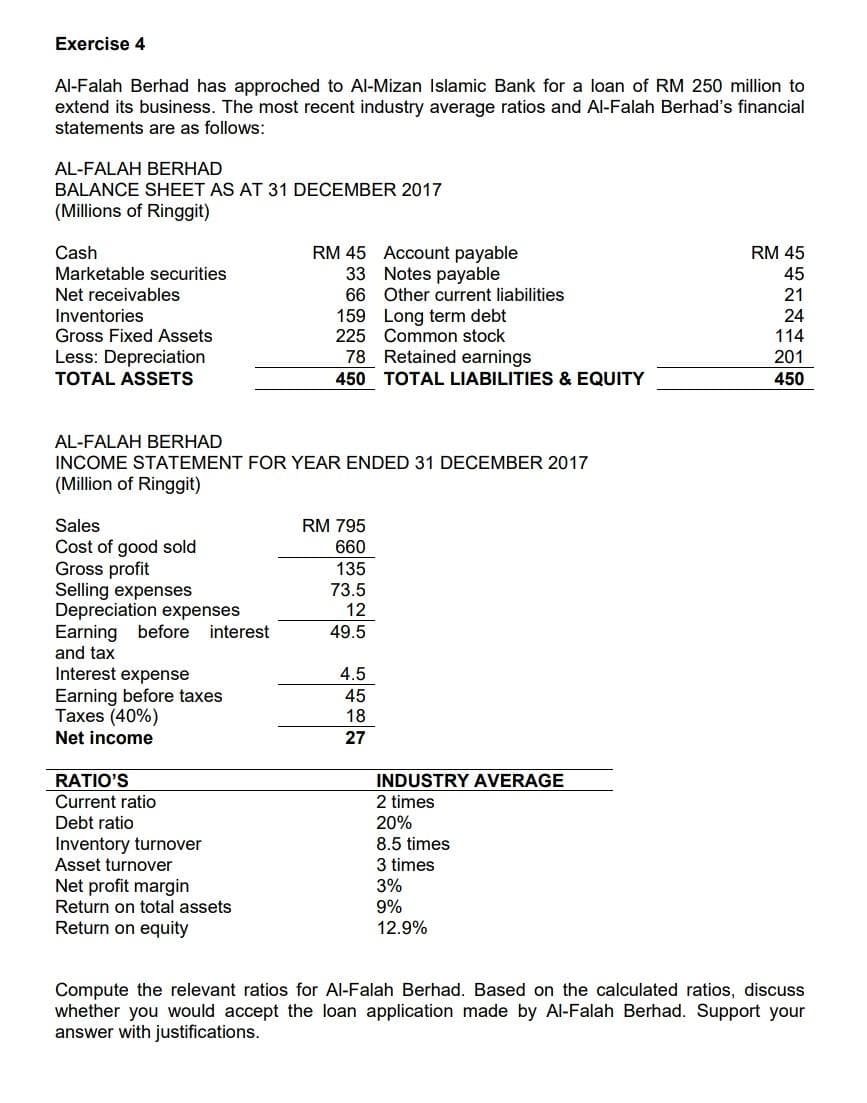

Exercise 4 Al-Falah Berhad has approched to Al-Mizan Islamic Bank for a loan of RM 250 million to extend its business. The most recent industry average ratios and Al-Falah Berhad's financial statements are as follows: AL-FALAH BERHAD BALANCE SHEET AS AT 31 DECEMBER 2017 (Millions of Ringgit) Cash Marketable securities Net receivables Inventories Gross Fixed Assets RM 45 Account payable 33 Notes payable 66 Other current liabilities RM 45 45 21 24 114 201 159 Long term debt 225 Common stock 78 Retained earnings Less: Depreciation TOTAL ASSETS 450 TOTAL LIABILITIES & EQUITY 450 AL-FALAH BERHAD INCOME STATEMENT FOR YEAR ENDED 31 DECEMBER 2017 (Million of Ringgit) RM 795 Sales Cost of good sold Gross profit Selling expenses Depreciation expenses Earning before interest and tax 660 135 73.5 12 49.5 Interest expense Earning before taxes Taxes (40%) 4.5 45 18 Net income 27 INDUSTRY AVERAGE 2 times 20% 8.5 times 3 times 3% 9% RATIO'S Current ratio Debt ratio Inventory turnover Asset turnover Net profit margin Return on total assets Return on equity 12.9% Compute the relevant ratios for Al-Falah Berhad. Based on the calculated ratios, discuss whether you would accept the loan application made by Al-Falah Berhad. Support your answer with justifications.

Exercise 4 Al-Falah Berhad has approched to Al-Mizan Islamic Bank for a loan of RM 250 million to extend its business. The most recent industry average ratios and Al-Falah Berhad's financial statements are as follows: AL-FALAH BERHAD BALANCE SHEET AS AT 31 DECEMBER 2017 (Millions of Ringgit) Cash Marketable securities Net receivables Inventories Gross Fixed Assets RM 45 Account payable 33 Notes payable 66 Other current liabilities RM 45 45 21 24 114 201 159 Long term debt 225 Common stock 78 Retained earnings Less: Depreciation TOTAL ASSETS 450 TOTAL LIABILITIES & EQUITY 450 AL-FALAH BERHAD INCOME STATEMENT FOR YEAR ENDED 31 DECEMBER 2017 (Million of Ringgit) RM 795 Sales Cost of good sold Gross profit Selling expenses Depreciation expenses Earning before interest and tax 660 135 73.5 12 49.5 Interest expense Earning before taxes Taxes (40%) 4.5 45 18 Net income 27 INDUSTRY AVERAGE 2 times 20% 8.5 times 3 times 3% 9% RATIO'S Current ratio Debt ratio Inventory turnover Asset turnover Net profit margin Return on total assets Return on equity 12.9% Compute the relevant ratios for Al-Falah Berhad. Based on the calculated ratios, discuss whether you would accept the loan application made by Al-Falah Berhad. Support your answer with justifications.

Financial Accounting Intro Concepts Meth/Uses

14th Edition

ISBN:9781285595047

Author:Weil

Publisher:Weil

Chapter13: Marketable Securities And Derivatives

Section: Chapter Questions

Problem 27P

Related questions

Question

Transcribed Image Text:Exercise 4

Al-Falah Berhad has approched to Al-Mizan Islamic Bank for a loan of RM 250 million to

extend its business. The most recent industry average ratios and Al-Falah Berhad's financial

statements are as follows:

AL-FALAH BERHAD

BALANCE SHEET AS AT 31 DECEMBER 2017

(Millions of Ringgit)

RM 45 Account payable

33 Notes payable

66 Other current liabilities

Cash

RM 45

Marketable securities

45

Net receivables

21

Inventories

Gross Fixed Assets

159 Long term debt

225 Common stock

78 Retained earnings

450 TOTAL LIABILITIES & EQUITY

24

114

Less: Depreciation

201

TOTAL ASSETS

450

AL-FALAH BERHAD

STATEM

INCO

FOR

EAR ENDED 31 DECEMBER 2017

(Million of Ringgit)

Sales

Cost of good sold

Gross profit

Selling expenses

Depreciation expenses

Earning before interest

and tax

RM 795

660

135

73.5

12

49.5

Interest expense

Earning before taxes

Taxes (40%)

4.5

45

18

Net income

27

RATIO'S

Current ratio

Debt ratio

INDUSTRY AVERAGE

2 times

Inventory turnover

Asset turnover

20%

8.5 times

3 times

Net profit margin

3%

Return on total assets

9%

Return on equity

12.9%

Compute the relevant ratios for Al-Falah Berhad. Based on the calculated ratios, discuss

whether you would accept the loan application made by Al-Falah Berhad. Support your

answer with justifications.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning