3. Analytic Question on Durable Consumption It is known that durable consumption is more sensitive to interest rates and expected income. In this question, ve investigate if this is the case in the context of the model we have been studying. We investigate the following lecision: 1 U (c1, c2) = max {c1,c2} 2 /C1 + o+ ubject to the following budget constraints: The time 1 budget constraint: a = Y1 - C nd the time 2 budget constraint: C2 = Y2 + (1 +r) a. The novelty is that ro is now a variable to represents past purchases of goods 1. You can think of this as a car. n turn, we have that a1 = c1 so a1 is consumption derived utility in period 2 derived from past purchases. For this juestion assume that B (1+r) = 1. Answer the following questions. а. Substitute out a from both budget constraints, the one at time 1 and time 2, to write a single

3. Analytic Question on Durable Consumption It is known that durable consumption is more sensitive to interest rates and expected income. In this question, ve investigate if this is the case in the context of the model we have been studying. We investigate the following lecision: 1 U (c1, c2) = max {c1,c2} 2 /C1 + o+ ubject to the following budget constraints: The time 1 budget constraint: a = Y1 - C nd the time 2 budget constraint: C2 = Y2 + (1 +r) a. The novelty is that ro is now a variable to represents past purchases of goods 1. You can think of this as a car. n turn, we have that a1 = c1 so a1 is consumption derived utility in period 2 derived from past purchases. For this juestion assume that B (1+r) = 1. Answer the following questions. а. Substitute out a from both budget constraints, the one at time 1 and time 2, to write a single

Chapter1: Making Economics Decisions

Section: Chapter Questions

Problem 1QTC

Related questions

Question

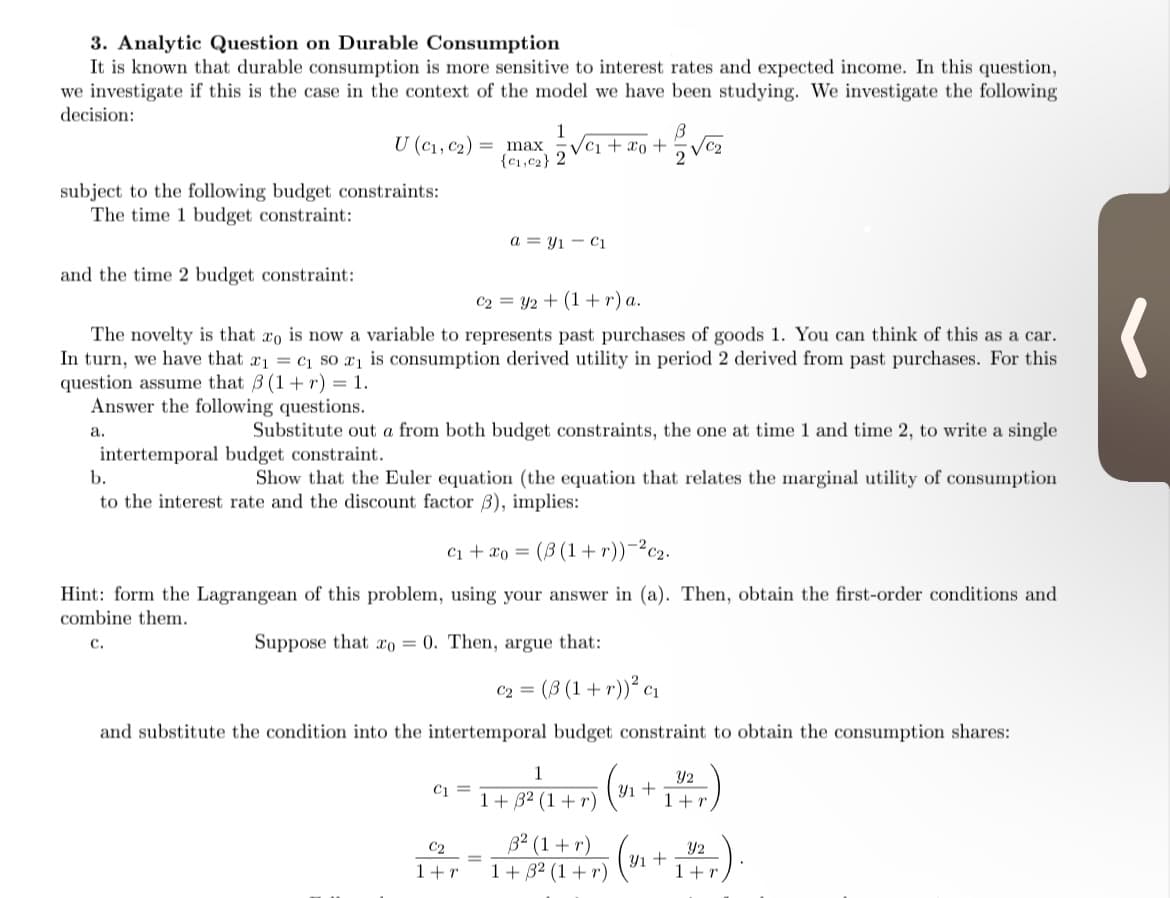

Transcribed Image Text:3. Analytic Question on Durable Consumption

It is known that durable consumption is more sensitive to interest rates and expected income. In this question,

we investigate if this is the case in the context of the model we have been studying. We investigate the following

decision:

U (c1, c2)

1

max

{c1,c2} 2

VCi + xo +

subject to the following budget constraints:

The time 1 budget constraint:

a = Y1 - Ci

and the time 2 budget constraint:

C2 = Y2 + (1 +r) a.

The novelty is that ro is now a variable to represents past purchases of goods 1. You can think of this as a car.

In turn, we have that x1 = c1 so a1 is consumption derived utility in period 2 derived from past purchases. For this

question assume that B (1+ r) = 1.

Answer the following questions.

а.

Substitute out a from both budget constraints, the one at time 1 and time 2, to write a single

intertemporal budget constraint.

b.

Show that the Euler equation (the equation that relates the marginal utility of consumption

to the interest rate and the discount factor 3), implies:

C1 + xo = (B (1 +r))-²c2.

Hint: form the Lagrangean of this problem, using your answer in (a). Then, obtain the first-order conditions and

combine them.

с.

Suppose that xo = 0. Then, argue that:

C2 = (B (1 + r))² c1

C1

and substitute the condition into the intertemporal budget constraint to obtain the consumption shares:

1

Y2

Y1 +

C1 =

1+ 32 (1 + r)

1+r

B2 (1+ r)

1 + 32 (1 + r)

Y2

Yı +

C2

1+r

1+r

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Economics (12th Edition)

Economics

ISBN:

9780134078779

Author:

Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:

PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:

9780134870069

Author:

William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:

PEARSON

Principles of Economics (12th Edition)

Economics

ISBN:

9780134078779

Author:

Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:

PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:

9780134870069

Author:

William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:

PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:

9781305585126

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:

9781337106665

Author:

Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:

Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-…

Economics

ISBN:

9781259290619

Author:

Michael Baye, Jeff Prince

Publisher:

McGraw-Hill Education