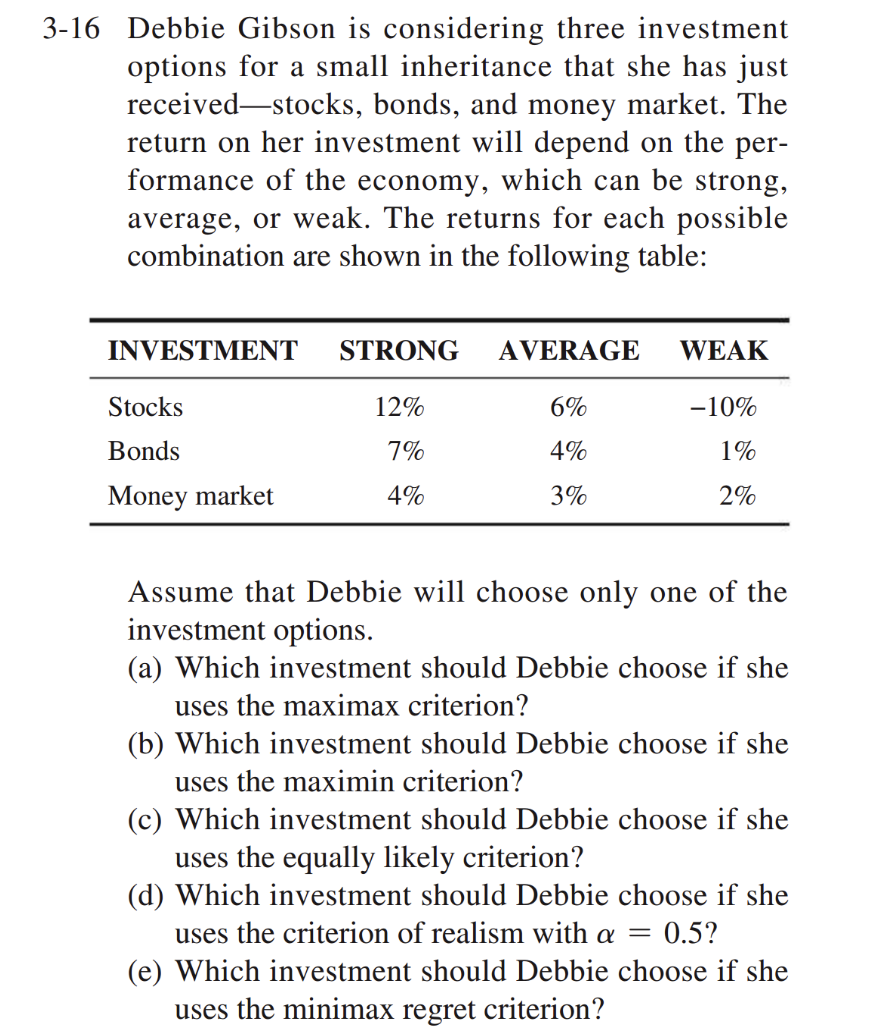

3-16 Debbie Gibson is considering three investment options for a small inheritance that she has just received-stocks, bonds, and money market. The return on her investment will depend on the per- formance of the economy, which can be strong, average, or weak. The returns for each possible combination are shown in the following table: INVESTMENT STRONG 12% 7% 4% Stocks Bonds Money market AVERAGE 6% 4% 3% WEAK -10% 1% 2% Assume that Debbie will choose only one of the investment options. (a) Which investment should Debbie choose if she uses the maximax criterion? (b) Which investment should Debbie choose if she uses the maximin criterion? (c) Which investment should Debbie choose if she uses the equally likely criterion? (d) Which investment should Debbie choose if she uses the criterion of realism with a = 0.5? (e) Which investment should Debbie choose if she uses the minimax regret criterion?

Q: What are the management Philosophies that emerged and influence the current personnel…

A: NOTE: We are allowed to do one question only at a time. Management philosophies are the set of…

Q: With examples, discuss how companies adopting sustainable methods of production and marketing can…

A: Sustainable marketing is the strategic promotion of environmentally and socially responsible…

Q: Bearing in mind the scope of the study, identify one hazard and its source or cause for each of the…

A: Process step: Slicing by machine Hazard & source/cause: Mechanical injury/cuts - The slicing…

Q: a) b) c) State the two (2) shopping habits of the Mexicans that were different. Explain how Walmart…

A: a) The two shopping habits of Mexicans that were different from the United States are: Most people…

Q: Canine Gourmet Super Breath dog treats are sold in boxes labeled with a net weight of 15 ounces (425…

A:

Q: Question: How does Anna balance demand and capacity by doing a special on bagels from 2 to 4 pm?

A: Anna balances demand and capacity by doing a special on bagels from 2 to 4 pm in several ways: By…

Q: Analyze the most pressing issues in the field of risk management. Discussion How important is risk…

A: The field of risk management is constantly evolving and facing new challenges, but some of the most…

Q: Consider the following table of activities A through G in which A is the start node and G is the…

A: A project schedule is considered sensitive in the event that the critical way will probably change…

Q: What precisely is the purpose of doing a technical analysis? Explain not just how and why it is used…

A: Meaning of Technical Analysis Technical analysis is a device or technique, used to foresee the…

Q: Projects with very general scope definitions are at risk of expanding gradually, without specific…

A: NOTE: We are allowed to do one question only. Projects are also useful for learning new…

Q: Lower Control Limit (LCLx) = enter your response here inches (round your response to three…

A: As found in the previous part of the question, X¯= 3.027916667 R = 1.025416667 A2 = 0.729 , D3 = 0…

Q: Audi Company's Strategic Approach 1. Analyze the company’s strategic approach and why it works for…

A: 1. Audi's strategic approach involves a combination of differentiation and low cost. The…

Q: ) Based on Table 1, calculate forecast volume using and 5 periods-moving average. b) Based on Table…

A: Given the data stated below, For this dataset, I would use forecasting techniques like 5…

Q: Is outsourcing best practice? Argue FOR AND AGAINST

A: Introduction- Outsourcing is a typical act of contracting out business works and cycles to outsider…

Q: Introduction The Protective Equipment Company (PEC) is a medium-sized enterprise in the private…

A: (a) Three different sourcing approaches that could be used by the purchaser at PEC to all the more…

Q: d. How many customers in total should have been served in a day by all the sales people? e. What is…

A: Given Formulas used :-

Q: Sampling 4 pieces of precision-cut wire (to be used in computer assembly) every hour for the past…

A: Given data is

Q: Newpaper sales data suggest that 20% of the days, 80 papers are sold; 40% of the days, 90 papers are…

A: Cycle Service Level is the anticipated likelihood that a producer will supply the demand for a…

Q: Explain what is meant by an “assignment problem” and how it arises. How can an assignment problem…

A: Assignment problems are one of the most common issues faced in a variety of industries. Fortunately,…

Q: Stepping up is an emotional issue, not an intellectual one. People can rationalize all day the need…

A: Stepping up in the workplace means taking on a greater level of responsibility and leadership, and…

Q: At Quick Car Wash, the wash process is advertised to take less than 6 minutes. Consequently,…

A:

Q: ● Sweet World Limited is considering building a Super-Pop facility in one of the European countries.…

A: Formulae used: Center of Gravity method: x-coordinate= ΣWXΣW y-coordinate= ΣWYΣW

Q: Read the pages and make a brief summary of them with your own words, please. Mention important…

A: WEF (World Economic Forum) has recently ranked USA as most competitive country in the world after…

Q: a. What is the setup cost, based on the desired lot size? b. What is the setup time, based on $40…

A: a. To calculate the setup cost based on the desired lot size of Q = 63 units, you would use the…

Q: he producers at Real Play Theatre believe it’s never too early to start teaching kids about the…

A: Student Name : The Characters :

Q: The Carbondale Hospital is considering the purchase of a new ambulance. The decision will rest…

A: The 2-year Moving average (MA) forecast is calculated using the below formula: 2-year MA Forecast…

Q: What order of reaction has a linear curve when plotting concentration versus time? A) Zeroth B)…

A: Introduction: To determine the reaction order either the integrated rate law or the deferential rate…

Q: In project management describe FIVE techniques for estimating project activities in situations of…

A: Estimating a project is challenging. Because one can really truly figure out what lengthy a job…

Q: Subject: Procurement & Sourcing Q): How contract is establish? Q) What are the main terms of…

A: The fact that sourcing must be completed before any procurement can begin is one of the critical…

Q: design strategies?

A: Mobile First and Desktop First are two different approaches to responsive design, which is the…

Q: What is the importance of resources schedule in project management? Explain with one specific…

A: Resource scheduling is a vital stage of project management for sure. At the point when resource…

Q: For the network shown below, the arc capacity from node i to node j is the number nearest node i…

A: Linear programming is a mathematical technique that is commonly used in the operations management…

Q: hello, can someone help me with this question?: if a company regularly holds 50 units of safety…

A: A safety stock would be an extra amount of a product kept in the inventories to lower the…

Q: a) Which station is the bottleneck? (b) What is the process capacity in units per day (round to the…

A: Given Calculations:- Formulas Used:-

Q: case study: Anna runs a small cafe that’s really busy at lunchtime but quiet at other times. She…

A: Queues can be confounded to make due. In any case, when done well, they won't just satisfy…

Q: Please set up a linear program and solve the problem using the Excel Solver. Thank you very much.

A: Given data is

Q: How do you define manufacturing decision patterns?

A: Manufacturing decision patterns refer to the systematic and repeatable methods, techniques and…

Q: 10. ovation 2 Complete the sentences using the vocabulary words. Use each word once. VOCABULARY LIST…

A: Solution is given in Step 2.

Q: A project consists of seven activities. The following table shows the estimated time of the…

A: By identifying the actions that are essential to the project schedule, the critical route technique…

Q: Which of the following is considered to be a drawback to Entrepreneurship? Uncertainty of Income…

A: Drawback to Entrepreneurship Uncertainty of Income Long Hours and Hard Work Risk of losing your…

Q: Garcia's Garage desires to create some colorful charts and graphs to illustrate how reliably its…

A: Given- P = Avg. proportion of customers return for repair within 30 day warranty = 0.12N = Sample…

Q: Explain any four points that highlight the importance of controlling.

A: Any business, process, task, or operation will have a specific procedure to follow and also various…

Q: Who are the external customers using self-service kiosk in a hotel?

A: Introduction- A self-check-in kiosk is a kiosk that permits visitors to facilitate more routine…

Q: How could personal financial software assist you in your personal financial decisions?

A: Personal financial software can help you make informed financial decisions by providing you with…

Q: Kuantan ATV, Inc. assembles five different models of all-terrain vehicles (ATVs) from various…

A: The supplier with lowest cost will be chosen. The value might change wrt the number of days…

Q: a) The upper and lower 3-sigma control chart limits are: Part 2 UCLp = enter your response here…

A: Control charts are also known as process-behaviour charts. It is a statistical process that helps in…

Q: Comparing two threads inside the same process to two distinct processes. What is the optimal course…

A: The optimal course of action depends on the specific circumstances and objectives of the system. If…

Q: where did the direct ship volume (CBM) of 169,100 cost come from?

A: Total Current volume (CBM) = 190,000 Direct shipping percentage = 0.89 Direct ship Volume…

Q: 4. Construct a Gantt chart to represent the various activities of the project with a date. The…

A: Find the Given details below: Activity Predecessor Optimistic Time(To) a(Week) Pessimistic…

please include excel sheet showing calculations

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 3 images

- The stocks in Example 7.9 are all positively correlated. What happens when they are negatively correlated? Answer for each of the following scenarios. In each case, two of the three correlations are the negatives of their original values. Discuss the differences between the optimal portfolios in these three scenarios. a. Change the signs of the correlations between stocks 1 and 2 and between stocks 1 and 3. (Here, stock 1 tends to go in a different direction from stocks 2 and 3.) b. Change the signs of the correlations between stocks 1 and 2 and between stocks 2 and 3. (Here, stock 2 tends to go in a different direction from stocks 1 and 3.) c. Change the signs of the correlations between stocks 1 and 3 and between stocks 2 and 3. (Here, stock 3 tends to go in a different direction from stocks 1 and 2.) EXAMPLE 7.9 PORTFOLIO SELECTION AT PERLMAN BROTHERS Perlman Brothers, an investment company, intends to invest a given amount of money in three stocks. From past data, the means and standard deviations of annual returns have been estimated as shown in Table 7.2. The correlations among the annual returns on the stocks are listed in Table 7.3. The company wants to find a minimum-variance portfolio that yields a mean annual return of at least 0.12.Based on Grossman and Hart (1983). A salesperson for Fuller Brush has three options: (1) quit, (2) put forth a low level of effort, or (3) put forth a high level of effort. Suppose for simplicity that each salesperson will sell 0, 5000, or 50,000 worth of brushes. The probability of each sales amount depends on the effort level as described in the file P07_71.xlsx. If a salesperson is paid w dollars, he or she regards this as a benefit of w1/2 units. In addition, low effort costs the salesperson 0 benefit units, whereas high effort costs 50 benefit units. If a salesperson were to quit Fuller and work elsewhere, he or she could earn a benefit of 20 units. Fuller wants all salespeople to put forth a high level of effort. The question is how to minimize the cost of encouraging them to do so. The company cannot observe the level of effort put forth by a salesperson, but it can observe the size of his or her sales. Thus, the wage paid to the salesperson is completely determined by the size of the sale. This means that Fuller must determine w0, the wage paid for sales of 0; w5000, the wage paid for sales of 5000; and w50,000, the wage paid for sales of 50,000. These wages must be set so that the salespeople value the expected benefit from high effort more than quitting and more than low effort. Determine how to minimize the expected cost of ensuring that all salespeople put forth high effort. (This problem is an example of agency theory.)If a monopolist produces q units, she can charge 400 4q dollars per unit. The variable cost is 60 per unit. a. How can the monopolist maximize her profit? b. If the monopolist must pay a sales tax of 5% of the selling price per unit, will she increase or decrease production (relative to the situation with no sales tax)? c. Continuing part b, use SolverTable to see how a change in the sales tax affects the optimal solution. Let the sales tax vary from 0% to 8% in increments of 0.5%.

- This problem is based on Motorolas online method for choosing suppliers. Suppose Motorola solicits bids from five suppliers for eight products. The list price for each product and the quantity of each product that Motorola needs to purchase during the next year are listed in the file P06_93.xlsx. Each supplier has submitted the percentage discount it will offer on each product. These percentages are also listed in the file. For example, supplier 1 offers a 7% discount on product 1 and a 30% discount on product 2. The following considerations also apply: There is an administrative cost of 5000 associated with setting up a suppliers account. For example, if Motorola uses three suppliers, it incurs an administrative cost of 15,000. To ensure reliability, no supplier can supply more than 80% of Motorolas demand for any product. A supplier must supply an integer amount of each product it supplies. Develop a linear integer model to help Motorola minimize the sum of its purchase and administrative costs.You want to take out a 450,000 loan on a 20-year mortgage with end-of-month payments. The annual rate of interest is 3%. Twenty years from now, you will need to make a 50,000 ending balloon payment. Because you expect your income to increase, you want to structure the loan so at the beginning of each year, your monthly payments increase by 2%. a. Determine the amount of each years monthly payment. You should use a lookup table to look up each years monthly payment and to look up the year based on the month (e.g., month 13 is year 2, etc.). b. Suppose payment each month is to be the same, and there is no balloon payment. Show that the monthly payment you can calculate from your spreadsheet matches the value given by the Excel PMT function PMT(0.03/12,240, 450000,0,0).The eTech Company is a fairly recent entry in the electronic device area. The company competes with Apple. Samsung, and other well-known companies in the manufacturing and sales of personal handheld devices. Although eTech recognizes that it is a niche player and will likely remain so in the foreseeable future, it is trying to increase its current small market share in this huge competitive market. Jim Simons, VP of Production, and Catherine Dolans, VP of Marketing, have been discussing the possible addition of a new product to the companys current (rather limited) product line. The tentative name for this new product is ePlayerX. Jim and Catherine agree that the ePlayerX, which will feature a sleeker design and more memory, is necessary to compete successfully with the big boys, but they are also worried that the ePlayerX could cannibalize sales of their existing productsand that it could even detract from their bottom line. They must eventually decide how much to spend to develop and manufacture the ePlayerX and how aggressively to market it. Depending on these decisions, they must forecast demand for the ePlayerX, as well as sales for their existing products. They also realize that Apple. Samsung, and the other big players are not standing still. These competitors could introduce their own new products, which could have very negative effects on demand for the ePlayerX. The expected timeline for the ePlayerX is that development will take no more than a year to complete and that the product will be introduced in the market a year from now. Jim and Catherine are aware that there are lots of decisions to make and lots of uncertainties involved, but they need to start somewhere. To this end. Jim and Catherine have decided to base their decisions on a planning horizon of four years, including the development year. They realize that the personal handheld device market is very fluid, with updates to existing products occurring almost continuously. However, they believe they can include such considerations into their cost, revenue, and demand estimates, and that a four-year planning horizon makes sense. In addition, they have identified the following problem parameters. (In this first pass, all distinctions are binary: low-end or high-end, small-effect or large-effect, and so on.) In the absence of cannibalization, the sales of existing eTech products are expected to produce year I net revenues of 10 million, and the forecast of the annual increase in net revenues is 2%. The ePIayerX will be developed as either a low-end or a high-end product, with corresponding fixed development costs (1.5 million or 2.5 million), variable manufacturing costs ( 100 or 200). and selling prices (150 or 300). The fixed development cost is incurred now, at the beginning of year I, and the variable cost and selling price are assumed to remain constant throughout the planning horizon. The new product will be marketed either mildly aggressively or very aggressively, with corresponding costs. The costs of a mildly aggressive marketing campaign are 1.5 million in year 1 and 0.5 million annually in years 2 to 4. For a very aggressive campaign, these costs increase to 3.5 million and 1.5 million, respectively. (These marketing costs are not part of the variable cost mentioned in the previous bullet; they are separate.) Depending on whether the ePlayerX is a low-end or high-end produce the level of the ePlayerXs cannibalization rate of existing eTech products will be either low (10%) or high (20%). Each cannibalization rate affects only sales of existing products in years 2 to 4, not year I sales. For example, if the cannibalization rate is 10%, then sales of existing products in each of years 2 to 4 will be 10% below their projected values without cannibalization. A base case forecast of demand for the ePlayerX is that in its first year on the market, year 2, demand will be for 100,000 units, and then demand will increase by 5% annually in years 3 and 4. This base forecast is based on a low-end version of the ePlayerX and mildly aggressive marketing. It will be adjusted for a high-end will product, aggressive marketing, and competitor behavior. The adjustments with no competing product appear in Table 2.3. The adjustments with a competing product appear in Table 2.4. Each adjustment is to demand for the ePlayerX in each of years 2 to 4. For example, if the adjustment is 10%, then demand in each of years 2 to 4 will be 10% lower than it would have been in the base case. Demand and units sold are the samethat is, eTech will produce exactly what its customers demand so that no inventory or backorders will occur. Table 2.3 Demand Adjustments When No Competing Product Is Introduced Table 2.4 Demand Adjustments When a Competing Product Is Introduced Because Jim and Catherine are approaching the day when they will be sharing their plans with other company executives, they have asked you to prepare an Excel spreadsheet model that will answer the many what-if questions they expect to be asked. Specifically, they have asked you to do the following: You should enter all of the given data in an inputs section with clear labeling and appropriate number formatting. If you believe that any explanations are required, you can enter them in text boxes or cell comments. In this section and in the rest of the model, all monetary values (other than the variable cost and the selling price) should be expressed in millions of dollars, and all demands for the ePlayerX should be expressed in thousands of units. You should have a scenario section that contains a 0/1 variable for each of the binary options discussed here. For example, one of these should be 0 if the low-end product is chosen and it should be 1 if the high-end product is chosen. You should have a parameters section that contains the values of the various parameters listed in the case, depending on the values of the 0/1 variables in the previous bullet For example, the fixed development cost will be 1.5 million or 2.5 million depending on whether the 0/1 variable in the previous bullet is 0 or 1, and this can be calculated with a simple IF formula. You can decide how to implement the IF logic for the various parameters. You should have a cash flows section that calculates the annual cash flows for the four-year period. These cash flows include the net revenues from existing products, the marketing costs for ePlayerX, and the net revenues for sales of ePlayerX (To calculate these latter values, it will help to have a row for annual units sold of ePlayerX.) The cash flows should also include depreciation on the fixed development cost, calculated on a straight-line four-year basis (that is. 25% of the cost in each of the four years). Then, these annual revenues/costs should be summed for each year to get net cash flow before taxes, taxes should be calculated using a 32% tax rate, and taxes should be subtracted and depreciation should be added back in to get net cash flows after taxes. (The point is that depreciation is first subtracted, because it is not taxed, but then it is added back in after taxes have been calculated.) You should calculate the company's NPV for the four-year horizon using a discount rate of 10%. You can assume that the fixed development cost is incurred now. so that it is not discounted, and that all other costs and revenues are incurred at the ends of the respective years. You should accompany all of this with a line chart with three series: annual net revenues from existing products; annual marketing costs for ePlayerX; and annual net revenues from sales of ePlayerX. Once all of this is completed. Jim and Catherine will have a powerful tool for presentation purposes. By adjusting the 0/1 scenario variables, their audience will be able to see immediately, both numerically and graphically, the financial consequences of various scenarios.

