L...AccountingISBN:9781337619455Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L...AccountingISBN:9781337619455Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:Cengage Learning