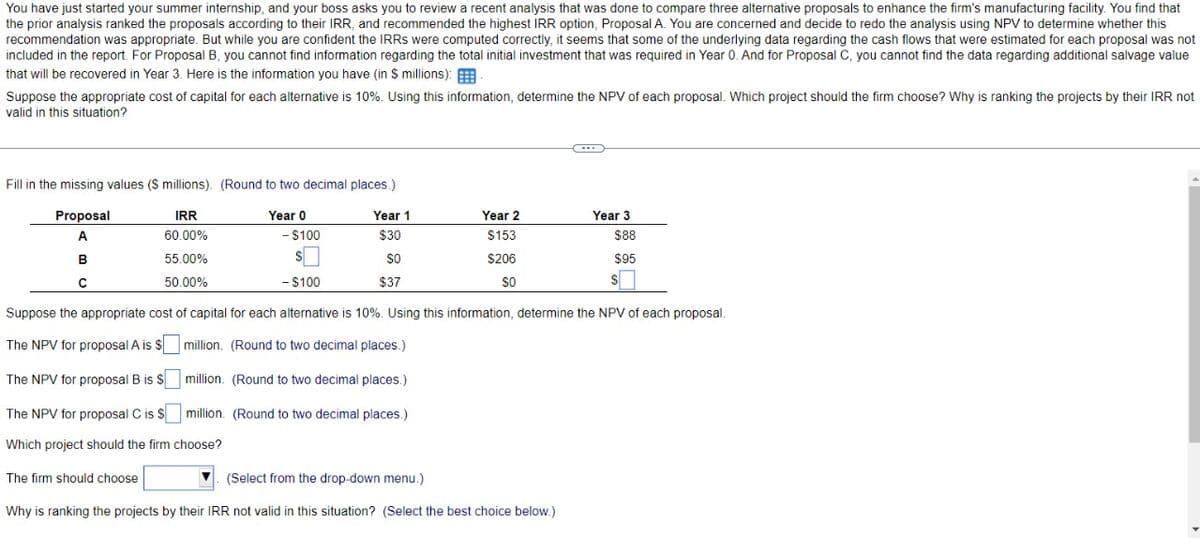

You have just started your summer internship, and your boss asks you to review a recent analysis that was done to compare three alternative proposals to enhance the firm's manufacturing facility. You find that the prior analysis ranked the proposals according to their IRR, and recommended the highest IRR option, Proposal A. You are concerned and decide to redo the analysis using NPV to determine whether this recommendation was appropriate. But while you are confident the IRRS were computed correctly, it seems that some of the underlying data regarding the cash flows that were estimated for each proposal was not included in the report. For Proposal B, you cannot find information regarding the total initial investment that was required in Year 0. And for Proposal C, you cannot find the data regarding additional salvage value that will be recovered in Year 3. Here is the information you have (in $ millions): Suppose the appropriate cost of capital for each alternative is 10%. Using this information, determine the NPV of each proposal. Which project should the firm choose? Why is ranking the projects by their IRR not valid in this situation? Fill in the missing values (S millions). (Round to two decimal places.) Proposal A IRR 60.00% B 55.00% с 50.00% Year 0 -$100 Year 1 Year 2 Year 3 $30 $153 $88 $206 $95 -$100 $37 Suppose the appropriate cost of capital for each alternative is 10%. Using this information, determine the NPV of each proposal. The NPV for proposal A is $☐ million. (Round to two decimal places.) The NPV for proposal B is $ million. (Round to two decimal places.) The NPV for proposal C is S☐ million. (Round to two decimal places.) Which project should the firm choose? The firm should choose (Select from the drop-down menu.) Why is ranking the projects by their IRR not valid in this situation? (Select the best choice below.)

You have just started your summer internship, and your boss asks you to review a recent analysis that was done to compare three alternative proposals to enhance the firm's manufacturing facility. You find that the prior analysis ranked the proposals according to their IRR, and recommended the highest IRR option, Proposal A. You are concerned and decide to redo the analysis using NPV to determine whether this recommendation was appropriate. But while you are confident the IRRS were computed correctly, it seems that some of the underlying data regarding the cash flows that were estimated for each proposal was not included in the report. For Proposal B, you cannot find information regarding the total initial investment that was required in Year 0. And for Proposal C, you cannot find the data regarding additional salvage value that will be recovered in Year 3. Here is the information you have (in $ millions): Suppose the appropriate cost of capital for each alternative is 10%. Using this information, determine the NPV of each proposal. Which project should the firm choose? Why is ranking the projects by their IRR not valid in this situation? Fill in the missing values (S millions). (Round to two decimal places.) Proposal A IRR 60.00% B 55.00% с 50.00% Year 0 -$100 Year 1 Year 2 Year 3 $30 $153 $88 $206 $95 -$100 $37 Suppose the appropriate cost of capital for each alternative is 10%. Using this information, determine the NPV of each proposal. The NPV for proposal A is $☐ million. (Round to two decimal places.) The NPV for proposal B is $ million. (Round to two decimal places.) The NPV for proposal C is S☐ million. (Round to two decimal places.) Which project should the firm choose? The firm should choose (Select from the drop-down menu.) Why is ranking the projects by their IRR not valid in this situation? (Select the best choice below.)

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter3: Cost Behavior

Section: Chapter Questions

Problem 39P: Randy Harris, controller, has been given the charge to implement an advanced cost management system....

Related questions

Question

Transcribed Image Text:You have just started your summer internship, and your boss asks you to review a recent analysis that was done to compare three alternative proposals to enhance the firm's manufacturing facility. You find that

the prior analysis ranked the proposals according to their IRR, and recommended the highest IRR option, Proposal A. You are concerned and decide to redo the analysis using NPV to determine whether this

recommendation was appropriate. But while you are confident the IRRS were computed correctly, it seems that some of the underlying data regarding the cash flows that were estimated for each proposal was not

included in the report. For Proposal B, you cannot find information regarding the total initial investment that was required in Year 0. And for Proposal C, you cannot find the data regarding additional salvage value

that will be recovered in Year 3. Here is the information you have (in $ millions): -

Suppose the appropriate cost of capital for each alternative is 10%. Using this information, determine the NPV of each proposal. Which project should the firm choose? Why is ranking the projects by their IRR not

valid in this situation?

Fill in the missing values ($ millions). (Round to two decimal places.)

Proposal

A

IRR

60.00%

Year 0

Year 1

Year 2

Year 3

B

55.00%

-$100

S

$30

$153

$88

$206

с

50.00%

-$100

$37

$0

$95

$

Suppose the appropriate cost of capital for each alternative is 10%. Using this information, determine the NPV of each proposal.

The NPV for proposal A is $ million. (Round to two decimal places.)

The NPV for proposal B is $☐ million. (Round to two decimal places.)

The NPV for proposal C is $ million. (Round to two decimal places.)

Which project should the firm choose?

The firm should choose

(Select from the drop-down menu.)

Why is ranking the projects by their IRR not valid in this situation? (Select the best choice below.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning