31.25 25.0

Q: 20

A: Ledger is the book of secondary entry in which the posting is made from the journal.

Q: f 25%. What will be the WACC for this project? (Note: Round your intermediate calculations to two…

A: WACC: It represents the company's average cost of capital. Thus, it is estimated by the sum of the…

Q: Q 9.50: Which of the following processes best describes depreciation? A Cost allocation Asset…

A: Fixed assets: These are the assets which were used in the business for more than one year. These…

Q: Question 25

A: A theory that helps to compute the present or future value of the cash flows is term as the TVM…

Q: Q 7: prices What is meant by Transfer price and why transfer are needed?

A: “Since you have asked multiple question, we will solve the first question for you. If you want any…

Q: Answer no.26 and 27 thank you

A: Cost recovery method: In construction contracts, revenues and expenses are recognized only when the…

Q: hich of the following is not is liability?

A: Note: “Since you have asked multiple questions, we will solve the first question for you. If you…

Q: Please solve:25 / 1.08 * 1 - 1 / 1.08^20 / 1 - 1 / 1.08Thank you

A: In this step we re-write the equation with parantheses

Q: Problem 29 please

A: Ordinary Annuity - When payment or receipt happens at the end of a time period. Annuity Due - When…

Q: 37.50 15.00

A: Number of units=25000

Q: 8.5 Beptember 22,

A: The cash price can be calculated as follows :

Q: Solve:30 / 1.07^2 * 1 - 1 / 1.07^39 / 1 - 1 / 1.07Thank you

A: Let's look at the expression you have. It's produced below:Solve:S = 30 / 1.07^2 * 1 - 1 / 1.07^39 /…

Q: 27) Inder the cornor

A: Stockholders are the people associated with the company but have a separate entity so they are…

Q: Question 22

A: An account receivable is defined as it is money that has not been paid by customers after using the…

Q: Solve:30 / 1.07 ^2 * 1 / 1 - 1 / 1.07

A: We begin by affixing the parantheses correctly.

Q: Tota 21 22 23 24 25 22 of 45 All Choose the best option O Assets, liabilities, and equity are…

A: Basic accounting equation Assets =Laibilties +Equity

Q: 0.25 -5% 0.50 8%

A: Note : As per the guidelines, only the first three questions will be answered. Given information :

Q: 7.77% 9.00% 10.14% 8.27%

A: As per CAPM , Cost of equity = Risk free rate +beta (Market return - Rosk free rate)

Q: ROE 34.25% RNOA 17.28% What inference can I draw based on this ROE and RNOA

A: Return on equity (ROE) is a profitability ratio which shows the portion of net income available for…

Q: 12. 13. ts| 14.

A: “Since you have posted a question with many sub-parts, we will solve three sub-parts for you. To get…

Q: Question 26-32

A: Cash flow is the net amount of cash or money being transferred in or out of business Cash received…

Q: 26 $ 97 45 102 20 104 50 105

A: Computation of units sold,

Q: 26+40

A: To determine: 26+40

Q: $12 632 when its cost of capital is 12. cost of capital is 22 percent. What is i

A: 9. Internal rate of return (IRR) is that rate which equates the Present value of Cash Inflow to…

Q: estion

A: Cost per equivalent unit of production for direct materials = Total direct material costs…

Q: 20.42 19.20 17.78

A: On each bond there are periodic coupon payments and face value is paid on the MATURITY of bond also.

Q: Question 19 of 42 View Roli 广场

A: We know the first step in accounting is to record the transaction in journal. hence all journal…

Q: or this investment? 19.54% -24.43% 13.03% 1. 29.31% 15 63%

A: Internal rate of return is return on which present value of cash flow is equivalent to initial…

Q: S=26.32 E-55 t=3 standard diviation=60% r=3.1% d₁ = 3-year r=2.4% 10-year S [¹n ( 2 ) + ( R + ° *) x…

A: Stock Price S 26.32 Strike Price E…

Q: 20.

A: Target costing is a technique wherein the management set the target of cost in considering the price…

Q: Question 7 Part A: Which project (or projects) can be immedia eliminated? O Project 205 O Project…

A: B/C ratio is the ratio of present value of benefits to the initial cost and quite extensively used…

Q: P 40,000 P100,000 15% 10% 12%

A: Solution: Sales for Division A = Net earnings of A / Margin % = 40000/ 10% = 400,000

Q: O 1.33 c) 1.37 D 1.41 g) 1.43 h) 1.45 5. The simple payback period is closest to ...

A: Simple payback period is the period or the time which a project takes in order to recover the cost…

Q: Advances and declines are associated with market a efficiency b. position c. diffusion d. depth

A: Advances and losses relate to the number of stocks (or even other assets in a certain market) that…

Q: Answer question 34

A: Intermediate Bonds also known as medium term funds are a type of debt funds that invest in debt…

Q: 12.30% 13.36%

A: D0=Dividend =1.45 g=constant growth =6.5% Price of equity =22.5 D1=1.45(1.065)=1.544=Dividend next…

Q: b. R=12% Present value = Future value/ (1+r)^n = 10,000 / (1+0.1268)^3 = 6989.25

A: Dear student, you have specifically asked, how 0.1268 get in the solution. This is an annual…

Q: 40$ 20% 40$ 0용 37.5% 37.5% i the departments (including both variable anc

A: Step method of cost allocation : This is the method of allocating costs of one department to the…

Q: 10.5

A: Statement of profit or loss is defined as the one of the major financial statement prepared at the…

Q: Calculate the table factor, the finance charge, and the monthly payment (in $) for the loan by using…

A: The annual percentage rate (APR) refers to the annual interest rate generated by borrowers or…

Q: 51.25 and $6. three months.

A: Put option gives the owner the right to but notthe obligation to sell a particular security or…

Q: 7

A: We know that in order to avail tha cash discount we need to settle the amount on or before that due…

Q: Calculate the asset efficiency - receivables, inventory, fixed asset and total asset turnover ratios

A: Ratios refer to establishing the relationship between the two numbers. In accounting, the ratio is…

Q: $1 20. Κ 21. Μ 22. Τ

A: The amount withheld by the company whenever the employee receives a check is referred to as the tax…

Q: 42 98 19

A: The incremental borrowing rate is the interest rate a borrower would pay to borrow money to fund an…

Q: What 27

A: 27. The time value of money is the concept widely used by the management to determine the correct…

Q: Y RM RM 120 128 32 26 40 50 20 16

A:

Q: States Probability Asset M Return Asset N Return Asset O Return Вoom 32% 13% 23% 5% Normal 50% 11%…

A: Portfolio Return = Return on asset M * 1/3 + Return on asset N * 1/3 + Return on asset O * 1/3…

Q: 29) The two ways that a c

A: The publicly held company, ownership is with the general public, and regulations imposed are strict…

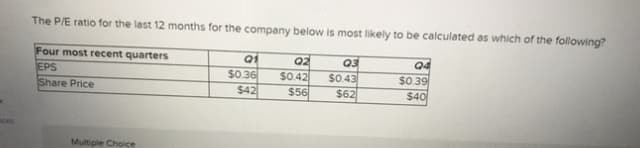

EPS=Earnings per share =0.36+0.42+0.39+0.43=1.60

Price Of shares =P

P/E=Price/EPS

Step by step

Solved in 2 steps

- The following table shows a tool and dies company’s quarterly sales for the current year. What sales would you predict for the first quarter of next year? Quarter relatives are SR1= 1.10, SR2 = 0.99, SR3 = 0.90, and SR4 = 1.01.Quarter 1 2 3 4Sales 236.50 227.70 220.50 262.6010. XYZ has developed the following data from its Material A Safety stock Average (normally) daily use 280 240 180 1.000 200 Maximum daily use Minimum daily use EOQ Cost of placing an order Working days per year P20 250 days Lead time 6 days What is the average inventory?The portion of the functional income statements of Brief Company for 2021 and 2020 are presented below: 2021 2020 Sales P890,000 P800,000 Cost of goods sold 530,000 450,000 Gross margin 360,000 350,000 Assuming that effective January of 2021 the unit cost is higher by 6 percent, calculate the change in sales due to change in volume rounded to nearest thousands. Group of answer choices P85,000 Favorable P88,000 Favorable P88,000 Unfavorable P85,000 Unfavorable

- Use the following information to determine the Prior Year and Current Year trend percents for net sales using the Prior Year as the base year. (Enter the answers in thousands of dollars.) ($ thousands) CurrentYear PriorYear Net sales $ 453,100 $ 230,000 Cost of goods sold 222,019 68,080 Trend Percent for Net Sales: Choose Numerator: / Choose Denominator: / = Trend Percent Current Year: / = % Prior Year: / = %Prepare an income statement in comparative form, stating each item for both years as a percent of sales. Round your percentages answers to one decimal place. Enter all amounts as positive numbers. Question not attempted. Score: 0/62 Innovation Quarter Inc. Comparative Income Statement For the Years Ended December 31 1 Current year Current year Previous year Previous year 2 Amount Percent Amount Percent 3 Sales $3,400,000.00 $3,750,000.00 4 Cost of goods sold 2,046,800.00 2,040,000.00 5 Gross profit $1,353,200.00 $1,710,000.00 6 Selling expenses $374,000.00 $600,000.00 7 Administrative expenses 530,400.00 465,000.00 8 Total operating expenses $904,400.00 $1,065,000.00 9 Income from operations $448,800.00 $645,000.00 10 Income tax expense 170,000.00 217,500.00 11 Net income $278,800.00…Suppose we want to compute the four-quarter moving average of Company ABC’s sales as of the beginning of the first quarter of 2022. ABCs sales in the previous four quarters were as follows: 1Q 2021, R 1,200,000; 2Q 2021, R 800,000; 3Q 2021, R 750,000; and 4Q 2021, R 1,600,000. Calculate the four-quarter moving average of sales as of the beginning of the first quarter of 2022.

- Florida Company (FC) andMinnesota Company (MC) areboth service companies. Theirstock returns for the past threeyears were as follows: FC: -16 |percent, 24 percent, 22 percent;MC: 19 percent, 19 percent, 31percent, Calculate the correlationcoefficient between the returnsof FC and MC. Multiple Choice-0.461 0.469 0.306 0.000The following information is available for a company's cost of sales over the last five months. MonthUnits soldCost of salesJanuary560$28,600February740$34,000March1,300$46,000April2,560$58,000 Using the high-low method, the estimated total fixed cost is:Philip Inc. expects their sales to increase by $900,000 next month. If their CMR is calculated as 48%, operating income of the next month would be expected to: Group of answer choices Increase by $432,000 Decrease by $468,000 Decrease by $432,000 Increase by $468,000

- The sample data above represent the daily price (Adjusted Close) of Microsoft Corporation (MSFT) and Apple Inc. (AAPL) for the period from February 5, 2022, through February 9, 2022. The standard deviation of MSFT’s returns is approximately A. 0.94%. B. 2.71%. C. 5.97%. D. 9.08%.A company has following details for this yearDetails Total sales($) Total cost($) Details Total sales($) Total cost($)Year ended 31/12/2018 35,78,998 25,89,709Year ended 31/12/2019 48,90,742 31,67,984 Calculate P/V ratio, Fixed cost, break even sales, Margin of safety 2018/2019, Variable cost 2018/2019and percent of fixed cost 2018/2019Attached is a schedule of five proposed changes at the end of the year. ($ in 000s) Before theChange ProposedChange After theChange Net sales $ 18,800,000 (a) $200,000 $ 19,000,000 Cost of goods sold 13,200,000 (b) 400,000 13,600,000 Operating expenses 1,600,000 (c) (100,000) 1,500,000 Other revenue 500,000 (d) 50,000 550,000 Other expense 450,000 (e) (50,000) 400,000 Net income $ 4,050,000 $ 4,050,000 Required:1. Indicate whether each of the proposed changes is conservative, aggressive, or neutral.2. Indicate whether the total effect of all the changes is conservative, aggressive, or neutral.