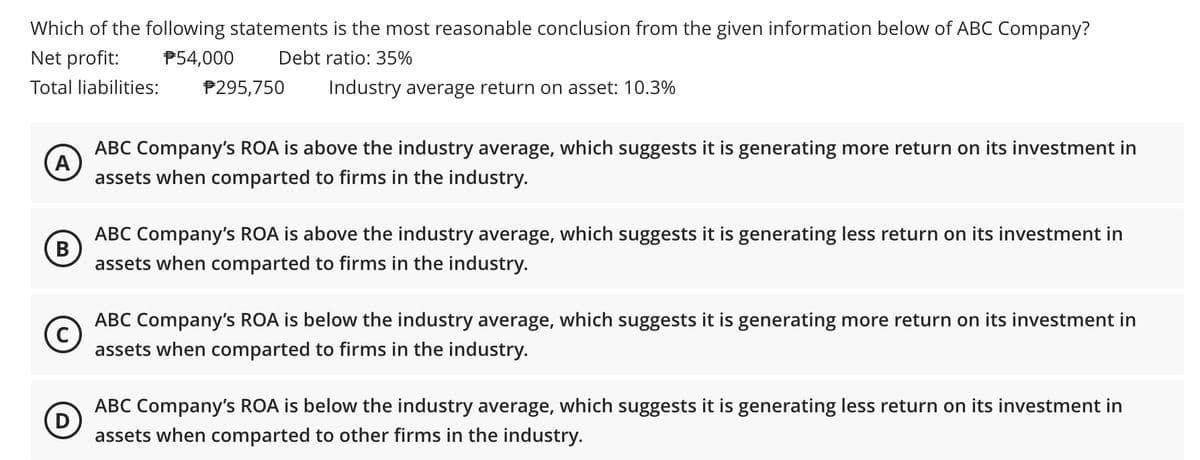

Which of the following statements is the most reasonable conclusion from the given information below of ABC Company? Net profit: P54,000 Debt ratio: 35% Total liabilities: P295,750 Industry average return on asset: 10.3% ABC Company's ROA is above the industry average, which suggests it is generating more return on its investment in assets when comparted to firms in the industry. ABC Company's ROA is above the industry average, which suggests it is generating less return on its investment in assets when comparted to firms in the industry. ABC Company's ROA is below the industry average, which suggests it is generating more return on its investment in assets when comparted to firms in the industry. ABC Company's ROA is below the industry average, which suggests it is generating less return on its investment in D assets when comparted to other firms in the industry.

Which of the following statements is the most reasonable conclusion from the given information below of ABC Company? Net profit: P54,000 Debt ratio: 35% Total liabilities: P295,750 Industry average return on asset: 10.3% ABC Company's ROA is above the industry average, which suggests it is generating more return on its investment in assets when comparted to firms in the industry. ABC Company's ROA is above the industry average, which suggests it is generating less return on its investment in assets when comparted to firms in the industry. ABC Company's ROA is below the industry average, which suggests it is generating more return on its investment in assets when comparted to firms in the industry. ABC Company's ROA is below the industry average, which suggests it is generating less return on its investment in D assets when comparted to other firms in the industry.

Chapter3: Evaluation Of Financial Performance

Section: Chapter Questions

Problem 10P

Related questions

Question

M9

Transcribed Image Text:Which of the following statements is the most reasonable conclusion from the given information below of ABC Company?

Net profit:

P54,000

Debt ratio: 35%

Total liabilities:

P295,750

Industry average return on asset: 10.3%

ABC Company's ROA is above the industry average, which suggests it is generating more return on its investment in

A

assets when comparted to firms in the industry.

ABC Company's ROA is above the industry average, which suggests it is generating less return on its investment in

В

assets when comparted to firms in the industry.

ABC Company's ROA is below the industry average, which suggests it is generating more return on its investment in

C

assets when comparted to firms in the industry.

ABC Company's ROA is below the industry average, which suggests it is generating less return on its investment in

assets when comparted to other firms in the industry.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 1 images

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College