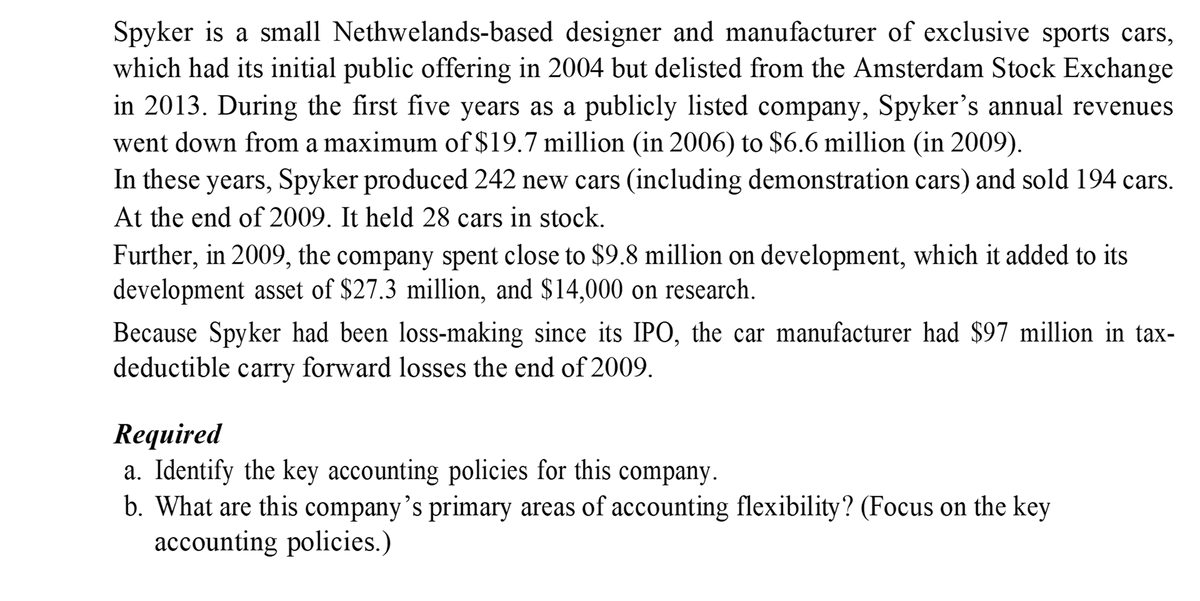

Spyker is a small Nethwelands-based designer and manufacturer of exclusive sports cars, which had its initial public offering in 2004 but delisted from the Amsterdam Stock Exchange in 2013. During the first five years as a publicly listed company, Spyker's annual revenues went down from a maximum of $19.7 million (in 2006) to $6.6 million (in 2009). In these years, Spyker produced 242 new cars (including demonstration cars) and sold 194 cars. At the end of 2009. It held 28 cars in stock. Further, in 2009, the company spent close to $9.8 million on development, which it added to its development asset of $27.3 million, and $14,000 on research. Because Spyker had been loss-making since its IPO, the car manufacturer had $97 million in tax- deductible carry forward losses the end of 2009. Required a. Identify the key accounting policies for this company. b. What are this company's primary areas of accounting flexibility? (Focus on the key accounting policies.)

Spyker is a small Nethwelands-based designer and manufacturer of exclusive sports cars, which had its initial public offering in 2004 but delisted from the Amsterdam Stock Exchange in 2013. During the first five years as a publicly listed company, Spyker's annual revenues went down from a maximum of $19.7 million (in 2006) to $6.6 million (in 2009). In these years, Spyker produced 242 new cars (including demonstration cars) and sold 194 cars. At the end of 2009. It held 28 cars in stock. Further, in 2009, the company spent close to $9.8 million on development, which it added to its development asset of $27.3 million, and $14,000 on research. Because Spyker had been loss-making since its IPO, the car manufacturer had $97 million in tax- deductible carry forward losses the end of 2009. Required a. Identify the key accounting policies for this company. b. What are this company's primary areas of accounting flexibility? (Focus on the key accounting policies.)

Chapter7: Valuation Of Stocks And Corporations

Section: Chapter Questions

Problem 1lM

Related questions

Topic Video

Question

Transcribed Image Text:Spyker is a small Nethwelands-based designer and manufacturer of exclusive sports cars,

which had its initial public offering in 2004 but delisted from the Amsterdam Stock Exchange

in 2013. During the first five years as a publicly listed company, Spyker's annual revenues

went down from a maximum of $19.7 million (in 2006) to $6.6 million (in 2009).

In these years, Spyker produced 242 new cars (including demonstration cars) and sold 194 cars.

At the end of 2009. It held 28 cars in stock.

Further, in 2009, the company spent close to $9.8 million on development, which it added to its

development asset of $27.3 million, and $14,000 on research.

Because Spyker had been loss-making since its IPO, the car manufacturer had $97 million in tax-

deductible carry forward losses the end of 2009.

Required

a. Identify the key accounting policies for this company.

b. What are this company’s primary areas of accounting flexibility? (Focus on the key

accounting policies.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you