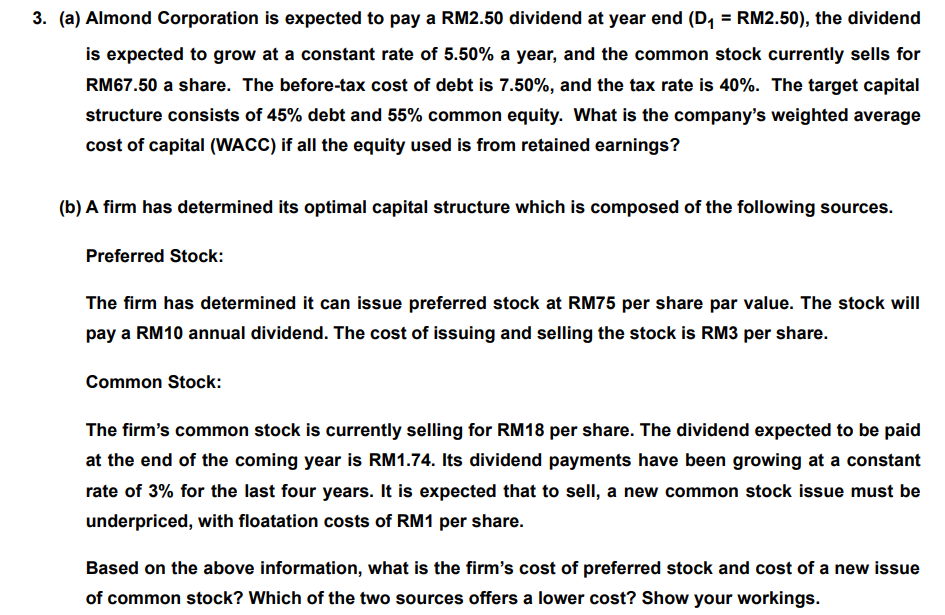

3. (a) Almond Corporation is expected to pay a RM2.50 dividend at year end (D, = RM2.50), the dividend is expected to grow at a constant rate of 5.50% a year, and the common stock currently sells for RM67.50 a share. The before-tax cost of debt is 7.50%, and the tax rate is 40%. The target capital structure consists of 45% debt and 55% common equity. What is the company's weighted average cost of capital (WACC) if all the equity used is from retained earnings? (b) A firm has determined its optimal capital structure which is composed of the following sources. Preferred Stock: The firm has determined it can issue preferred stock at RM75 per share par value. The stock will pay a RM10 annual dividend. The cost of issuing and selling the stock is RM3 per share. Common Stock: The firm's common stock is currently selling for RM18 per share. The dividend expected to be paid at the end of the coming year is RM1.74. Its dividend payments have been growing at a constant rate of 3% for the last four years. It is expected that to sell, a new common stock issue must be underpriced, with floatation costs of RM1 per share. Based on the above information, what is the firm's cost of preferred stock and cost of a new issue of common stock? Which of the two sources offers a lower cost? Show your workings.

3. (a) Almond Corporation is expected to pay a RM2.50 dividend at year end (D, = RM2.50), the dividend is expected to grow at a constant rate of 5.50% a year, and the common stock currently sells for RM67.50 a share. The before-tax cost of debt is 7.50%, and the tax rate is 40%. The target capital structure consists of 45% debt and 55% common equity. What is the company's weighted average cost of capital (WACC) if all the equity used is from retained earnings? (b) A firm has determined its optimal capital structure which is composed of the following sources. Preferred Stock: The firm has determined it can issue preferred stock at RM75 per share par value. The stock will pay a RM10 annual dividend. The cost of issuing and selling the stock is RM3 per share. Common Stock: The firm's common stock is currently selling for RM18 per share. The dividend expected to be paid at the end of the coming year is RM1.74. Its dividend payments have been growing at a constant rate of 3% for the last four years. It is expected that to sell, a new common stock issue must be underpriced, with floatation costs of RM1 per share. Based on the above information, what is the firm's cost of preferred stock and cost of a new issue of common stock? Which of the two sources offers a lower cost? Show your workings.

Chapter15: Dividend Policy

Section: Chapter Questions

Problem 4P

Related questions

Question

Q5a

Please assist to answer Q5b with detail work out and explaination

Transcribed Image Text:3. (a) Almond Corporation is expected to pay a RM2.50 dividend at year end (D, = RM2.50), the dividend

is expected to grow at a constant rate of 5.50% a year, and the common stock currently sells for

RM67.50 a share. The before-tax cost of debt is 7.50%, and the tax rate is 40%. The target capital

structure consists of 45% debt and 55% common equity. What is the company's weighted average

cost of capital (WACC) if all the equity used is from retained earnings?

(b) A firm has determined its optimal capital structure which is composed of the following sources.

Preferred Stock:

The firm has determined it can issue preferred stock at RM75 per share par value. The stock will

pay a RM10 annual dividend. The cost of issuing and selling the stock is RM3 per share.

Common Stock:

The firm's common stock is currently selling for RM18 per share. The dividend expected to be paid

at the end of the coming year is RM1.74. Its dividend payments have been growing at a constant

rate of 3% for the last four years. It is expected that to sell, a new common stock issue must be

underpriced, with floatation costs of RM1 per share.

Based on the above information, what is the firm's cost of preferred stock and cost of a new issue

of common stock? Which of the two sources offers a lower cost? Show your workings.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning