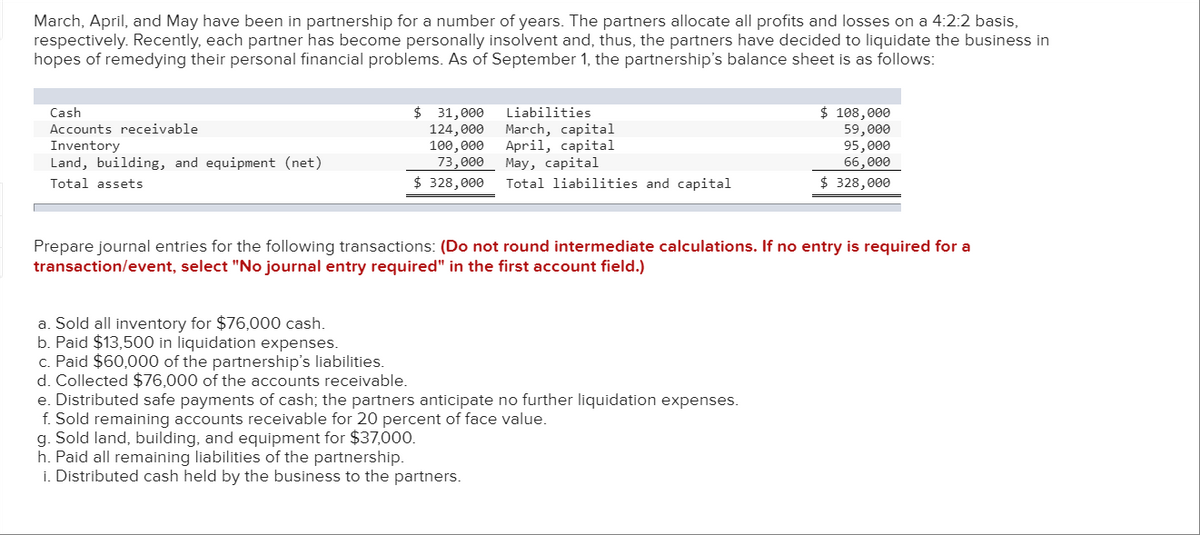

March, April, and May have been in partnership for a number of years. The partners allocate all profits and losses e respectively. Recently, each partner has become personally insolvent and, thus, the partners have decided to liquidate the business in hopes of remedying their personal financial problems. As of September 1, the partnership's balance sheet is as follows: a 4:2:2 basis, Cash Accounts receivable Inventory Land, building, and equipment (net) Total assets $ 31,000 124,000 100,000 73,000 May, capital $ 328,000 Liabilities March, capital April, capital $ 108,000 59,000 95,000 66,000 $ 328,000 Total liabilities and capital Prepare journal entries for the following transactions: (Do not round intermediate calculations. If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) a. Sold all inventory for $76,000 cash. b. Paid $13,500 in liquidation expenses. c. Paid $60,000 of the partnership's liabilities. d. Collected $76,000 of the accounts receivable. e. Distributed safe payments of cash; the partners anticipate no further liquidation expenses. f. Sold remaining accounts receivable for 20 percent of face value. g. Sold land, building, and equipment for $37,000. h. Paid all remaining liabilities of the partnership. i. Distributed cash held by the business to the partners.

Partnership Accounting

A partnership is a kind of arrangement between two or more people whereby they agree to manage the business operations and share its profits and losses in an agreed ratio between them. The agreement that is drafted and signed by the partners of the firm is termed as partnership deed and contains various important clauses agreed between the partners such as profit/loss sharing, interest on capital, remuneration allocation of each partner, drawings, admission of a new partner, etc.

Partner Admission and Withdrawal

A partnership is a kind of arrangement between two or more people whereby they agree to manage the business operations and share its profits and losses in an agreed ratio between them. The agreement that is drafted and signed by the partners of the firm is termed as a partnership deed and contains various important clauses agreed between the partners such as profit/loss sharing, interest on capital, remuneration allocation of each partner, drawings of a partner, etc.

Trending now

This is a popular solution!

Step by step

Solved in 6 steps with 10 images