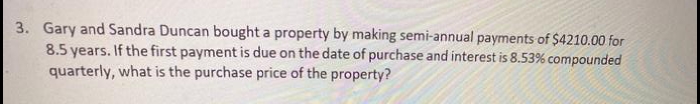

3. Gary and Sandra Duncan bought a property by making semi-annual payments of $4210.00 for 8.5 years. If the first payment is due on the date of purchase and interest is 8.53% compounded quarterly, what is the purchase price of the property?

3. Gary and Sandra Duncan bought a property by making semi-annual payments of $4210.00 for 8.5 years. If the first payment is due on the date of purchase and interest is 8.53% compounded quarterly, what is the purchase price of the property?

Chapter8: Depreciation And Sale Of Business Property

Section: Chapter Questions

Problem 18MCQ: Pat sells land for $25,000 cash and a $75,000 5-year note. If her basis in the property is $30,000...

Related questions

Question

Help me fast.

Transcribed Image Text:3. Gary and Sandra Duncan bought a property by making semi-annual payments of $4210.00 for

8.5 years. If the first payment is due on the date of purchase and interest is 8.53% compounded

quarterly, what is the purchase price of the property?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT