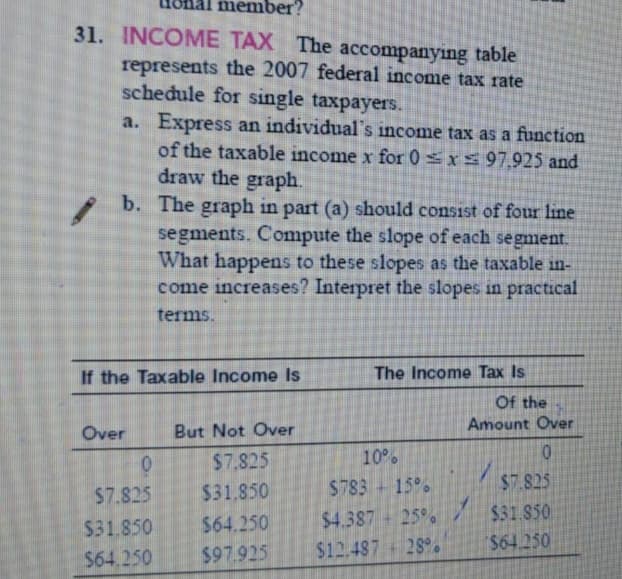

31. INCOME TAX The accompanying table represents the 2007 federal income tax rate schedule for single taxpayers. a. Express an individual's income tax as a function of the taxable income x for 0 =xs 97,925 and draw the graph. b. The graph in part (a) should consist of four line segments. Compute the slope of each segment. What happens to these slopes as the taxable in- come increases? Interpret the slopes in practical terms.

31. INCOME TAX The accompanying table represents the 2007 federal income tax rate schedule for single taxpayers. a. Express an individual's income tax as a function of the taxable income x for 0 =xs 97,925 and draw the graph. b. The graph in part (a) should consist of four line segments. Compute the slope of each segment. What happens to these slopes as the taxable in- come increases? Interpret the slopes in practical terms.

Chapter3: Economic Decision Makers

Section: Chapter Questions

Problem 3.10P

Related questions

Question

Transcribed Image Text:member?

31. INCOME TAX The accompanying table

represents the 2007 federal income tax rate

schedule for single taxpayers.

a. Express an individual's income tax as a function

of the taxable income x for 0 =xs 97,925 and

draw the graph.

b. The graph in part (a) should consist of four line

segments. Compute the slope of each segment.

What happens to these slopes as the taxable in-

come increases? Interpret the slopes in practical

terms.

If the Taxable Income Is

The Income Tax Is

Of the

Amount Over

Over

But Not Over

$7.825

10%

$7.825

$31.850

$783 + 15°.

$7.825

$4.387 25%. /

$31.850

$31.850

$64.250

$97.925

$12.487 28°.

$64.250

$64.250

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning