leslady told her that she can purchase it on installment basis to be paid with oney is worth 8% compounded annually, what is her yearly amortization if e to be made at beginning of each year?

leslady told her that she can purchase it on installment basis to be paid with oney is worth 8% compounded annually, what is her yearly amortization if e to be made at beginning of each year?

Chapter10: Financial Statements And Reports

Section: Chapter Questions

Problem 1.6C

Related questions

Question

4.

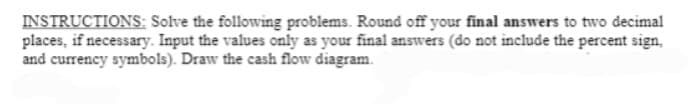

Transcribed Image Text:INSTRUCTIONS: Solve the following problems. Round off your final answers to two decimal

places, if necessary. Input the values only as your final answers (do not include the percent sign,

and currency symbols). Draw the cash flow diagram.

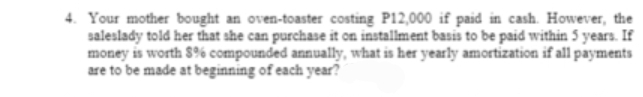

Transcribed Image Text:4. Your mother bought an oven-toaster costing P12,000 if paid in cash. However, the

saleslady told her that she can purchase it on installment basis to be paid within 5 years. If

money is worth $% compounded annually, what is her yearly amortization if all payments

are to be made at beginning of each year?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you