3 Allied made its first and only purchase of inventory for the period on May 3 for 2,000 units at a price of $10 cash per unit (for a total cost of $20,000) 5 Allied sold 1,000 of the units in inventory for $14 per unit (invoice total: $14,000) to Macy Co. under credit terms 2/10, n/60. The goods cost Allied $10,000. 7 Macy returns 100 units because they did not fit the customer's needs (invoice amount: $1,400). Allied restores the units, which cost $1,000, to its inventory. 8 Macy discovers that 100 units are scuffed but are still of use and, therefore, keeps the units. Allied gives a price reduction (allowance) and credits Macy's accounts receivable for $600 to compensate for the damage 15 Allied receives payment from Macy for the amount owed on the May 5 purchase; payment is net of returns, allowances, and any cash discount. May Allied receives payment from Macy for the amount owed on the May 5 purchase; payment is net of returns, allowances, and any cash discount. Note: Enter debits before credits. Credit Date General Journal Debit Cash May 15 Sales discounts Accounts receivable

3 Allied made its first and only purchase of inventory for the period on May 3 for 2,000 units at a price of $10 cash per unit (for a total cost of $20,000) 5 Allied sold 1,000 of the units in inventory for $14 per unit (invoice total: $14,000) to Macy Co. under credit terms 2/10, n/60. The goods cost Allied $10,000. 7 Macy returns 100 units because they did not fit the customer's needs (invoice amount: $1,400). Allied restores the units, which cost $1,000, to its inventory. 8 Macy discovers that 100 units are scuffed but are still of use and, therefore, keeps the units. Allied gives a price reduction (allowance) and credits Macy's accounts receivable for $600 to compensate for the damage 15 Allied receives payment from Macy for the amount owed on the May 5 purchase; payment is net of returns, allowances, and any cash discount. May Allied receives payment from Macy for the amount owed on the May 5 purchase; payment is net of returns, allowances, and any cash discount. Note: Enter debits before credits. Credit Date General Journal Debit Cash May 15 Sales discounts Accounts receivable

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter7: Inventories: Cost Measurement And Flow Assumptions

Section: Chapter Questions

Problem 9RE: RE7-8 Johnson Company uses a perpetual inventory system. On October 23, Johnson purchased 100,000 of...

Related questions

Question

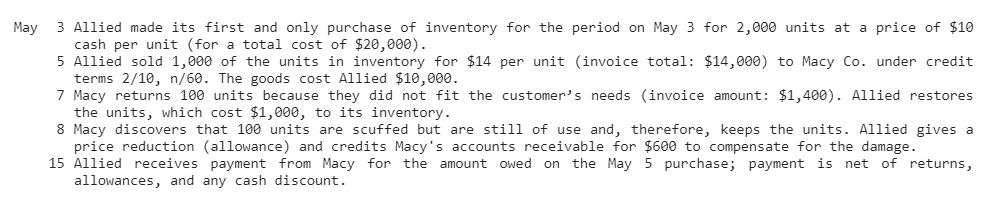

Transcribed Image Text:3 Allied made its first and only purchase of inventory for the period on May 3 for 2,000 units at a price of $10

cash per unit (for a total cost of $20,000)

5 Allied sold 1,000 of the units in inventory for $14 per unit (invoice total: $14,000) to Macy Co. under credit

terms 2/10, n/60. The goods cost Allied $10,000.

7 Macy returns 100 units because they did not fit the customer's needs (invoice amount: $1,400). Allied restores

the units, which cost $1,000, to its inventory.

8 Macy discovers that 100 units are scuffed but are still of use and, therefore, keeps the units. Allied gives a

price reduction (allowance) and credits Macy's accounts receivable for $600 to compensate for the damage

15 Allied receives payment from Macy for the amount owed on the May 5 purchase; payment is net of returns,

allowances, and any cash discount.

May

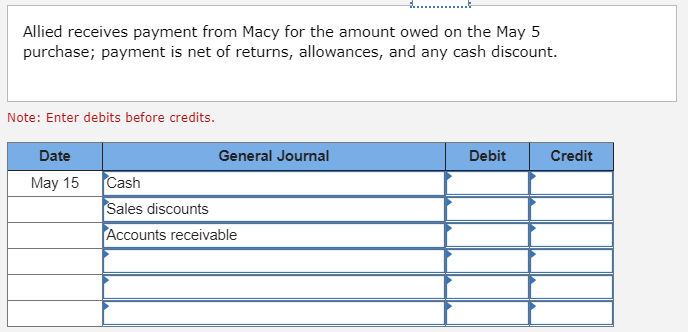

Transcribed Image Text:Allied receives payment from Macy for the amount owed on the May 5

purchase; payment is net of returns, allowances, and any cash discount.

Note: Enter debits before credits.

Credit

Date

General Journal

Debit

Cash

May 15

Sales discounts

Accounts receivable

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning