31, 2021, Max Company committed to a plan to discontinue the fair value of the facilities was P1,000,000 less than carrying ama

Q: property dividend On October 1, 2025, Ajax Corporation declared a property dividend of 2 million sha...

A: Dividend Declared & Paid: In the case of dividends, the declaration date is the day on which a f...

Q: please answer number 14:bes 221-engineering economics. please give detailed and correct answers. I ...

A: The process of estimating and analyzing an entity's margin of safety based on revenues and related c...

Q: You company provided the following information on Dec. 31, 2019: Accounts Payable Bank note payable ...

A: Current Liabilities are those liabilities which are due and payable within one year. Out of the item...

Q: Balerio Corporation's relevant range of activity is 8,000 units to 12,000 units. When it produces an...

A: Formula: Product cost per unit = Direct materials + Direct labor + variable manufacturing overhead +...

Q: During October, a sari-sari store had the following transactions involving revenue and expenses. Did...

A: In order to determine the net income, the total expenses are required to be subtracted from the tota...

Q: Which of the following statements is the most reasonable conclusion from the given information below...

A: Quick ratio is a popular liquidity ratio. This ratio is also known as acid test ratio. This along wi...

Q: Directions: Complete the table below. The first item has been done for yu Decreased by Normal Increa...

A: Introduction:- Assets have debit balance and liabilities have credit balance If asset increases Deb...

Q: company purchased factory equipment on April 1, 2017, for $128,000 and placed it into service on tha...

A: Depreciation: Depreciation means the reduction in the value of an asset over the life of the assets ...

Q: Question 3 (Statement of shareholders’ equity): Below is the statement of shareholder’s equity of HK...

A: Number of ordinary shares Ordinary shares on Dec 31, 2022 6000 Add: shares issued 800 Add: ...

Q: Problem 2-7 Classification of Accounts - General/Administrative expenses or Selling Expenses or Not ...

A: Classification of above expenses are as follows.

Q: Journalize the inception of the lease and the first payment made by PMA in the books of GP (Lessee) ...

A: Lease liability refers to obligation of the company requires to pay periodic lease payment on the le...

Q: Lake Company, organized in 2020, has the following transactions related to intangible assets in that...

A: The question is related to Intangible Assets. The intangible assets will be amortised over a period ...

Q: Sydney Retailing (buyer) and Troy Wholesalers (seller) enter into the following transactions. May 11...

A: The journal entries are prepared to keep the record of day to day transactions of the business.

Q: what are some examples of internal controls? How are internal controls related to the Sarbanes-Oxley...

A: Internal Control: In an organization, internal control is a procedure carried out by the entity's bo...

Q: suming a 360-day year, when a $12,600, 90-day, 11% interest-bearing note payable matures, total paym...

A: Maturity Value of Note Payable = Face Value + Interest Maturity value = Face Value + (Face Value x R...

Q: Determine the December 31, 2020 cash and cash equivalents amount for the 2020 statement of cash flow...

A: Cash equivalents refers to those short-term investment of the company which are easily converted int...

Q: The following pertained to Lomi Inc.: Product Sales Price Unit Variable Co...

A: There are two forms of costs that are being used and incurred by the business. These are known as Va...

Q: On December 31, 20x0 an entity sells one of its assets to a leasing company and immediately leases i...

A: Lease is an contract enforceable under the law, in which the owner of the asset rent the asset to th...

Q: Exercise 8-2 Recording costs of assets LO C1 Cala Manufacturing purchases land for $367,000 as part ...

A: The question requires a single journal entry for the transaction of cash paid . Cash has been paid f...

Q: On January 1, 2021, Mustas issued new bonds with face amount of P 10,000,000 for P 10,800,000. Musta...

A: Loss on bonds retirement = Unamortized discount on the existing bonds + call premium on payment + di...

Q: On January 1, 2020, Resty Company issued bonds with the face amount of P 10,000,000, 8% serial bonds...

A: Annual interest payment = Face value of bonds x stated rate of interest x no. of months/12 Annual in...

Q: Spyker is a small Nethwelands-based designer and manufacturer of exclusive sports cars, which had it...

A: Accounting policies are the concepts, foundations, conventions, regulations, and practices that a co...

Q: Advanced Accounting requires many rules and regulations. The latter come from many sources. In your ...

A: Accounting Principles: Accounting principles are the standards and rules that organizations should o...

Q: Bu Co. is being sued for illness caused to local residents as a result of negligence on the company'...

A: Answer: a. a loss contingency of P 4,800,000 and disclose an additional contingency of up to P 3,200...

Q: nce Company placed a coupon re- cereal sold at P 200 Each premiu by a customer to receive a premi s ...

A: Lance Co has estimated Premium expenses at 70% of Sales. 10 coupons of are given to the customer , ...

Q: Zoey Bella Company has a payroll of $7,820 for a five-day workweek. Its employees are paid each Frid...

A: Salaries expense for 5 days = $7,820 Hence, Salaries expense for 4 days period = $7,820 x 4/5 = $6,2...

Q: What is the difference between tax reliefs and tax credits?

A: Taxes are mandatory payments placed on individuals or businesses by a government agency, whether loc...

Q: Beginning inventory consist of 800 units at P200 each. Purchases made for the period: January 18 for...

A: Total cost = Cost per unit * Number of units The question requires purchase cost of goods purchased ...

Q: The Prepaid insurance was not recognized in year 2021. What is the effect of its omission in Retaine...

A: Lets understand the basics. Prepaid expense arise when expense is paid for more than one period in c...

Q: QUE Ltd had the following activity during 2020: Proceeds from sale of long-term $156,000 investments...

A: Answer) Calculation of Cash flow from Financing Activities Amount Cash Flow From Finan...

Q: The Foundational 15 [LO2-1, LO2-2, LO2-3, LO2-4] [The following information applies to the questions...

A: The predetermined overhead rate is calculated as estimated overhead cost divided by base activity.

Q: eto ABC Con coupo bag of dog TOod it sells. return for eight coupons, customers receive a leash. The...

A: The correct calculation answer for the above question is given in the following steps for your refer...

Q: Directions: Complete the table below. The first item has been done for Decreased by Classification N...

A: All the assets, expenses, and losses have a nominal debit balance. All the liabilities, revenue, and...

Q: Beta industries produced an product, has provided its contribution format income statement for April...

A: Break even volume in units: = Fixed costs / Unit contribution margin Number of units sold=1600 units...

Q: Lexy Company issued P 10,000,000 of 10-year, 9% bonds on March 1, 2020 at 97 plus accrued interest. ...

A: Given that, Lexy Company issued P 1,00,00,000 face value of bonds @ 97 each Plus accrued interest. ...

Q: Toasty Treats Company makes high end toaster ovens. The standard model price is $360 and variable ex...

A: Break-even point of the product mix = Fixed expenses/Weighted contribution margin per unit of the pr...

Q: What is the required journal entry as a result of this litigation? * a. Debit Litigation Expense fo...

A: Solution:- Given, Kelly Inc. is involved in litigation regarding a faulty product sold in a prior ye...

Q: PWC Inc. has a policy of distributing 30% of its current year income after interest and taxes. Which...

A: Company's earning after interest and taxes are divided into two parts i.e. dividend payout and reten...

Q: Ayayai Ltd. had the following 2020 income statement data: Sales $205,600 Cost of goods sold 119,400 ...

A: The Cash Flow statement shows the flows of cash and cash equivalent during the period under report. ...

Q: Problem 2-5 Preparing the Statement of Comprehensive Income - Multi-Step (Function of Expense Method...

A: An income statement is a financial report that indicates the revenue and expenses of a business. It ...

Q: On January 1, Year 1, Hills purchased equipment for $350,000. The equipment had an estimated useful ...

A: Depreciation is a method of distributing the cost of a physical or physical object over its useful l...

Q: Service Revenue $10,000 Cash $12,000. Accounts Receivable $3,000 Office Supplies Rent Expense Salari...

A: Introduction: Balance sheet: All Assets and liabilities are shown in balance sheet. It tells the net...

Q: Peter Joshua established an advertising and marketing company registered with the DTI under the name...

A: Theory - Journal entries are the first step of recording the transactions, we can prepare the journa...

Q: Which of the following statements is the most reasonable conclusion from the given information below...

A: Return on assets indicates that how much is the company is profitable regarding it's assets, it mean...

Q: Instructions O Journal Creative Images Co. offers its services to individuals desining to improve th...

A: 1. Closing Entries - Closing Entries are made at the end of the year to close temporary accounts. Te...

Q: Andres Michael bought a new boat. He took out a loan for $24,320 at 4.5% interest for 2 years. He ma...

A: Lets understand the basics. Here in this question, we are required to calculate how much amount is d...

Q: Which of the following statement is incorrect? * a. Trade payable are classified as current liabili...

A: Current Liability: Current liabilities are commitments or debts owed by a company that is due within...

Q: Classify the following items that may cause discrepancy between accounting profit and taxable income...

A: 1. Collections of rental in excess of rent revenue reported during the period is a Taxable temporary...

Q: a. The reduction in sales price attributed to the coupon is recognized as premium expense b. The dif...

A: GOODS are sold it is sold at above the the cost that is incurred in order to generate profit. so sel...

Q: For the properties listed below compute the depreciation taken during the useful life of the propert...

A: MARCS is the short form for the Modified Accelerated cost Recovery System. It provides various asset...

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

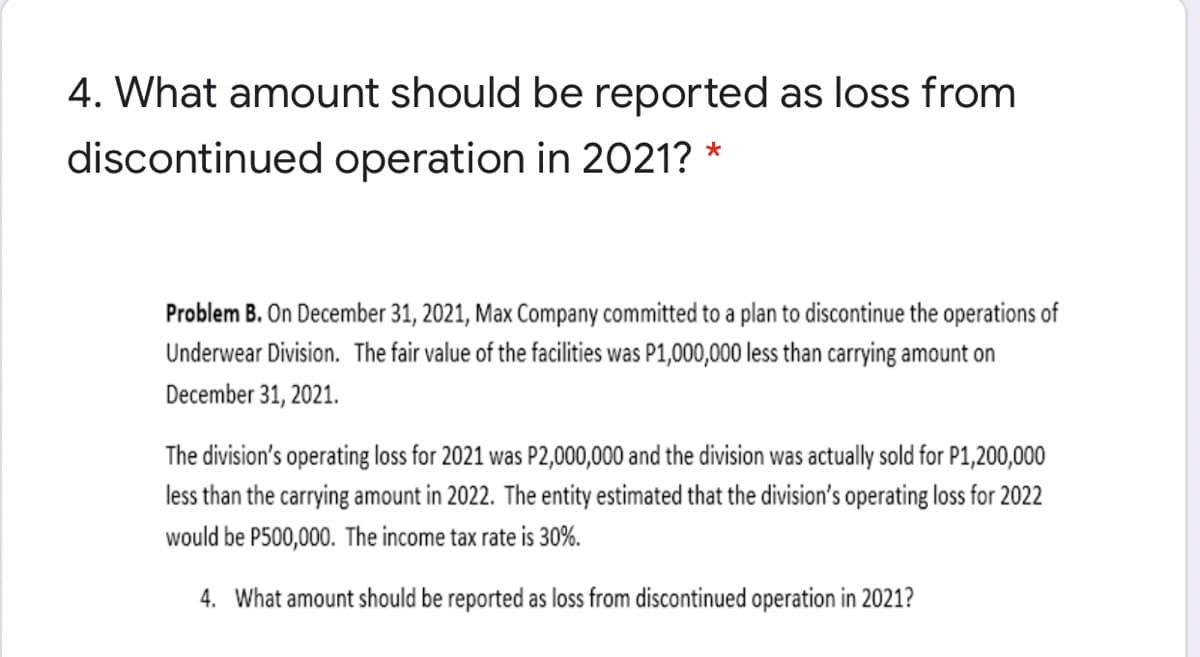

- On December 31, 2021, Max Company committed to a plan to discontinue the operations of Underwear Division. The fair value of the facilities was P1,000,000 less than carrying amount on December 31, 2021. The division's operating loss for 2021 was P2,000,000 and the division was actually sold for P1,200,000 less than the carrying amount in 2022. The entity estimated that the division's operating loss for 2022 would be P500,000, The income tax rate is 30% What amount should be reported as loss from discontinued operation in 2021?On December 31, 2021 Max Sara Beauty Corp. committed to a plan to discontinue the operations of its Lingerie Division. The fair value of the facilities was P1,000,000 less than carrying amount on December 31,2021. The division's operating loss for 2021 was P2,000,000 and the division was actually sold for P1,200,000 less than carrying amount in 2022.The entity estimated that the division's operating loss for 2022 would be P500,000. The income tax rate is 30%. What amount would be reported as loss from discontinued operation in 2021? A.3000000 B. 2100000 C. 2240000 D.2450000Booker Company committed to sell the comic book division, a component of the business, on September 1, 2020. The carrying amount of the division was P4,000,000 and the fair value was P3,500,000. The disposal date is expected on June 1, 2021, The division reported an operating loss of P200,000 for the year ended December 31, 2020. What amount should be reported as pretax loss from discontinued operation in 2020? a.500,000b.200,000c.700,000d.0

- 1.In February 2019, Wall Corp decided to sell its entire Plant division. The Plant division was a major part of Wall Corp's business and the sale will result in a strategic change in direction for the company. The sale was completed in January 2020 and resulted in a gain on disposal of P500,000. In 2019 Plant's net losses were P350,000 and P20,000 in 2020 up until the date of sale. Excluding taxation, what should the net gain/(loss) to be reported in the income statements of Wall Corp for its Plant division? A.2019 (P350,000) / 2020 P500,000 B. 2019 (P350,000) / 2020 P480,000 C. 2019 P230,000 / 2020 P0 D. 2019 P0 / 2020 P230,000In February 2019, Walley Corp decided to sell its entire Plant division. The Plant division was a major part of Walley Corp’s business and the sale will result in a strategic change in direction for the company. The sale was completed in January 2020 and resulted in a gain on disposal of P500,000. In 2019 Plant’s net losses were P350,000 and P20,000 in 2020 up until the date of sale. Excluding taxation, what should the net gain/(loss) to be reported in the income statements of Walley Corp for its Plant division? Select one: a. 2019 P 230,000 / 2020 P 0 b. 2019 (P 350,000) / 2020 P 480,000 c. 2019 P 0 / 2020 P 230,000 d. 2019 (P 350,000) / 2020 P 500,000On January 1, 2021, Concretti Inc. had a division that met the criteria for discontinuance of a business component. For the period January 1 through October 15, 2021, the component had revenue of P500,000 and expenses of P800,000. The assets of the component were sold on October 15, 2021 at a loss of P100,000. How should Concretti report the component's operation for 2021? A. 500,000 and 800,000 should be included in continuing operationsB. 400,000 should be reported as loss on discontinued operationsC. 400,000 should be reported as an extraordinary lossD. 300,000 should be reported as loss on discontinued operations

- On December 31, 2024, the end of the fiscal year, California Microtech Corporation held its semiconductor business for sale at year-end. The estimated fair value of the segment’s assets, less costs to sell, on December 31 was $18 million. The semiconductor business segment qualifies as a component of the entity according to GAAP. Consider the following additional information. The book value of the assets of the segment at the time of the sale was $17 million. The loss from operations of the segment during 2024 was $3.2 million. Pretax income from other continuing operations for the year totaled $6.0 million. The income tax rate is 25%. Prepare the lower portion of the 2024 income statement beginning with income from continuing operations before income taxes. Note: Loss amounts should be indicated with a minus sign. Enter your answers in whole dollars and not in millions. For example, $4,000,000 rather than $4.In February 2019, Wall Corp decided to sell its entire Plant division. The Plant division was a major part of Wall Corp’s business and the sale will result in a strategic change in direction for the company. The sale was completed in January 2020 and resulted in a gain on disposal of P500,000. In 2019 Plant’s net losses were P350,000 and P20,000 in 2020 up until the date of sale. Excluding taxation, what should the net gain/(loss) to be reported in the income statements of Wall Corp for its Plant division?2 points A.2019 (P350,000) / 2020 P500,000B. 2019 (P350,000) / 2020 P480,000C. 2019 P230,000 / 2020 P0D. 2019 P0 / 2020 P230,000In February 2019, Wall Corp decided to sell its entire Plant division. The Plant division was a major part of Wall Corp’s business and the sale will result in a strategic change in direction for the company. The sale was completed in January 2020 and resulted in a gain on disposal of P500,000. In 2019 Plant’s net losses were P350,000 and P20,000 in 2020 up until the date of sale. Excluding taxation, what should the net gain/(loss) to be reported in the income statements of Wall Corp for its Plant division?

- 19. In 2020, Roy Industries decided to discontinue its Laminating Division, a separately identifiable component of Roy's business. At December 31, 2020, the division has not been completely sold. However, negotiations for the final and complete sale are progressing in a positive manner, and it is probable that the disposal will be completed within a year. Analysis of the records disclosed the following:Operating loss for the year P899,000Loss on disposal of some assets during 2020 50,000Expected operating loss in 2021 450,000Expected gain in 2021 on disposal of division 200,000 Assuming a 35% tax rate, how much will be reported as loss from discontinued operations in Roy's 2020 income statement? P_________ Use the following information for the next two questions. Presented below are the condensed income statements ofRobert Corporation for the years ended…On January 1, 2021, Concretti Inc. had a division that met the criteria for discontinuance of a business component. For the period January 1 through October 15, 2021, the component had revenue of P500,000 and expenses of P800,000. The assets of the component were sold on October 15, 2021 at a loss of P100,000. How should Concretti report the component's operation for 2021?On November 1, 2021, Jamison Inc. adopted a plan to discontinue its barge division, which qualifies as a separate component of the business according to GAAP regarding discontinued operations. The disposal of the division was expected to be concluded by April 30, 2022. On December 31, 2021, the company's year-end, the following information relative to the discontinued division was accumulated: Operating loss Jan. 1–Dec. 31, 2021 $ 65 million Estimated operating losses, Jan. 1 to April 30, 2022 80 million Excess of fair value, less costs to sell, over book value at Dec. 31, 2021 15 million In its income statement for the year ended December 31, 2021, Jamison would report a before-tax loss on discontinued operations of: Multiple Choice $65 million. $50 million. $130 million. $145 million.