2021 Dividends Percent Ownership Received Percentage Less than 20 percent 50% 20 percent or more, but less than 80 percent 65% 80 percent or more 100% a. Calculate the corporation's dividends received deduction for 2021. 19,500 v Feedback b. Assume that instead of $210,000, Fisafolia Corporation has gross income from operations of $135,00 Calculate the corporation's dividends received deduction for 2021. 3,250 x Feedback c. Assume that instead of $210,000, Fisafolia Corporation has gross income from operations of $158,00 Calculate the corporation's dividends received deduction for 2021. 18,200

2021 Dividends Percent Ownership Received Percentage Less than 20 percent 50% 20 percent or more, but less than 80 percent 65% 80 percent or more 100% a. Calculate the corporation's dividends received deduction for 2021. 19,500 v Feedback b. Assume that instead of $210,000, Fisafolia Corporation has gross income from operations of $135,00 Calculate the corporation's dividends received deduction for 2021. 3,250 x Feedback c. Assume that instead of $210,000, Fisafolia Corporation has gross income from operations of $158,00 Calculate the corporation's dividends received deduction for 2021. 18,200

Chapter11: The Corporate Income Tax

Section: Chapter Questions

Problem 5P: Fisafolia Corporation has gross income from operations of $210,000 and operating expenses of...

Related questions

Question

Problem 11-5

Special Deductions and Limitations (LO 11.3)

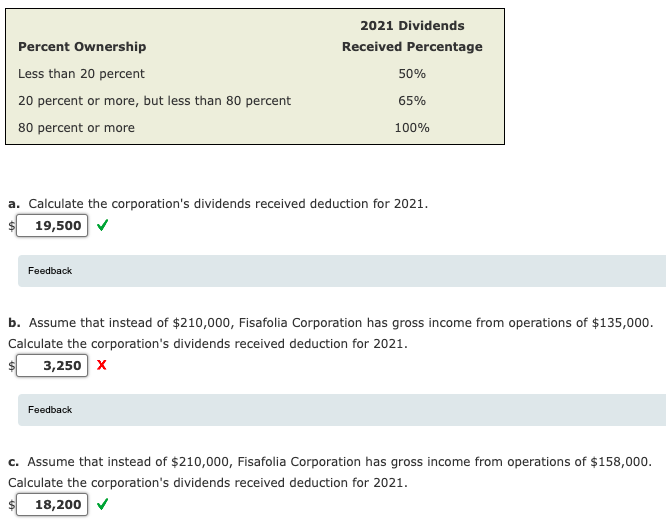

Fisafolia Corporation has gross income from operations of $210,000 and operating expenses of $160,000 for 2021. The corporation also has $30,000 in dividends from publicly-traded domestic corporations in which the ownership percentage was 45 percent.

Below is the Dividends Received Deduction table to use for this problem.

Transcribed Image Text:2021 Dividends

Percent Ownership

Received Percentage

Less than 20 percent

50%

20 percent or more, but less than 80 percent

65%

80 percent or more

100%

a. Calculate the corporation's dividends received deduction for 2021.

19,500

Feedback

b. Assume that instead of $210,000, Fisafolia Corporation has gross income from operations of $135,000.

Calculate the corporation's dividends received deduction for 2021.

3,250| х

Feedback

c. Assume that instead of $210,000, Fisafolia Corporation has gross income from operations of $158,000.

Calculate the corporation's dividends received deduction for 2021.

18,200 v

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning