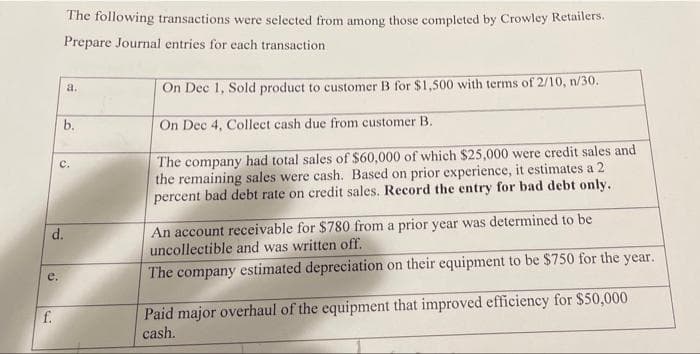

The following transactions were selected from among those completed by Crowley Retailers. Prepare Journal entries for cach transaction On Dec 1, Sold product to customer B for $1,500 with terms of 2/10, n/30. a. b. On Dec 4, Collect cash due from customer B. The company had total sales of $60,000 of which $25,000 were credit sales and the remaining sales were cash. Based on prior experience, it estimates a 2 percent bad debt rate on credit sales. Record the entry for bad debt only. с. An account receivable for $780 from a prior year was determined to be uncollectible and was written off. The company estimated depreciation on their equipment to be $750 for the year. d. Paid major overhaul of the equipment that improved efficiency for $50,000 cash.

Q: On April 1, Kang Corporation purchased back 250 shares of $1 par value common stock for $20 per…

A: Treasury stock: When shares are purchased from the open market by the company then these shares are…

Q: The comparative statements of Coronado Company are presented here. Coronado Company Income…

A: The net change in cash created by a business's activities during a reporting period, less cash…

Q: At the beginning of current year, Melancholy Company reported the following property, plant and…

A: The question is related to Property Plant and Equipment. The details are given regarding the same.

Q: Chloe Mendez owns a clothing company, Chloe's Closet. She has a team of tailors who work for 8 hours…

A: Determination of problems in Chloe's closet business. To ascertain the problem the financial…

Q: I need help solving 2 and 3 I am stuck.

A: Solution:- 1)Calculation of the mozzarella cheese activity variance for June as follows under:-

Q: 2. Pistons company sells portable DVD players for P28,000 each and offers to each customer a 3-year…

A: Warranty means the undertaking given by the company selling the goods that in case of any defect ,…

Q: Imp entered into the second forward contract to hedge a commitment to purchase equipment being…

A: Solution:- Given, On December 12, year 1, Imp Co. entered into three forward exchange contracts,…

Q: For the given scenario, identify the weakness or weaknesses in internal control and opposite the…

A: Internal control is a process, performed by a board of directors of business, management and other…

Q: would these be considered as a single performance obligation for financial accounting purposes…

A: Performance obligation is the obligation which have to fulfilled by the party in order to earn the…

Q: K-Tyres Corp. produces two types of tires, regular and snow tires. company uses activity-based…

A: Activity rate = Budgeted cost/Number of basis hours

Q: If fixed costs are $246,000, the unit selling price is $120, and the unit variable costs are $71,…

A: Formula: Break even sales units = Fixed cost / Unit contribution margin Division of unit…

Q: VESTION The Articles of Con O True

A: The Articles of Confederation have been approved by the Continental Congress in the year 1777. This…

Q: How would you define depreciation and explain its purpose to someone who is not taking this course?…

A: Depreciation expense is the reduction in the value of assets due to normal wear and tear, the…

Q: Tugwell Inc. budgeted 10,700 pounds of direct materials costing $23.50 per pound to make 5,100…

A: Given, Actual quantity = 11,000 pounds Standard quantity = 10,700 pounds Standard price = $23.50

Q: Written, Inc. has outstanding 300,000 shares of $2 par ordinary shares and 60,000 shares of no-par…

A: Outstanding Shares: 60,000 shares of no-par 8% preference shares Value of Shares: $5 per share…

Q: A state corp, all of whose business os done within the city, showed the following for 2018: Entire…

A: Introduction Corporate income tax depends most common federal taxable income generally ranging from…

Q: 30 June 2022, Happy Ltd purchased machinery for its fair value of $41 600 and then leased it to…

A: Journal entries (JF) refers to the recording the transactions into the original books of accounts…

Q: Mailmax Direct is incorporated in the state of Arizona. Their charter authorized Mailmax to issue…

A: The shareholder's equity section is prepared to record the equity that belongs to the shareholders…

Q: When two (2) partners make no agreement as to how to share profits but agree to share losses 60-40,…

A: A partnership is an agreement between two or more persons who agree to work together for a common…

Q: Numbers 9-10 (LCNRV and Write-down of Raw Materials) The following figures relate to inventory of…

A: Inventory of material when recorded at LCNRV method implies that the cost of inventory to be…

Q: A friend, Wazir, has asked you for advice because he understands very little about accounting…

A: The question is related to Ratio Analysis. The Gross Profit amd Net Profit are Profitability Ratio…

Q: The following figures are for the year 2020: Inventory 1.1.2020 $4000 Inventory 31.12.2020…

A: The gross profit is calculated as difference between sales and cost of goods sold. Cost of goods…

Q: Would you prefer the use of bottom-up or top-down budgeting for project cost control? What are the…

A: Top-down budgeting is a budgeting strategy in which top management creates a high-level budget for…

Q: Can a farm business be solvent but not liquid? Liquid but not solvent? Explain your answers.

A: Solvency is a measure of a company's ability to cover its liabilities including its assets; hence, a…

Q: What are some exceptions to UBIT provided by legislation?

A: The question is related to some exceptions to Unrelated Business Income tax .Unrelated business…

Q: When Wisconsin Corporation was formed on January 1, the corporate charter provided for 115,800…

A: Introduction:- The following basic information as follows under:- Wisconsin Corporation was formed…

Q: Burdensome employment regulations do more harm than good. If employees don’t like a particular job,…

A: Burdensome Regulatory Condition means any condition or restrictions imposed on authorizations or…

Q: Calculate labor rate and efficiency variances and the controllable overhead variance and the…

A: 1. Labor Rate Variance: = (Actual Hours x Standard Rate) - (Actual Hours x Actual Rate) 2. Labor…

Q: Lopez Company is considering replacing one of its old manufacturing machines. The old machine has a…

A: In the companies that are involved with the manufacture of goods, machinery is an important asset…

Q: 3. During September an organisation had sales of £148,000, which showed a gross profit of £40,000.…

A: The term stock refers to tangible property held for sales in the ordinary course of business or for…

Q: Listed below is the inventory, purchases and sales for the month of July 2021: Units RM per unit…

A: Under perpetual inventory system cost of goods sold is recorded simultaneously whereas under…

Q: 18, Armstrong Company paid $3,500,000 to acquire all of the common stock of Hall Co ce sheet at the…

A: Impairment loss Impairment loss refers to the loss in the value of asset when the recoverable…

Q: Alma Corp. issues 1,120 shares of $7 par common stock at $15 per share. When the transaction is…

A: The correct journal entry to record issue of shares will be: Account Titles Debit Credit…

Q: Utilities expense 2,180 Equipment 66,600 Accounts payable 17,520 Cash 11,460 Salaries and wages…

A: Formula: Net income = Total Revenues - Total Expenses Deduction of total expenses from Total…

Q: Taylor Company has two products: A and B. The anual production and sales level of Product A is 9,094…

A: A flexible budget is prepared on the basis of the budgeted rate and on the basis of different…

Q: On July 15, 2021, the Nixon Car Company purchased 1,700 tires from the Harwell Company for $50 each.…

A: Under perpetual inventory method inventory is updated as soon as sales takes place.

Q: 1.Describe three (3) techniques of constructing accounts from incomplete records

A: Incomplete records are those records for which double entry system is not used. In simple, it is the…

Q: Required: Compute the inventory turnover in Year 2. Write answer in whole figure only. 10. Using…

A: Ratio analysis means where different ratio of various years of years companies has been compared and…

Q: ed 30 November 2021. most recent income statement and statement of financial positi nparatives for…

A: Cash Flow statement from Indirect Method

Q: 46. When a company uses the periodic inventory system in accounting for its merchandise inventory,…

A: Inventory is one of the important current asset of the business. It includes inventory of raw…

Q: P1.990,000 he following information were taken from the books of Laxa Co. for the month of December,…

A: Prime costs = Direct materials used + Direct labor Conversion Costs = Direct labor + Factory…

Q: 3) Parker Company reports operating expenses as selling and general or administrative. The adjusted…

A: Selling Expenses: It is the cost related with sale of products or services. It includes the…

Q: Do the networth and networth ratio reflect whether the farm is earning or not? Explain fully

A: Earnings Earnings refer to the profits of the company in a given accounting period. It is the…

Q: nd Joria are married and file a joint return. They have the following items for th ries S345,000 s…

A: The calculation of AGI is straightforward. Simply add all of your sources of income together and…

Q: Security Common Stock c Common Stock D Cost $10,000 8,000 $18.000 Fair Value $12,000 5,000 $17,000…

A: The journal entries are prepared to record day to day transactions of the business on regular basis.

Q: Using the following information Actual direct labor hours used,…

A: Variance analysis is the detailed analysis of the standards for the operations made relating to the…

Q: Required: a Compile a consolidated statement of profit or loss for P Ltd's group for the year ended…

A: Consolidated income statement is a statement which presents the income, expenses, revenues of the…

Q: f change

A: Trend analysis is an analysis of financial statements of a company over a period of time. Trend…

Q: How many total units should Emma include in her company's period-end inventory?

A: 1. In case FOB destination, seller is the owner till it reaches the buyer. So, this is part of year…

Q: Which of the following requires periodic shareholder approval of executive compensation? Multiple…

A: Dodd-Frank Wall Street Reform and Consumer Protection Act proposed Regulations 14a-21(a) would…

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

- The following transactions were completed by Hammond Auto Supply during January, which is the first month of this fiscal year. Terms of sale are 2/10, n/30. The balances of the accounts as of January 1 have been recorded in the general ledger in your Working Papers or in CengageNow. Hammond Auto Supply does not track cash sales by customer. Jan. 2Issued Ck. No. 6981 to JSS Management Company for monthly rent, 775. 2J. Hammond, the owner, invested an additional 3,500 in the business. 4Bought merchandise on account from Valencia and Company, invoice no. A691, 2,930; terms 2/10, n/30; dated January 2. 4Received check from Vega Appliance for 980 in payment of 1,000 invoice less discount. 4Sold merchandise on account to L. Paul, invoice no. 6483, 850. 6Received check from Petty, Inc., 637, in payment of 650 invoice less discount. 7Issued Ck. No. 6982, 588, to Fischer and Son, in payment of invoice no. C1272 for 600 less discount. 7Bought supplies on account from Doyle Office Supply, invoice no. 1906B, 108; terms net 30 days. 7Sold merchandise on account to Ellison and Clay, invoice no. 6484, 787. 9Issued credit memo no. 43 to L. Paul, 54, for merchandise returned. 11Cash sales for January 1 through January 10, 4,863.20. 11Issued Ck. No. 6983, 2,871.40, to Valencia and Company, in payment of 2,930 invoice less discount. 14Sold merchandise on account to Vega Appliance, invoice no. 6485, 2,050. Jan. 18Bought merchandise on account from Costa Products, invoice no. 7281D, 4,854; terms 2/10, n/60; dated January 16; FOB shipping point, freight prepaid and added to the invoice, 147 (total 5,001). 21Issued Ck. No. 6984, 194, to M. Miller for miscellaneous expenses not recorded previously. 21Cash sales for January 11 through January 20, 4,591. 23Issued Ck. No. 6985 to Forbes Freight, 96, for freight charges on merchandise purchased on January 4. 23Received credit memo no. 163, 376, from Costa Products for merchandise returned. 29Sold merchandise on account to Bruce Supply, invoice no. 6486, 1,835. 31Cash sales for January 21 through January 31, 4,428. 31Issued Ck. No. 6986, 53, to M. Miller for miscellaneous expenses not recorded previously. 31Recorded payroll entry from the payroll register: total salaries, 6,200; employees federal income tax withheld, 872; FICA Social Security tax withheld, 384.40, FICA Medicare tax withheld, 89.90. 31Recorded the payroll taxes: Social Security tax, 384.40, FICA Medicare tax, 89.90; state unemployment tax, 334.80; federal unemployment tax, 37.20. 31Issued Ck. No. 6987, 4,853.70, for salaries for the month. 31J. Hammond, the owner, withdrew 1,000 for personal use, Ck. No. 6988. Required 1. Record the transactions for January using a sales journal, page 73; a purchases journal, page 56; a cash receipts journal, page 38; a cash payments journal, page 45; and a general journal, page 100. Assume the periodic inventory method is used. 2. Post daily all entries involving customer accounts to the accounts receivable ledger. 3. Post daily all entries involving creditor accounts to the accounts payable ledger. 4. Post daily those entries involving the Other Accounts columns and the general journal to the general ledger. Write the owners name in the Capital and Drawing accounts. 5. Add the columns of the special journals and prove the equality of the debit and credit totals. 6. Post the appropriate totals of the special journals to the general ledger. 7. Prepare a trial balance. 8. Prepare a schedule of accounts receivable and a schedule of accounts payable. Do the totals equal the balances of the related controlling accounts?The following transactions were completed by Hammond Auto Supply during January, which is the first month of this fiscal year. Terms of sale are 2/10, n/30. The balances of the accounts as of January 1 have been recorded in the general ledger in your Working Papers or in CengageNow. Hammond Auto Supply does not track cash sales by customer. Jan. 2Issued Ck. No. 6981 to JSS Management Company for monthly rent, 775. 2J. Hammond, the owner, invested an additional 3,500 in the business. 4Bought merchandise on account from Valencia and Company, invoice no. A691, 2,930; terms 2/10, n/30; dated January 2. 