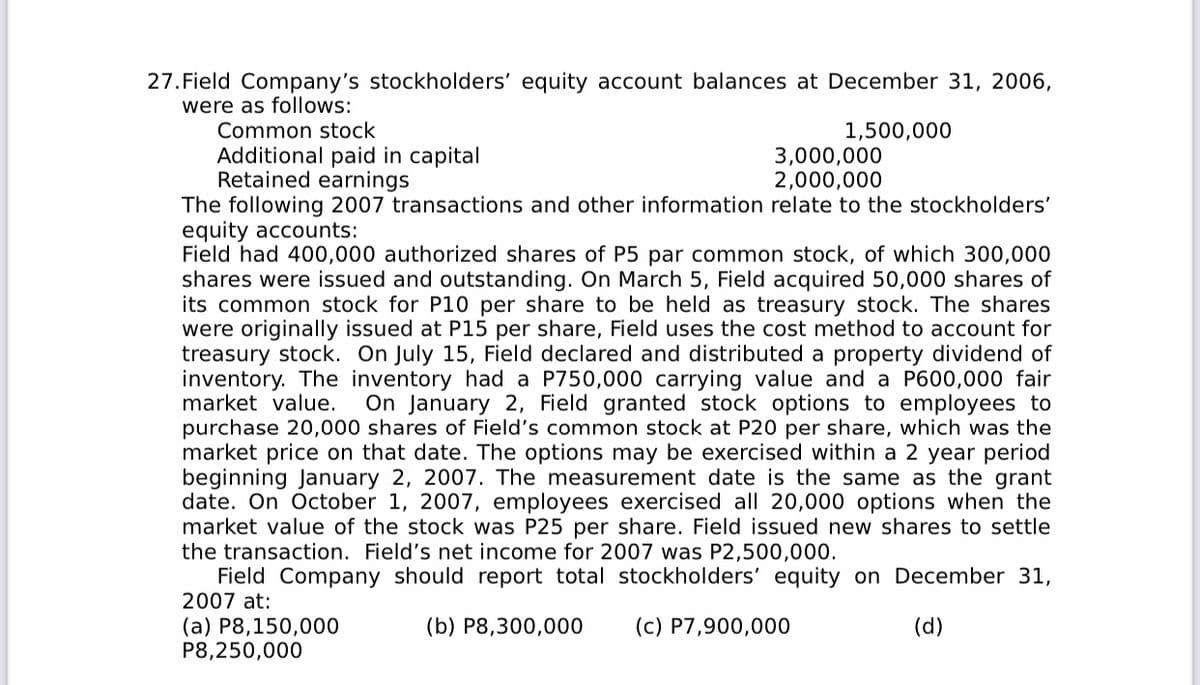

27. Field Company's stockholders' equity account balances at December 31, 2006, were as follows: Common stock 1,500,000 Additional paid in capital Retained earnings The following 2007 transactions and other information relate to the stockholders' equity accounts: Field had 400,000 authorized shares of P5 par common stock, of which 300,000 shares were issued and outstanding. On March 5, Field acquired 50,000 shares of its common stock for P10 per share to be held as treasury stock. The shares were originally issued at P15 per share, Field uses the cost method to account for treasury stock. On July 15, Field declared and distributed a property dividend of inventory. The inventory had a P750,000 carrying value and a P600,000 fair market value. purchase 20,000 shares of Field's common stock at P20 per share, which was the market price on that date. The options may be exercised within a 2 year period beginning January 2, 2007. The measurement date is the same as the grant date. On October 1, 2007, employees exercised all 20,000 options when the market value of the stock was P25 per share. Field issued new shares to settle the transaction. Field's net income for 2007 was P2,500,000. Field Company should report total stockholders' equity on December 31, 2007 at: (a) P8,150,000 P8,250,000 3,000,000 2,000,000 On January 2, Field granted stock options to employees to (b) P8,300,000 (c) P7,900,000 (d)

27. Field Company's stockholders' equity account balances at December 31, 2006, were as follows: Common stock 1,500,000 Additional paid in capital Retained earnings The following 2007 transactions and other information relate to the stockholders' equity accounts: Field had 400,000 authorized shares of P5 par common stock, of which 300,000 shares were issued and outstanding. On March 5, Field acquired 50,000 shares of its common stock for P10 per share to be held as treasury stock. The shares were originally issued at P15 per share, Field uses the cost method to account for treasury stock. On July 15, Field declared and distributed a property dividend of inventory. The inventory had a P750,000 carrying value and a P600,000 fair market value. purchase 20,000 shares of Field's common stock at P20 per share, which was the market price on that date. The options may be exercised within a 2 year period beginning January 2, 2007. The measurement date is the same as the grant date. On October 1, 2007, employees exercised all 20,000 options when the market value of the stock was P25 per share. Field issued new shares to settle the transaction. Field's net income for 2007 was P2,500,000. Field Company should report total stockholders' equity on December 31, 2007 at: (a) P8,150,000 P8,250,000 3,000,000 2,000,000 On January 2, Field granted stock options to employees to (b) P8,300,000 (c) P7,900,000 (d)

Financial Accounting

14th Edition

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Carl Warren, Jim Reeve, Jonathan Duchac

Chapter13: Corporations: Organization, Stock Transactions, And Dividends

Section: Chapter Questions

Problem 3PA: The following selected accounts appear in the ledger of EJ Construction Inc. at the beginning of the...

Related questions

Question

100%

Transcribed Image Text:27. Field Company's stockholders' equity account balances at December 31, 2006,

were as follows:

Common stock

Additional paid in capital

Retained earnings

The following 2007 transactions and other information relate to the stockholders'

equity accounts:

Field had 400,000 authorized shares of P5 par common stock, of which 300,000

shares were issued and outstanding. On March 5, Field acquired 50,000 shares of

its common stock for P10 per share to be held as treasury stock. The shares

were originally issued at P15 per share, Field uses the cost method to account for

treasury stock. On July 15, Field declared and distributed a property dividend of

inventory. The inventory had a P750,000 carrying value and a P600,000 fair

market value.

purchase 20,000 shares of Field's common stock at P20 per share, which was the

market price on that date. The options may be exercised within a 2 year period

beginning January 2, 2007. The measurement date is the same as the grant

date. On October 1, 2007, employees exercised all 20,000 options when the

market value of the stock was P25 per share. Field issued new shares to settle

the transaction. Field's net income for 2007 was P2,500,000.

Field Company should report total stockholders' equity on December 31,

2007 at:

1,500,000

3,000,000

2,000,000

On January 2, Field granted stock options to employees to

(a) P8,150,000

P8,250,000

(b) P8,300,000

(c) P7,900,000

(d)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning