Financial Management: Theory & Practice

16th Edition

ISBN: 9781337909730

Author: Brigham

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 12, Problem 3P

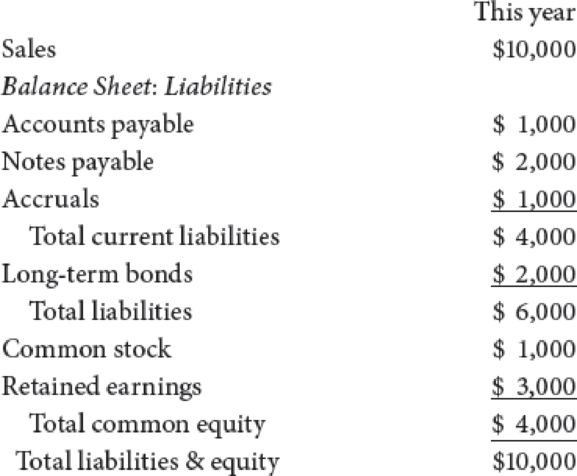

Smiley Corporation’s current sales and partial balance sheet are shown here. Sales are expected to grow by 10% next year. Assuming no change in operations from this year to next year, what are the projected spontaneous liabilities?

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Austin Grocers recently reported the following 2018income statement (in millions of dollars):

For the coming year, the company is forecasting a 25% increase in sales, and it expects thatits year-end operating costs, including depreciation, will equal 70% of sales. Austin’s taxrate, interest expense, and dividend payout ratio are all expected to remain constant.a. What is Austin’s projected 2019 net income?b. What is the expected growth rate in Austin’s dividends?

A company has profits of $38,982 this year and expects profits to decrease by $1,728 dollars per year over the next 12 years. If the profits will be continuously invested in an account bearing 6.2% APR compounded continuously, what is the 12-year present value of this income stream?

The table below shows the forecast cash flow information of Good Time Inc. for the nextyear. The required debt payment in the next year is $88 million, with a current market valueof $60 million. The company pays no tax. If you invest in the corporate debt of Good TimeInc. today, what is your expected return on this investment?

Chapter 12 Solutions

Financial Management: Theory & Practice

Ch. 12 - Prob. 2QCh. 12 - Prob. 3QCh. 12 - Prob. 4QCh. 12 - What is meant by the term “self-supporting growth...Ch. 12 - Suppose a firm makes the following policy changes...Ch. 12 - Broussard Skateboard’s sales are expected to...Ch. 12 - Berman & Jaccor Corporation’s current sales and...Ch. 12 - Smiley Corporations current sales and partial...Ch. 12 - Maggie’s Muffins Bakery generated $5 million in...Ch. 12 - At year-end 2019, Wallace Landscapings total...

Ch. 12 - The Booth Company’s sales are forecasted to double...Ch. 12 - Upton Computers makes bulk purchases of small...Ch. 12 - Stevens Textile Corporations 2019 financial...Ch. 12 - Hatfield Medical Supplys stock price had been...Ch. 12 - Use the AFN equation to estimate Hatfield’s...Ch. 12 - Prob. 3MC

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Ogier Incorporated currently has $800 million in sales, which are projected to grow by 10% in Year 1 and by 5% in Year 2. Its operating profitability ratio (OP) is 10%, and its capital requirement ratio (CR) is 80%? What are the projected sales in Years 1 and 2? What are the projected amounts of net operating profit after taxes (NOPAT) for Years 1 and 2? What are the projected amounts of total net operating capital (OpCap) for Years 1 and 2? What is the projected FCF for Year 2?arrow_forwardFinlay Corporation had sales this year of $3,270 million, and sales are expected to grow by 20 percent next year. Next year the company expects cost of goods sold to be 60 percent of sales, selling expenses to be $40 million per month, depreciation to be $10 million per month, and interest expense to be $24 million per month. Taxes are computed at 21 percent. What is Finlay's expected net income next year?arrow_forwardA stock market analyst has forecasted the following year-end numbers for Raedebe Technology. Sales = $70 million. EBITDA = $20 million. Depreciation = $ 7 million. Amortization = $ 0.The company’s tax rate is 40 percent. The company does not expect any changes in its net operating working capital. This year the company’s planned gross capital expenditures will total $12 million. (Gross capital expenditures represent capital expenditures before deducting depreciation.) What is the company’s forecasted free cash flow for the year?arrow_forward