4Received check from Vega Appliance for 980 in payment of 1,000 invoice less discount. 4Sold merchandise on account to L. Paul, invoice no. 6483, 850. 6Received check from Petty, Inc., 637, in payment of 650 invoice less discount. 7Issued Ck. No. 6982, 588, to Fischer and Son, in payment of invoice no. C1272 for 600 less discount. 7Bought supplies on account from Doyle Office Supply, invoice no. 1906B, 108; terms net 30 days. 7Sold merchandise on account to Ellison and Clay, invoice no. 6484, 787. 9Issued credit memo no. 43 to L. Paul, 54, for merchandise returned. 11Cash sales for January 1 through January 10, 4,863.20. 11Issued Ck. No. 6983, 2,871.40, to Valencia and Company, in payment of 2,930 invoice less discount. 14Sold merchandise on account to Vega Appliance, invoice no. 6485, 2,050. Jan. 18Bought merchandise on account from Costa Products, invoice no. 7281D, 4,854; terms 2/10, n/60; dated January 16; FOB shipping point, freight prepaid and added to the invoice, 147 (total 5,001). 21Issued Ck. No. 6984, 194, to M. Miller for miscellaneous expenses not recorded previously. 21Cash sales for January 11 through January 20, 4,591. 23Issued Ck. No. 6985 to Forbes Freight, 96, for freight charges on merchandise purchased on January 4. 23Received credit memo no. 163, 376, from Costa Products for merchandise returned. 29Sold merchandise on account to Bruce Supply, invoice no. 6486, 1,835. 31Cash sales for January 21 through January 31, 4,428. 31Issued Ck. No. 6986, 53, to M. Miller for miscellaneous expenses not recorded previously. 31Recorded payroll entry from the payroll register: total salaries, 6,200; employees federal income tax withheld, 872; FICA Social Security tax withheld, 384.40, FICA Medicare tax withheld, 89.90. 31Recorded the payroll taxes: Social Security tax, 384.40, FICA Medicare tax, 89.90; state unemployment tax, 334.80; federal unemployment tax, 37.20. 31Issued Ck. No. 6987, 4,853.70, for salaries for the month. 31J. Hammond, the owner, withdrew 1,000 for personal use, Ck. No. 6988. Required 1. Record the transactions in the general journal for January. If you are using Working Papers, start with page 1 in the journal. Assume the periodic inventory method is used. The chart of accounts is as follows: 2. Post daily all entries involving customer accounts to the accounts receivable ledger. 3. Post daily all entries involving creditor accounts to the accounts payable ledger. 4. Post daily the general journal entries to the general ledger. Write the owners name in the Capital and Drawing accounts. 5. Prepare a trial balance. 6. Prepare a schedule of accounts receivable and a schedule of accounts payable. Do the totals equal the balances of the related controlling accounts?The following transactions were completed by Nelsons Hardware, a retailer, during September. Terms on sales on account are 1/10, n/30, FOB shipping point. Sept. 4Received cash from M. Alex in payment of August 25 invoice of 275, less cash discount. 7Issued Ck. No. 8175, 915.75, to Top Tools, Inc., for invoice. no. 2256, recorded previously for 925, less cash discount of 9.25. 10Sold merchandise in the amount of 175 on a credit card. Sales tax on this sale is 8%. The credit card fee the bank deducted for this transaction is 5. 11Issued Ck. No. 8176, 653.40, to Snap Tools, Inc. for invoice no. 726, recorded previously on account for 660. A trade discount of 15% was applied at the time of purchase, and Snap Tools, Inc.s credit terms are 1/10, n/45. 15Received 95 cash in payment of August 20 invoice from N. Johnson. No cash discount applied. 19Received 1,165 cash in payment of a 1,100 note receivable and interest of 65. 22Voided Ck. No. 8177 due to error. 26Received and paid telephone bill, 62; Ck. No. 8178, payable to Southern Telephone Company. 30Paid wages recorded previously for the month, 3,266, Ck. No. 8179. Required 1. Journalize the transactions for September in the cash receipts journal, the general journal (for the transaction on Sept. 10th), or the cash payments journal as appropriate. Assume the periodic inventory method is used. 2. If you are using Working Papers, total and rule the journals. Prove the equality of debit and credit totals.

- FINANCIAL RATIOS Based on the financial statements, shown on pages 603604, for McDonald Carpeting Co. (income statement, statement of owners equity, and balance sheet), prepare the following financial ratios. All sales are credit sales. The balance of Accounts Receivable on January 1, 20--, was 6,800. 1. Working capital 2. Current ratio 3. Quick ratio 4. Return on owners equity 5. Accounts receivable turnover and average number of days required to collect receivables 6. Inventory turnover and average number of days required to sell inventoryReview the following transactions and prepare any necessary journal entries for Lands Inc. A. On December 10, Lands Inc. contracts with a supplier to purchase 450 plants for its merchandise inventory, on credit, for $12.50 each. Credit terms are 4/15, n/30 from the invoice date of December 10. B. On December 28, Lands pays the amount due in cash to the supplier.FINANCIAL RATIOS Based on the financial statements, shown on pages 605606, for McDonald Carpeting Co. (income statement, statement of owners equity, and balance sheet), prepare the following financial ratios. All sales are credit sales. The balance of Accounts Receivable on January 1, 20--, was 6,800. 1. Working capital 2. Current ratio 3. Quick ratio 4. Return on owners equity 5. Accounts receivable turnover and the average number of days required to collect receivables 6. Inventory turnover and the average number of days required to sell inventory

- Post the following July transactions to T-accounts for Accounts Receivable, Sales Revenue, and Cash, indicating the ending balance. Assume no beginning balances in these accounts. A. on first day of the month, sold products to customers for cash, $13,660 B. on fifth day of month, sold products to customers on account, $22,100 C. on tenth day of month, collected cash from customer accounts, $18,500On March 24, MS Companys Accounts Receivable consisted of the following customer balances: S. Burton 310 A. Tangier 240 J. Holmes 504 F. Fullman 110 P. Molty 90 During the following week, MS made a sale of 104 to Molty and collected cash on account of 207 from Burton and 360 from Holmes. Prepare a schedule of accounts receivable for MS at March 31, 20--.Analyzing the Accounts The controller for Summit Sales Inc. provides the following information on transactions that occurred during the year: a. Purchased supplies on credit, $18,600 b. Paid $14,800 cash toward the purchase in Transaction a c. Provided services to customers on credit1 $46,925 d. Collected $39,650 cash from accounts receivable e. Recorded depreciation expense, $8,175 f. Employee salaries accrued, $15,650 g. Paid $15,650 cash to employees for salaries earned h. Accrued interest expense on long-term debt, $1,950 i. Paid a total of $25,000 on long-term debt, which includes $1.950 interest from Transaction h j. Paid $2,220 cash for l years insurance coverage in advance k. Recognized insurance expense, $1,340, that was paid in a previous period l. Sold equipment with a book value of $7,500 for $7,500 cash m. Declared cash dividend, $12,000 n. Paid cash dividend declared in Transaction m o. Purchased new equipment for $28,300 cash. p. Issued common stock for $60,000 cash q. Used $10,700 of supplies to produce revenues Summit Sales uses the indirect method to prepare its statement of cash flows. Required: 1. Construct a table similar to the one shown at the top of the next page. Analyze each transaction and indicate its effect on the fundamental accounting equation. If the transaction increases a financial statement element, write the amount of the increase preceded by a plus sign (+) in the appropriate column. If the transaction decreases a financial statement element, write the amount of the decrease preceded by a minus sign (-) in the appropriate column. 2. Indicate whether each transaction results in a cash inflow or a cash outflow in the Effect on Cash Flows column. If the transaction has no effect on cash flow, then indicate this by placing none in the Effect on Cash Flows column. 3. For each transaction that affected cash flows, indicate whether the cash flow would be classified as a cash flow from operating activities, cash flow from investing activities, or cash flow from financing activities. If there is no effect on cash flows, indicate this as a non-cash activity.

- The following transactions were completed by Yang Restaurant Equipment during January, the first month of this fiscal year. Terms of sale are 2/10, n/30. The balances of the accounts as of January 1 have been recorded in the general ledger in your Working Papers or in CengageNow. Yang Restaurant Equipment does not track cash sales by customer. Jan. 2Issued Ck. No. 6981 to Tri-County Management Company for monthly rent, 850. 2L. Yang, the owner, invested an additional 4,500 in the business. 4Bought merchandise on account from Valentine and Company, invoice no. A694, 2,830; terms 2/10, n/30; dated January 2. 4Received check from Velez Appliance for 980 in payment of invoice for 1,000 less discount. 4Sold merchandise on account to L. Parrish, invoice no. 6483, 755. 6Received check from Peck, Inc., 637, in payment of 650 invoice less discount. 7Issued Ck. No. 6982, 588, to Frost and Son, in payment of invoice no. C127 for 600 less discount. 7Bought supplies on account from Dudley Office Supply, invoice no. 190B, 93.54; terms net 30 days. 7Sold merchandise on account to Ewing and Charles, invoice no. 6484, 1,115. 9Issued credit memo no. 43 to L. Parrish, 47, for merchandise returned. 11Cash sales for January 1 through January 10, 4,454.87. 11Issued Ck. No. 6983, 2,773.40, to Valentine and Company, in payment of 2,830 invoice less discount. 14Sold merchandise on account to Velez Appliance, invoice no. 6485, 2,100. 14Received check from L. Parrish, 693.84, in payment of 755 invoice, less return of 47 and less discount. Jan. 19Bought merchandise on account from Crawford Products, invoice no. 7281, 3,700; terms 2/10, n/60; dated January 16; FOB shipping point, freight prepaid and added to invoice, 142 (total 3,842). 21Issued Ck. No. 6984, 245, to A. Bautista for miscellaneous expenses not recorded previously. 21Cash sales for January 11 through January 20, 3,689. 23Received credit memo no. 163, 87, from Crawford Products for merchandise returned. 29Sold merchandise on account to Bradford Supply, invoice no. 6486, 1,697.20. 29Issued Ck. No. 6985 to Western Freight, 64, for freight charges on merchandise purchased January 4. 31Cash sales for January 21 through January 31, 3,862. 31Issued Ck. No. 6986, 65, to M. Pineda for miscellaneous expenses not recorded previously. 31Recorded payroll entry from the payroll register: total salaries, 5,899.95; employees federal income tax withheld, 795; FICA Social Security tax withheld, 365.80, FICA Medicare tax withheld, 85.50. 31Recorded the payroll taxes: FICA Social Security tax, 365.80; FICA Medicare tax, 85.50; state unemployment tax, 318.60; federal unemployment tax, 35.40. 31Issued Ck. No. 6987, 4,653.65, for salaries for the month. 31L. Yang, the owner, withdrew 1,000 for personal use, Ck. No. 6988. Required 1. Record the transactions in the general journal for January. If you are using Working Papers, start with page 1 in the journal. Assume the periodic inventory method is used. The chart of accounts is as follows: 2. Post daily all entries involving customer accounts to the accounts receivable ledger. 3. Post daily all entries involving creditor accounts to the accounts payable ledger. 4. Post daily the general journal entries to the general ledger. Write the owners name in the Capital and Drawing accounts. 5. Prepare a trial balance. 6. Prepare a schedule of accounts receivable and a schedule of accounts payable. Do the totals equal the balances of the related controlling accounts?The following transactions were completed by Yang Restaurant Equipment during January, the first month of this fiscal year. Terms of sale are 2/10, n/30. The balances of the accounts as of January 1 have been recorded in the general ledger in your Working Papers or in CengageNow. Yang Restaurant Equipment does not track cash sales by customer. Jan. 2Issued Ck. No. 6981 to Tri-County Management Company for monthly rent, 850. 2L. Yang, the owner, invested an additional 4,500 in the business. 4Bought merchandise on account from Valentine and Company, invoice no. A694, 2,830; terms 2/10, n/30; dated January 2. 4Received check from Velez Appliance for 980 in payment of invoice for 1,000 less discount. 4Sold merchandise on account to L. Parrish, invoice no. 6483, 755. 6Received check from Peck, Inc., 637, in payment of 650 invoice less discount. 7Issued Ck. No. 6982, 588, to Frost and Son, in payment of invoice no. C127 for 600 less discount. 7Bought supplies on account from Dudley Office Supply, invoice no. 190B, 93.54; terms net 30 days. 7Sold merchandise on account to Ewing and Charles, invoice no. 6484, 1,115. 9Issued credit memo no. 43 to L. Parrish, 47, for merchandise returned. 11Cash sales for January 1 through January 10, 4,454.87. 11Issued Ck. No. 6983, 2,773.40, to Valentine and Company, in payment of 2,830 invoice less discount. 14Sold merchandise on account to Velez Appliance, invoice no. 6485, 2,100. 14Received check from L. Parrish, 693.84, in payment of 755 invoice, less return of 47 and less discount. Jan. 19Bought merchandise on account from Crawford Products, invoice no. 7281, 3,700; terms 2/10, n/60; dated January 16; FOB shipping point, freight prepaid and added to invoice, 142 (total 3,842). 21Issued Ck. No. 6984, 245, to A. Bautista for miscellaneous expenses not recorded previously. 21Cash sales for January 11 through January 20, 3,689. 23Received credit memo no. 163, 87, from Crawford Products for merchandise returned. 29Sold merchandise on account to Bradford Supply, invoice no. 6486, 1,697.20. 29Issued Ck. No. 6985 to Western Freight, 64, for freight charges on merchandise purchased January 4. 31Cash sales for January 21 through January 31, 3,862. 31Issued Ck. No. 6986, 65, to M. Pineda for miscellaneous expenses not recorded previously. 31Recorded payroll entry from the payroll register: total salaries, 5,899.95; employees federal income tax withheld, 795; FICA Social Security tax withheld, 365.80, FICA Medicare tax withheld, 85.50. 31Recorded the payroll taxes: FICA Social Security tax, 365.80; FICA Medicare tax, 85.50; state unemployment tax, 318.60; federal unemployment tax, 35.40. 31Issued Ck. No. 6987, 4,653.65, for salaries for the month. 31L. Yang, the owner, withdrew 1,000 for personal use, Ck. No. 6988. Required 1. Record the transactions for January using a sales journal, page 91; a purchases journal, page 74; a cash receipts journal, page 56; a cash payments journal, page 63; and a general journal, page 119. Assume the periodic inventory method is used. 2. Post daily all entries involving customer accounts to the accounts receivable ledger. 3. Post daily all entries involving creditor accounts to the accounts payable ledger. 4. Post daily those entries involving the Other Accounts columns and the general journal to the general ledger. Write the owners name in the Capital and Drawing accounts. 5. Add the columns of the special journals and prove the equality of the debit and credit totals. 6. Post the appropriate totals of the special journals to the general ledger. 7. Prepare a trial balance. 8. Prepare a schedule of accounts receivable and a schedule of accounts payable. Do the totals equal the balances of the related controlling accounts?At the end of 20-3, Martel Co. had 410,000 in Accounts Receivable and a credit balance of 300 in Allowance for Doubtful Accounts. Martel has now been in business for three years and wants to base its estimate of uncollectible accounts on its own experience. Assume that Martel Co.s adjusting entry for uncollectible accounts on December 31, 20-2, was a debit to Bad Debt Expense and a credit to Allowance for Doubtful Accounts of 25,000. (a) Estimate Martels uncollectible accounts percentage based on its actual bad debt experience during the past two years. (b) Prepare the adjusting entry on December 31, 20-3, for Martel Co.s uncollectible accounts.