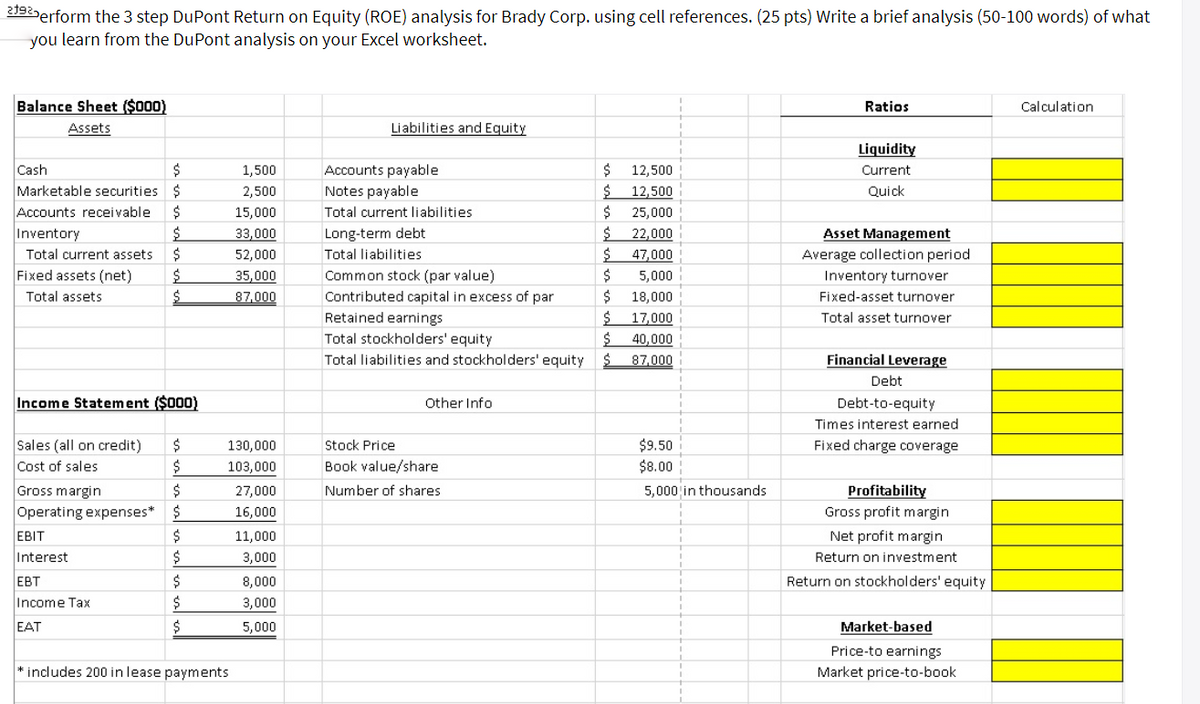

213erform the 3 step DuPont Return on Equity (ROE) analysis for Brady Corp. using cell references. (25 pts) Write a brief analysis (50-100 words) of what you learn from the DuPont analysis on your Excel worksheet. Balance Sheet ($000) Ratios Calculation Assets Liabilities and Equity Liquidity Cash 2$ Accounts payable Notes payable 1,500 12,500 Current Marketable securities $ $ $ 2,500 12,500 Quick Accounts receivable 15,000 Total current liabilities $ 25,000 Inventory 33,000 Long-term debt 22,000 Asset Management Total current assets 2$ 52,000 Total liabilities 47,000 Average collection period Fixed assets (net) 35,000 Common stock (par value) 2$ 5,000 Inventory turnover Total assets $ Fixed-asset turnover Contributed capital in excess of par Retained earnings 87,000 18,000 17,000 Total asset turnover Total stockholders' equity 40,000 Total liabilities and stockholders' equity 87,000 Financial Leverage Debt Income Statement ($000) Other Info Debt-to-equity Times interest earned Sales (all on credit) Cost of sales 130,000 Stock Price $9.50 Fixed charge coverage $ 103,000 Book value/share $8.00 Gross margin 27,000 Number of shares 5,000 in thousands Profitability Operating expenses* 24 16,000 Gross profit margin EBIT 11,000 Net profit margin Interest 3,000 Return on investment ЕВТ 8,000 Return on stockholders' equity Income Tax $ 3,000 EAT 5,000 Market-based Price-to earnings * includes 200 in lease payments Market price-to-book

213erform the 3 step DuPont Return on Equity (ROE) analysis for Brady Corp. using cell references. (25 pts) Write a brief analysis (50-100 words) of what you learn from the DuPont analysis on your Excel worksheet. Balance Sheet ($000) Ratios Calculation Assets Liabilities and Equity Liquidity Cash 2$ Accounts payable Notes payable 1,500 12,500 Current Marketable securities $ $ $ 2,500 12,500 Quick Accounts receivable 15,000 Total current liabilities $ 25,000 Inventory 33,000 Long-term debt 22,000 Asset Management Total current assets 2$ 52,000 Total liabilities 47,000 Average collection period Fixed assets (net) 35,000 Common stock (par value) 2$ 5,000 Inventory turnover Total assets $ Fixed-asset turnover Contributed capital in excess of par Retained earnings 87,000 18,000 17,000 Total asset turnover Total stockholders' equity 40,000 Total liabilities and stockholders' equity 87,000 Financial Leverage Debt Income Statement ($000) Other Info Debt-to-equity Times interest earned Sales (all on credit) Cost of sales 130,000 Stock Price $9.50 Fixed charge coverage $ 103,000 Book value/share $8.00 Gross margin 27,000 Number of shares 5,000 in thousands Profitability Operating expenses* 24 16,000 Gross profit margin EBIT 11,000 Net profit margin Interest 3,000 Return on investment ЕВТ 8,000 Return on stockholders' equity Income Tax $ 3,000 EAT 5,000 Market-based Price-to earnings * includes 200 in lease payments Market price-to-book

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter12: Fainancial Statement Analysis

Section: Chapter Questions

Problem 99.5C

Related questions

Question

100%

Transcribed Image Text:213erform the 3 step DuPont Return on Equity (ROE) analysis for Brady Corp. using cell references. (25 pts) Write a brief analysis (50-100 words) of what

you learn from the DuPont analysis on your Excel worksheet.

Balance Sheet ($000)

Ratios

Calculation

Assets

Liabilities and Equity

Liquidity

Cash

2$

Accounts payable

Notes payable

1,500

12,500

Current

Marketable securities $

$

$

2,500

12,500

Quick

Accounts receivable

15,000

Total current liabilities

$ 25,000

Inventory

33,000

Long-term debt

22,000

Asset Management

Total current assets

2$

52,000

Total liabilities

47,000

Average collection period

Fixed assets (net)

35,000

Common stock (par value)

2$

5,000

Inventory turnover

Total assets

$

Fixed-asset turnover

Contributed capital in excess of par

Retained earnings

87,000

18,000

17,000

Total asset turnover

Total stockholders' equity

40,000

Total liabilities and stockholders' equity

87,000

Financial Leverage

Debt

Income Statement ($000)

Other Info

Debt-to-equity

Times interest earned

Sales (all on credit)

Cost of sales

130,000

Stock Price

$9.50

Fixed charge coverage

$

103,000

Book value/share

$8.00

Gross margin

27,000

Number of shares

5,000 in thousands

Profitability

Operating expenses*

24

16,000

Gross profit margin

EBIT

11,000

Net profit margin

Interest

3,000

Return on investment

ЕВТ

8,000

Return on stockholders' equity

Income Tax

$

3,000

EAT

5,000

Market-based

Price-to earnings

* includes 200 in lease payments

Market price-to-book

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning