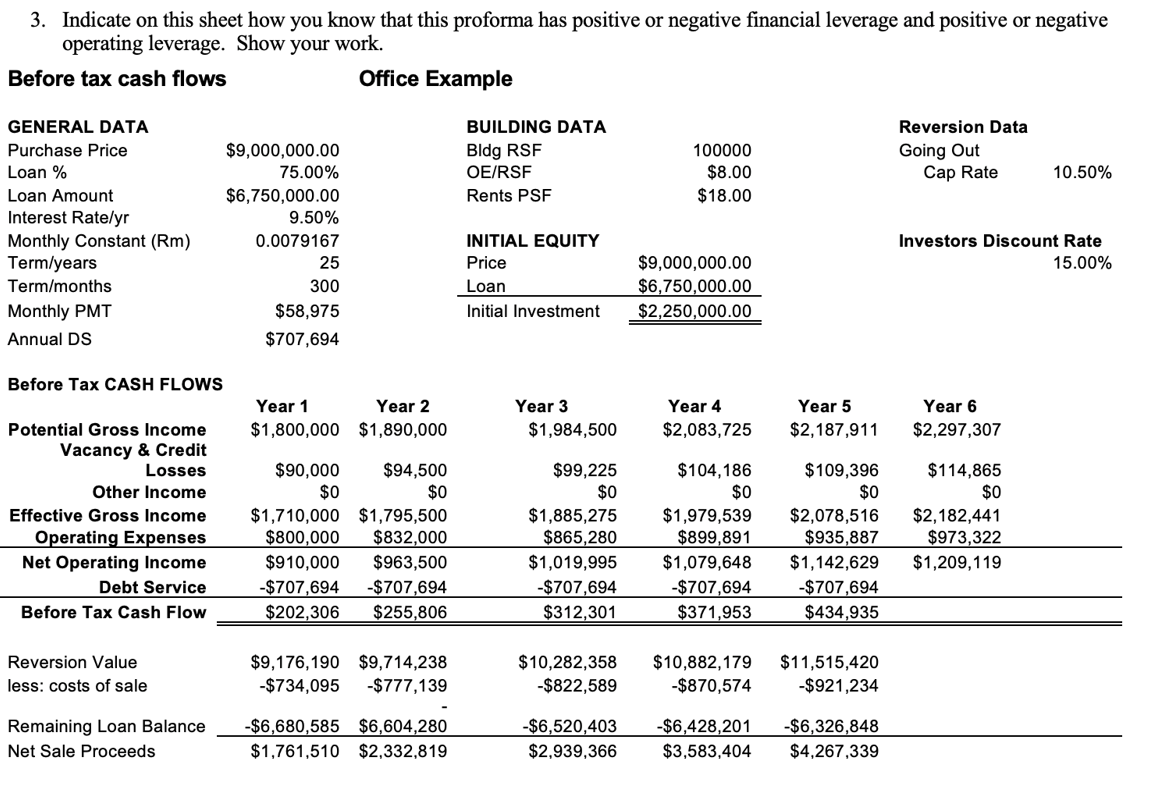

3. Indicate on this sheet how you know that this proforma has positive or negative financial leverage and positive or negative operating leverage. Show your work. Before tax cash flows Office Example GENERAL DATA Purchase Price BUILDING DATA Loan % Loan Amount $9,000,000.00 75.00% Bldg RSF 100000 Reversion Data Going Out OE/RSF $8.00 Cap Rate 10.50% $6,750,000.00 Rents PSF $18.00 Interest Rate/yr 9.50% Monthly Constant (Rm) 0.0079167 INITIAL EQUITY Investors Discount Rate Term/years 25 Price $9,000,000.00 15.00% Term/months 300 Loan $6,750,000.00 Monthly PMT $58,975 Initial Investment $2,250,000.00 Annual DS $707,694 Before Tax CASH FLOWS Year 1 Potential Gross Income $1,800,000 Year 2 $1,890,000 Year 3 $1,984,500 Year 4 $2,083,725 Year 5 $2,187,911 Year 6 $2,297,307 Vacancy & Credit Losses Other Income Effective Gross Income Operating Expenses Net Operating Income Debt Service $90,000 $94,500 $0 Before Tax Cash Flow $0 $1,710,000 $1,795,500 $800,000 $832,000 $910,000 $963,500 -$707,694 -$707,694 $202,306 $255,806 $99,225 $0 $104,186 $0 $109,396 $0 $114,865 $0 $1,885,275 $865,280 $1,979,539 $899,891 $2,078,516 $2,182,441 $935,887 $973,322 $1,019,995 $1,079,648 $1,142,629 $1,209,119 -$707,694 -$707,694 -$707,694 $312,301 $371,953 $434,935 Reversion Value less: costs of sale $9,176,190 $9,714,238 -$734,095 -$777,139 $10,282,358 $10,882,179 $11,515,420 -$822,589 -$870,574 -$921,234 Remaining Loan Balance -$6,680,585 $6,604,280 Net Sale Proceeds $1,761,510 $2,332,819 -$6,520,403 $2,939,366 -$6,428,201 -$6,326,848 $3,583,404 $4,267,339

3. Indicate on this sheet how you know that this proforma has positive or negative financial leverage and positive or negative operating leverage. Show your work. Before tax cash flows Office Example GENERAL DATA Purchase Price BUILDING DATA Loan % Loan Amount $9,000,000.00 75.00% Bldg RSF 100000 Reversion Data Going Out OE/RSF $8.00 Cap Rate 10.50% $6,750,000.00 Rents PSF $18.00 Interest Rate/yr 9.50% Monthly Constant (Rm) 0.0079167 INITIAL EQUITY Investors Discount Rate Term/years 25 Price $9,000,000.00 15.00% Term/months 300 Loan $6,750,000.00 Monthly PMT $58,975 Initial Investment $2,250,000.00 Annual DS $707,694 Before Tax CASH FLOWS Year 1 Potential Gross Income $1,800,000 Year 2 $1,890,000 Year 3 $1,984,500 Year 4 $2,083,725 Year 5 $2,187,911 Year 6 $2,297,307 Vacancy & Credit Losses Other Income Effective Gross Income Operating Expenses Net Operating Income Debt Service $90,000 $94,500 $0 Before Tax Cash Flow $0 $1,710,000 $1,795,500 $800,000 $832,000 $910,000 $963,500 -$707,694 -$707,694 $202,306 $255,806 $99,225 $0 $104,186 $0 $109,396 $0 $114,865 $0 $1,885,275 $865,280 $1,979,539 $899,891 $2,078,516 $2,182,441 $935,887 $973,322 $1,019,995 $1,079,648 $1,142,629 $1,209,119 -$707,694 -$707,694 -$707,694 $312,301 $371,953 $434,935 Reversion Value less: costs of sale $9,176,190 $9,714,238 -$734,095 -$777,139 $10,282,358 $10,882,179 $11,515,420 -$822,589 -$870,574 -$921,234 Remaining Loan Balance -$6,680,585 $6,604,280 Net Sale Proceeds $1,761,510 $2,332,819 -$6,520,403 $2,939,366 -$6,428,201 -$6,326,848 $3,583,404 $4,267,339

Chapter1: Financial Statements And Business Decisions

Section: Chapter Questions

Problem 1Q

Related questions

Question

Transcribed Image Text:3. Indicate on this sheet how you know that this proforma has positive or negative financial leverage and positive or negative

operating leverage. Show your work.

Before tax cash flows

Office Example

GENERAL DATA

BUILDING DATA

Purchase Price

Loan %

$9,000,000.00

75.00%

Bldg RSF

100000

Reversion Data

Going Out

OE/RSF

$8.00

Cap Rate

10.50%

Loan Amount

$6,750,000.00

Rents PSF

$18.00

Interest Rate/yr

9.50%

Monthly Constant (Rm)

0.0079167

INITIAL EQUITY

Investors Discount Rate

Term/years

25

Price

$9,000,000.00

15.00%

Term/months

300

Loan

$6,750,000.00

Monthly PMT

$58,975

Initial Investment

$2,250,000.00

Annual DS

$707,694

Before Tax CASH FLOWS

Potential Gross Income

Year 1

$1,800,000

Year 2

$1,890,000

Year 3

$1,984,500

Year 4

$2,083,725

Year 5

$2,187,911

Year 6

$2,297,307

Vacancy & Credit

Losses

Other Income

Effective Gross Income

Operating Expenses

Net Operating Income

$90,000

$94,500

$0

$0

$99,225

$0

$104,186

$0

$109,396

$0

$114,865

$0

$1,710,000

$1,795,500

$1,885,275

$1,979,539

$2,078,516

$2,182,441

Debt Service

Before Tax Cash Flow

$800,000

$910,000

-$707,694 -$707,694

$202,306 $255,806

$832,000

$865,280

$899,891

$935,887

$973,322

$963,500

$1,019,995

$1,079,648

$1,142,629

$1,209,119

-$707,694

-$707,694

-$707,694

$312,301

$371,953

$434,935

Reversion Value

less: costs of sale

$9,176,190 $9,714,238

-$734,095 -$777,139

$10,282,358

$10,882,179

$11,515,420

-$822,589

-$870,574

-$921,234

Remaining Loan Balance

Net Sale Proceeds

-$6,680,585 $6,604,280

$1,761,510 $2,332,819

-$6,520,403

-$6,428,201

-$6,326,848

$2,939,366

$3,583,404 $4,267,339

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis…

Accounting

ISBN:

9780134475585

Author:

Srikant M. Datar, Madhav V. Rajan

Publisher:

PEARSON

Intermediate Accounting

Accounting

ISBN:

9781259722660

Author:

J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:

McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:

9781259726705

Author:

John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:

McGraw-Hill Education