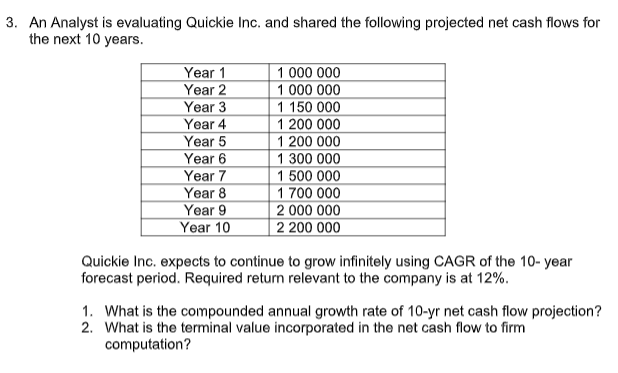

3. An Analyst is evaluating Quickie Inc. and shared the following projected net cash flows for the next 10 years. Year 1 Year 2 Year 3 1 000 000 1 000 000 1 150 000 Year 4 1 200 000 Year 5 Year 6 Year 7 1 200 000 1 300 000 1 500 000 Year 8 1 700 000 Year 9 Year 10 2 000 000 2 200 000 Quickie Inc. expects to continue to grow infinitely using CAGR of the 10- year forecast period. Required return relevant to the company is at 12%. 1. What is the compounded annual growth rate of 10-yr net cash flow projection? 2. What is the terminal value incorporated in the net cash flow to firm computation?

3. An Analyst is evaluating Quickie Inc. and shared the following projected net cash flows for the next 10 years. Year 1 Year 2 Year 3 1 000 000 1 000 000 1 150 000 Year 4 1 200 000 Year 5 Year 6 Year 7 1 200 000 1 300 000 1 500 000 Year 8 1 700 000 Year 9 Year 10 2 000 000 2 200 000 Quickie Inc. expects to continue to grow infinitely using CAGR of the 10- year forecast period. Required return relevant to the company is at 12%. 1. What is the compounded annual growth rate of 10-yr net cash flow projection? 2. What is the terminal value incorporated in the net cash flow to firm computation?

Financial Management: Theory & Practice

16th Edition

ISBN:9781337909730

Author:Brigham

Publisher:Brigham

Chapter7: Corporate Valuation And Stock Valuation

Section: Chapter Questions

Problem 1P: Ogier Incorporated currently has $800 million in sales, which are projected to grow by 10% in Year 1...

Related questions

Question

VALUATION METHOD

DISCOUNTED

Transcribed Image Text:3. An Analyst is evaluating Quickie Inc. and shared the following projected net cash flows for

the next 10 years.

Year 1

Year 2

Year 3

Year 4

Year 5

Year 6

1 000 000

1 000 000

1 150 000

1 200 000

1 200 000

1 300 000

Year 7

1 500 000

Year 8

1 700 000

Year 9

2 000 000

Year 10

2 200 000

Quickie Inc. expects to continue to grow infinitely using CAGR of the 10- year

forecast period. Required return relevant to the company is at 12%.

1. What is the compounded annual growth rate of 10-yr net cash flow projection?

2. What is the terminal value incorporated in the net cash flow to firm

computation?

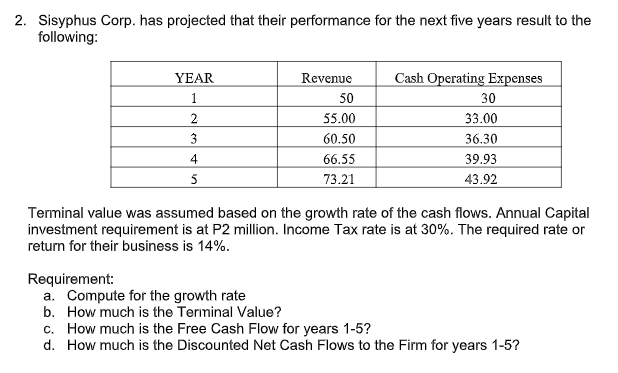

Transcribed Image Text:2. Sisyphus Corp. has projected that their performance for the next five years result to the

following:

YEAR

Revenue

Cash Operating Expenses

1

50

30

33.00

55.00

3

60.50

36.30

4.

66.55

39.93

5

73.21

43.92

Terminal value was assumed based on the growth rate of the cash flows. Annual Capital

investment requirement is at P2 million. Income Tax rate is at 30%. The required rate or

return for their business is 14%.

Requirement:

a. Compute for the growth rate

b. How much is the Terminal Value?

c. How much is the Free Cash Flow for years 1-5?

d. How much is the Discounted Net Cash Flows to the Firm for years 1-5?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning