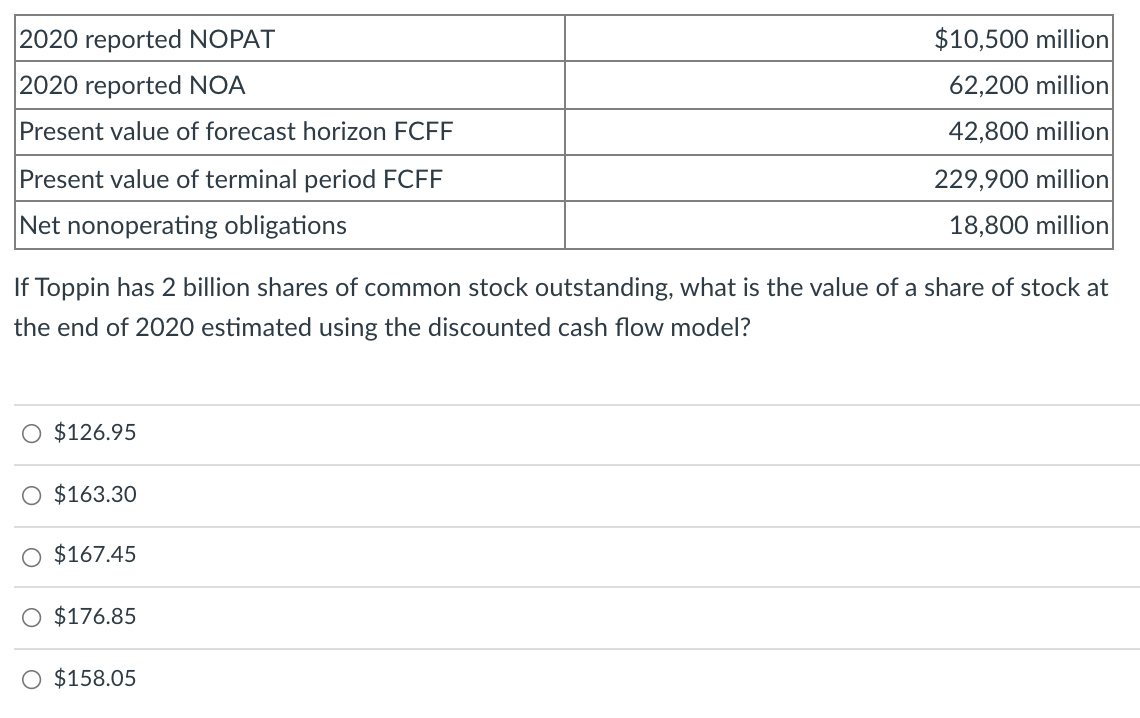

2020 reported NOPAT $10,500 million 2020 reported NOA 62,200 million Present value of forecast horizon FCFF 42,800 million Present value of terminal period FCFF 229,900 million Net nonoperating obligations 18,800 million If Toppin has 2 billion shares of common stock outstanding, what is the value of a share of stock at the end of 2020 estimated using the discounted cash flow model? O $126.95 O $163.30 O $167.45 O $176.85 O $158.05

Q: Security Cash flow Cash flow Today ($) in one year ($) A 50 B 200 200 100 If the current value…

A: No Arbitrage means where the prices of the securities are in equilibrium and the investors can earn…

Q: PLease explain the given tabele.

A: Equity is referred as an ownership of an assets in financial terms, which might have the liabilities…

Q: Year Cost Market Value Unrealized Gain / (Loss) 2020 GKKB P25,250 P23,350…

A: Jounral Entry Here provide the journal entries which are made the investment in the different…

Q: Enterprise stock trade for $52.50 per share. Its expected to pay $2.50 dividend at end of year (D1=…

A: WACC stands for Weighted Average Cost of Capital. It is the cost of capital of the company which is…

Q: Estimate the Cost of Capital for Company XYZ based on the information below. $50.00 $1.60 Stock…

A: Cost of equity is calculated using the Capital Asset Pricing Model.