- ECL Corporation recently reported the the following 2019 balance sheet and 2019 income statement (in pesos): For the coming year, the company's CFO has assembled this information: - The company is forecasting a 25% increase in sales - It expects that its cost of goods sold, operating expenses, assets and current liabilities will increase at the same rate as sales - Interest expense, long term debt and capital stock are expected to remain constant. -Tax rate is expected to remain at 30%. - No dividends will be declared. Prepare the statement of cash flows for the year 2020 using the percent of sales method (estimation method) ECL CORPORATION BALANCE SHEET DECEMBER 31, 2019 ASSETS CURRENT ASSETS CASH 114,690 ACCOUNTS RECEIVABLE 1,000 INVENTORY 1,000 TOTAL CURRENT ASSETS 116,690 FIXED ASSETS NET FIXED ASSETS 40,000 TOTAL ASSETS…arrow_forwardAntivirus Inc. expects its sales next year to be $3,100,000. Inventory and accounts receivable will increase by $540,000 to accommodate this sales level. The company has a steady profit margin of 15 percent with a 35 percent dividend payout. How much external financing will the firm have to seek? Assume there is no increase in liabilities other than that which will occur with the external financing.arrow_forwardYou are interested in determining the intrinsic value of Hoffman Inc. Your analysis shows that the firm’s growth rate will drop from its current pace by 20% each of the next two years, and then you estimate that dividends will continue to grow at the year 2 rate, with the same dividend policy in place, indefinitely. Lastly, your estimate of the required return on the firm’s equity is 12%. Hoffman’s recently published annual report shows the following financial relationships: Assets = 1.4 x Equity Current Assets = 1.7 x Current Liabilities Sales = 1.5 x Assets Net Income = 8% x Sales Dividends = 30% x Net Income Earnings per share (Basic) = $0.80 per share Required: Use the multi-period DDM to estimate the intrinsic value of the company’s stock now, at the beginning of year 1.arrow_forward

- You are interested in determining the intrinsic value of Hoffman Inc. Your analysis shows that the firm’s growth rate will drop from its current pace by 20% each of the next two years, and then you estimate that dividends will continue to grow at the year 2 rate, with the same dividend policy in place, indefinitely. Lastly, your estimate of the required return on the firm’s equity is 12%. Hoffman’s recently published annual report shows the following financial relationships: Assets = 1.4 x Equity Current Assets = 1.7 x Current Liabilities Sales = 1.5 x Assets Net Income = 8% x Sales Dividends = 30% x Net Income Earnings per share (Basic) = $0.80 per share Required: If all of your expectations remain as shown, except that, on the last day of year 1, the required return decreases by 1%. What would be your holding period return for the year?arrow_forwardTobin Supplies Company expects sales next year to be $490,000. Inventory and accounts receivable will increase $75,000 to accommodate this sales level. The company has a steady profit margin of 20 percent with a 50 percent dividend payout. How much external financing will Tobin Supplies Company have to seek? Assume there is no increase in liabilities other than that which will occur with the external financing.arrow_forwardSuppose that TV Industries, Inc. currently has the balance sheet shown as follows, and that sales for the year just ended were $5 million. The firm also has a profit margin of 15 percent, a retention ratio of 25 percent, and expects sales of $5.5 million next year. If all assets and current liabilities are expected to increase with sales, what amount of additional funds will the company need from external sources to fund the expected growth? Assets Liabilities and Equity Current assets $ 1,000,000 Current liabilities $ 1,000,000 Fixed assets 2,000,000 Long-term debt 1,000,000 Equity 1,000,000 Total assets $ 3,000,000 Total liabilities and equity $ 3,000,000arrow_forward

- Using the AFN formula in financial forecasting approach, Determine the following for Piano Co. given the following accounting information assuming that the firm’s profit margin remains constant and the company is at full capacity. · Sales this year is P6,000,000· Percentage increase projected for next year sales = 20%· Net income this year amounts to P600,000· Retention ratio = 50%· Accounts payable = P1,100,000· Notes payable = P180,000· Accrued expenses = P500,000· Projected excess funds available next year is determined to be P200,000 Questions: 1. Determine the spontaneous liabilities increase. 2. How much is the increase in Retained Earnings? 3. How much is the total assets?arrow_forwardTomey Supply Company’s financial statements for the most recent fiscal year are shown below. The company projects that sales will increase by 11 percent next year. Assume that all costs and assets increase directly with sales. The company has a constant 35 percent dividend payout ratio and has no plans to issue new equity. Any financing needed will be raised through the sale of long-term debt. Prepare pro forma financial statements for the coming year based on this information, and calculate the EFN for Tomey. Tomey Supply Company Income Statement and Balance Sheet Income Statement Balance Sheet Revenues $1,768,121 Assets Costs 1,116,487 Current Assets $280,754 EBT 651,634 Net Fixed Assets 713,655 Taxes (35%) 228,072 Total assets $994,409 Net Income $423,562 Liabilities and Equity: Current Liabilities $167,326 Long-term debt 319,456 Common Stock 200,000 Retained Earnings 307,627 Total liabilities…arrow_forwardBoehm Corporation has had stable earnings growth of 7% a year for the past 10 years, and in 2019 Boehm paid dividends of $2 million on net income of $5 million. However, net income is expected to grow by 34% in 2020, and Boehm plans to invest $3.5 million in a plant expansion. This one-time unusual earnings growth won't be maintained, though, and after 2020 Boehm will return to its previous 7% earnings growth rate. Its target debt ratio is 35%. Boehm has 1 million shares of stock. Calculate Boehm's dividend per share for 2020 under each of the following policies: -Its 2020 dividend payment is set to force dividends per share to grow at the long-run growth rate in earnings. Round your answer to the nearest cent. -It continues the 2019 dividend payout ratio. Round your answer to the nearest cent. -It uses a pure residual policy with all distributions in the form of dividends (35% of the $3.5 million investment is financed with debt). Round your answer to the nearest cent. -It employs a…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Financial Projections for Startups Basic Walkthrough; Author: Mike Lingle;https://www.youtube.com/watch?v=7avegQF4dxI;License: Standard youtube license