- An automobile manufacturer is considering whether to introduce a new model called the Racer. The profitability of the Racer depends on the following factors: The fixed cost of developing the Racer is triangularly distributed with parameters 3, 4, and 5, all in billions. Year 1 sales are normally distributed with mean 200,000 and standard deviation 50,000. Year 2 sales are normally distributed with mean equal to actual year 1 sales and standard deviation 50,000. Year 3 sales are normally distributed with mean equal to actual year 2 sales and standard deviation 50,000. The selling price in year 1 is 25,000. The year 2 selling price will be 1.05[year 1 price + 50 (% diff1)] where % diff1 is the number of percentage points by which actual year 1 sales differ from expected year 1 sales. The 1.05 factor accounts for inflation. For example, if the year 1 sales figure is 180,000, which is 10 percentage points below the expected year 1 sales, then the year 2 price will be 1.05[25,000 + 50( 10)] = 25,725. Similarly, the year 3 price will be 1.05[year 2 price + 50(% diff2)] where % diff2 is the percentage by which actual year 2 sales differ from expected year 2 sales. The variable cost in year 1 is triangularly distributed with parameters 10,000, 12,000, and 15,000, and it is assumed to increase by 5% each year. Your goal is to estimate the NPV of the new car during its first three years. Assume that the company is able to produce exactly as many cars as it can sell. Also, assume that cash flows are discounted at 10%. Simulate 1000 trials to estimate the mean and standard deviation of the NPV for the first three years of sales. Also, determine an interval such that you are 95% certain that the NPV of the Racer during its first three years of operation will be within this interval.A European put option allows an investor to sell a share of stock at the exercise price on the exercise data. For example, if the exercise price is 48, and the stock price is 45 on the exercise date, the investor can sell the stock for 48 and then immediately buy it back (that is, cover his position) for 45, making 3 profit. But if the stock price on the exercise date is greater than the exercise price, the option is worthless at that date. So for a put, the investor is hoping that the price of the stock decreases. Using the same parameters as in Example 11.7, find a fair price for a European put option. (Note: As discussed in the text, an actual put option is usually for 100 shares.)Another way to derive a demand function is to break the market into segments and identify a low price, a medium price, and a high price. For each of these prices and market segments, we ask company experts to estimate product demand. Then we use Excels trend curve fitting capabilities to fit a quadratic function that represents that segments demand function. Finally, we add the segment demand curves to derive an aggregate demand curve. Try this procedure for pricing a candy bar. Assume the candy bar costs 0.55 to produce. The company plans to charge between 1.10 and 1.50 for this candy bar. Its marketing department estimates the demands shown in the file P07_47.xlsx (in thousands) in the three regions of the country where the candy bar will be sold. What is the profit-maximizing price, assuming that the same price will be charged in all three regions?