Q: 2) An analyst forecasts to have expected dividends of $5.00 year 1 (Div1), $5.20 year 2 (Div2),…

A: We requires to calculate Current Stock Price P0 using the Dividend Discount Model in this question:…

Q: Amazon equity beta Market risk premium 1.5 5.00% 10-year Treasury 1 Jan 2020 Cost of equity 1.90%…

A: cost of equity = Risk free rate + beta * market risk premium

Q: 1. You have invested 10000 euros in a fund in the first of January 2020. During the year you…

A: Money Deposited10,000 euros on 01/01/2020 5000 euros on 31/03/2020 4000 euros on 30/09/2020 Money…

Q: Chen Chocolate Company’s EPS in 2020 was $1.80, and in 2015 it was $1.25. The company’s payout ratio…

A:

Q: Suppose a company estimates following one year returns from investing in the common stock of Leopard…

A: Expected return refers to the estimated return from the investment. The expected return is important…

Q: Consider the following information regarding Kent Ltd, a listed company on ASX in Australia.…

A: Residual Income: It is the excess profit earned over and above the charge for equity.

Q: Forecast Year 2. 4 Terminal No. of outstanding shares. Terminsi year growih raie Cost of eguity 500…

A: Particulars Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 O/S Shares 500 500 500 500 500 500 Net…

Q: year 2017 2018 2019 2020 2021 2022 2023 2024 2025 2026 TCL operating cash flow Annual growth rate…

A: Given , The initial outlay is 2535.10 Discount rate is 12%

Q: 1. Today's value of the S&P500 stock index is at 3,915. The 500 stocks underlying the index provide…

A: Given: Present value = 3,915 Dividend yield = 1.5% Risk free rate = 1.7%

Q: 12 - ABC Co. its selected financial statements items are given as following. Total assets equals to…

A: 12 a) Nominal Growth 20.00%, Reel Growth 6.19%

Q: The stock of Payout Inc. will go ex-dividend tomorrow. The dividend will be $1 per share. There are…

A: Financial Management: Financial management comprises of two words i.e. Finance and management.…

Q: A share of stock of A-Star Inc. is now selling for $23.50. A financial analyst summarizes the…

A: Calculate the holding period return in scenario 1 (HPR 1) by the formula. Here, 'D' refers to the…

Q: Mann Corporations $1000.00 par value zero-coupon debenture matures in 30 years. If they are priced…

A: Zero coupon debenture does not make periodic interest payments instead of this this it provides face…

Q: Multiple choice: Assuming that SN North Company has the following net cash inflow: P55,000,…

A: solution given cost of capital =25% NPV = present value of inflow- present value of outflow

Q: •1) An analyst forecasts to have expected dividends of $3.15 year 1 (Div1), $3.50 year 2 (Div2),…

A: In this question we requires to calculate Current Stock Price P0 using the Dividend Discount Model:…

Q: (Valuing common Stock) Assume the following: • The investor’s required rate of return is 15 percent.…

A: Price earning ratio is no. of times a company's share is trading compared to its earning per share.

Q: Assumptions: (a) Mr. X has a limited cash balance of P1,000,000.00. (b) The buying price of the…

A: Mr. X should sell his shares to Mr. if his sale proceeds cover costs associated with the stock i.e…

Q: On 9/30 ROI on cash is low, so buy 10% of a 4-year, 7%, $6m PA State new bond issue with 5% market…

A: Bond Valuation In the Bond valuation which can be taken consideration either in par value or in…

Q: QUESTION 18 At the beginning of 2021, you decide to sell bond position and invest in S&P 500. Past…

A: Solution:

Q: Omani’s company common stock is expected to pay of OMR (3) a share at the end of 2021, and expected…

A: The calculation of expected return and dividend (D) is as follows Expected return= Risk free…

Q: Short loans:

A: Definition: Balance sheet: It is the financial statement of company which includes share holder's…

Q: Problem 1 Suppose your company wants to place an investment with a private equity firm with an…

A: Investment Amount is Php 200,000 Discount rate is 12% To Find: NPV through period 2022 to 2028 NPV…

Q: mmon stocK has (-free rate is 4 percent an market risk prem 7 регcent. EQUIRED Calculate the…

A: Price of common equity can be present value of dividends and present value of terminal value of…

Q: Answer the following requirements assuming a discount rate (WACC) of 735, a terminal period growth…

A: The discount cash flow is a valuation model that helps to compute the valuation of the company by…

Q: 1. Today's value of the S&P500 stock index is at 3,915. The 500 stocks underlying the index provide…

A: Prices of the assets change with the time which may arise the loss or gain. To avoid the losses,…

Q: Today is June 4, 2020. Stock X is selling at $150 per share. The stock has a dividend yield of 5%…

A: Current Selling price or spot price is $150 (June 4, 2020 price) Dividend Yield is 5% Annual risk…

Q: Find the Net Present Value (NPV) for Muscat Packaging Company if the initial investment is 20000 OMR…

A: Net Present Value (NPV) is the difference between the present value of inflow and the present value…

Q: stock market Future market January KLSE composite index stands at 1162. Investor expects to purchase…

A: Given information KLSE composite index stands at 1162 expects to purchase at 10 million

Q: Dividends and share buybacks Here are key Önancial data for the company Silverstar Inc.: Earnings…

A: The with-dividend stock price remains $130; the announcement of a larger future dividend doesn’t…

Q: Year Cash Flow 17600 9,900 8,800 5,300 a. What is the profitabllity index for the set of cash flows…

A: Profitability index: It is the ratio of present value of cash inflows to present value of cash…

Q: stock market Future market January KLSE composite index stands at 1162. Investor expects to purchase…

A: The question is related to Spot transactions profit or loss.

Q: Question 8: Assume the following free cash flows for Elle Inc. for Year 6 and forecasted FCFF for…

A: Discount rate = 6% Terminal growth rate = 2%

Q: Assumptions: (a) Mr. X has a limited cash balance of P1,000,000.00. (b) The buying price of the…

A: Mr. X should sell stock to Mr. Y only if proceeds from sale cover all his costs associated with the…

Q: 5During the past three (3) years you have owned 100 shares of Williams Pharma Corporation, a…

A: The holding period return refers to the total return that an investor has earned on the investment…

Q: Please help me please show your calculation

A: As per provisions of IRS rules Capital losses unabsorbed can be carried…

Q: 1. A share of stock of company is now selling for 23.5 lei. A financial analyst summarizes the…

A: Portfolio: Investors do not invest all of their money in a single asset. In order to meet their…

Q: 2019 2020 Assets Cash & Short investments Accounts Receivable 021,000 ,רר 68,109,000 | 120,000,רה…

A: To compare the data of two years a statement is prepared calculating difference and difference…

Q: för Co. its selected financial statements items are given as following. Total assets equals to the…

A: Nominal growth = Increase in sales / initial sales

Q: Below is the stock price and dividend history for No-Cameras-Allowed Inc. (NCA), company organizing…

A: Honor Code: Hi there, thanks for posting the questions. But as per our Q&A guidelines, we must…

Q: VI. Solve the following problems. 1. QRS Corporation has declared dividend for January 2019 of P20…

A: The Supernormal Growth Model is the model in which the value of the stock is measured through its…

Q: YEAR CASH FLOW 50.000 -$ 20,000 $100,000 S400.000 sa00,000 A. Assume annual cash flows are expected…

A: Here, Expected Rate of Return is 30% Expected Rate of Return drop to 18% after year 6 Growth rate…

Q: Dixon Corp’s preferred stock does not mature (it is a “perpetual preferred”). Each share of…

A: Hi there. Thank you for the question. Post has multiple questions. As per company guidelines expert…

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

- CALCULATING THE WACC Here is the condensed 2019 balance sheet for Skye Computer Company (in thousands of dollars): Skyes earnings per share last year were 3.20. The common stock sells for 55.00. last years dividend (D0) was 2.10, and a flotation cost of 10% would be required to sell new common stock. Security analysts are projecting that the common dividend will grow at an annual rate of 9%. Skyes preferred stock pays a dividend of 3.30 per share, and its preferred stock sells for 30.00 per share. The firms before-lax cost of debt is 10%, and its marginal tax rate is 25%. The firms currently outstanding 10% annual coupon rate, long-term debt sells at par value. The market risk premium is 5%, the risk-free rate is 6%, and Skyes beta is 1.516. The firms total debt, which is the sum of the companys short-term debt and long-term debt, equals 1.2 million. a. Calculate the cost of each capital component, that is, the after-tax cost of debt, the cost of preferred stock, the cost of equity from retained earnings, and the cost of newly issued common stock. Use the DCF method to find the cost of common equity. b. Now calculate the cost of common equity from retained earnings, using the CAPM method. c. What is the cost of new common stock based on the CAPM? (Hint: Find the difference between r1 and rs as determined by the DCF method, and add that differential to the CAPM value for rs.) d. If Skye continues to use the same market-value capital structure, what is the firms WACC assuming that (1) it uses only retained earnings for equity and (2) if it expands so rapidly that it must issue new common stock?Start with the partial model in the file Ch08 P25 Build a Model.xlsx. Selected data for the Derby Corporation are shown here. Use the data to answer the questions. INPUTS (In Millions) Year Current Projected 0 1 2 3 4 Free cash flow -$15.0 $15.0 $60.0 $63.0 Marketable securities $30 Notes payable $100 Long-term bonds $300 Preferred stock $50 WACC 9.00% Number of shares of stock 50% Calculate the estimated horizon value (i.e., the value of operations at the end of the forecast period immediately after the Year-4 free cash flow). Assume growth becomes constant after Year 3. Enter your answer in millions. For example, an answer of $1.23 million should be entered as 1.23, not 1,230,000. Round your answer to two decimal places. $ fill in the blank 2 million Calculate the present value of the horizon value, the present value of the free cash flows, and the estimated Year-0 value of operations. Enter…Additional information 1) Sales for the year ended 31 December 2021 are expected to total R7 200 000, an increase of R800 000 over the previous year ended 31 December 2020. A profit margin (net profit margin) of 10% is expected. 2) A final dividend of 80 cents per share is expected to be recommended on 31 December 2021. These dividends will be paid during 2022. 3) Cash and cash equivalents and Ordinary share capital are expected to remain unchanged. 4) Trade and other receivables represent approximately 20% of the annual sales. 5) The company’s closing inventory will change directly with changes in sales for the financial year ended 31 December 2021. 6) An old machine (Cost price R400 000; Accumulated depreciation R360 000) is expected to be sold at carrying value on 31 December 2021 and a new machine with a cost price of R500 000 will be purchased on the same date to replace it. Total depreciation for the year ended 31 December 2021 is estimated at R240 000. 7) Trade…

- Kk.1. Ford has the following information related to 2020: 2020 2021 - Sales $1,000,000 $1,200,000 - Current Assets 350,000. 35% 420,000 - Long-Term Assets 650,000 65% 780,000 - Current Liabilities 120,000 12% 144,000 - Long-Term Liabilities 280,000 N/A - Common Stocks 550,000. N/A - Retained Earnings 50,000. Sales are expected to grow by 20% next year with expected Net Profit Margin 20% and Dividends layout 60% Required: 1.How much discretionary Financing needed by Ford in 2021?Year Cost Market Value Unrealized Gain / (Loss)2020GKKB P25,250 P23,350 (P1,900)ABC 32,450 33,950 1,5002021GKKB P25,250 P24,950 (P300)ABC 32,450 32,650 200 Question 7: The investment in stocks account is overstated or understated by? (Use negative sign if overstated)a) At the end of its financial year 2021, an analyst made the following forecast for Next plc for financial years 2022 – 2025 (in millions of pounds): Year Cash In-flows from Operations £ Cash Out-flows Investment £ 2022 2560 1200 2023 3420 1500 2024 3500 2400 2025 3600 2000 Next plc reported £5500 million in total debt at the end of 2021. Required:I. Use a required rate of return of 10% to calculate both the enterprise value and equity value for Next plc at the end of 2021 under the following two scenarios for the…

- Compute the Sales Growth Index and select the best Answer: 12/31/2020 12/31/2021Cash $5,000 Cash $7,000AR $20,000 AR $45,000Current Assets $60,000 Current Assets $55,000Net Fixed Assets $100,000 Net Fixed Assets $120,000Total Assets $200,000 Total Assets $360,000Sales $400,000 Sales $450,000Cost of Sales $300,000 Cost of Sales $340,000A. The index is 1.125 and suggests earnings management B. The index is 1.125 and does not suggest earnings managementC. The index is .89 and suggests earnings management D. The index is .89 and does not suggest earnings managementYearEPSDividendChange 20130.75 20140.78 20150.81 20160.82 20170.85 20180.90 Payout Ratio:30% Required Rate of Return: 10% Current Stock Price P0:$5.00 1) Dividend amount in 2013: 2) Dividend CAGR: 3) 2019 Dividend: 4) Intrinsic value: 5) Compared to P0: 6) Required rate of return (solver or goal seek): The following table contains the six-year EPS history for Corporation X. The dividend payout ratio is 30%. 1) What is the dividend amount paid in 2013? 2) What is the compound growth rate (CAGR) of the dividend based on the dividend paid from 2013 - 2018? 3) Assume dividend is growing at the the compound growth rate of the dividend in 2019, what is the dividend per share paid in 2019? 4) Use dividend constant growth model, calculate the intrinsic value of the stock using a 10% required rate of return. 5) How does the calculated intrinsic value compare to the current stock price of $5? Use IF statement. 6) Use the Goal Seek or Solver option to find the required rate…HCB, Inc.free cash flows for next year (FCF1) are expected to be $5 million. Free cash flows are expected to grow at a rate of 6% forever. It also has the following financial information: Market value of HCB Debt = $70 million Short-term investments = $15 million Book value of equity = $60 million Total Assets = $80 million Shares outstanding = 2.5 million Required return on stock = 11% WACC = 9% Calculate HCB's intrinsic value per share. $30.51 $33.56 $36.91 $40.61 $44.67 - the correct answer Do not use Excel!

- Net income, currents assets and current liabilities for 2020 are expected to vary with sales. The projected sales in 2020 is ₱210M. The company plans to pay ₱0.05 cash dividends per share in 2020. How much is the projected current assets in 2020? ₱73,000,000 ₱71,000,000 ₱73,500,000 ₱70,000,000Given the following regarding ABC corp. & XYZ corp.: ABC 2020 2021 2022 2023 Op Cash 50000 55000 60000 62000 Cap Ex 20000 21000 25000 26000 Dividends 10000 12000 13000 15000 XYZ 2020 2021 2022 2023 Op Cash 50000 55000 60000 62000 Cap Ex 5000 4000 2500 2000 Dividends 0 0 0 0 Required investment: ABC = $50,000, XYZ = $150,000. Discount rate = 4% Find the dollar value of the discounted net return (NPV-Initial investment) on ABCGiven the following regarding ABC corp. & XYZ corp.: ABC 2020 2021 2022 2023 Op Cash 50000 55000 60000 62000 Cap Ex 20000 21000 25000 26000 Dividends 10000 12000 13000 15000 XYZ 2020 2021 2022 2023 Op Cash 50000 55000 60000 62000 Cap Ex 5000 4000 2500 2000 Dividends 0 0 0 0 Required investment: ABC = $50,000, XYZ = $150,000. Discount rate = 4% Find the dollar value of the discounted net return (NPV-Initial investment) on ABC Please dont give images in answer thank you