Q: two periods = 0.83; For three periods = 0.75. What is the present value of the serial bonds on Janua...

A: Bond valuation refers to a method which is used to compute the current value or present value (PV) o...

Q: A debt of $28,400 is repaid by payments of $2,980 made at the end of every six months. Interest is 5...

A: Since you have posted a question with multiple sub-parts, we will solve the first three subparts for...

Q: Assume that you start with a balance of $3900 on your credit card. During the first month you charge...

A: A credit card is a card that is issued by the bank to the users to enable that holder to pay a provi...

Q: Your bank pays 12% interest, compounded quarterly. How much should you deposit now to yield an annui...

A: Present value is the amount that should be deposited to the given yield at each of the three months.

Q: You purchase a bond with an invoice price of $1,045. The bond has a coupon rate of 5.66 percent, it ...

A: A bond is an instrument of debt on which coupons are paid by the issuer. Coupons may be paid in peri...

Q: Consider the following cash flows: Year Cash Flow -$6,600 1,900 3,900 1,700 1,400 What is the paybac...

A: Year Cash flows Cumulative Cash flows 0 (6600) (6600) 1 1900 (4700) 2 3900 (800) 3 1700 900 ...

Q: hedge

A: “Since you have posted a question with multiple sub-parts, we will solve the first three subparts ...

Q: If a broker quotes a price of 111.25 for a bond on September 10, what amount will a client pay per $...

A: Solution : Given, Face value = $1,000 Coupon rate = 7% Accrued interest = Face value * coupon ra...

Q: Consider the following statement: "Jenny Limited has an after-tax cost of deb of 6% at the current t...

A: First we need to calculate cost of debt before tax by using this equation Cost of debt before tax ...

Q: Suppose a team operates in a stadium with 75,000 capacity and currently charges $85 per ticket, and ...

A: Annuity Annuity is a series of equal payment at equal interval for a specific period of time. With a...

Q: Michelle’s savings account earns 6% interest which is compounded semi-annually. For four years, she ...

A: Interest rate = 6% Semi annual interest rate (r) = 6%/2 = 3% Period = 4 Years Semi annual periods (...

Q: 7. In Japan, about 89 percent of transactions involve credit cards, and most Japanese have adopted t...

A: Credit card A credit card is a sort of credit facility offered by banks that permits clients to bor...

Q: An investment project provides cash inflows of $850 per year for five ears. What is the project payb...

A: Annual cash inflow = $850 Initial cost = $5,6004

Q: Define the principles of tapering rates, blanket rates, and commercial zones and the implication of ...

A: The growth of the global economy was aided by international trade. Global events affect and influenc...

Q: 6. Given a nominal rate of 15% čómpounde for 12 years in an ordinary annuity. Determine the followin...

A: The factor is calculated using the required rate of return and for the given period. The factor is d...

Q: A stock has a required rate of return of 13.99%, and it sells for $24.02 per share. The dividend is ...

A: Required return (r) = 13.99% Stock price (P0) = $24.02 Growth rate (g) = 1.6%

Q: An initial investment amount P, an annual interest rate r, and a time t are given. Find the future v...

A: Future value is the compounded value of an initial sum of money. It includes the initial amount as w...

Q: to determine the regular payment amount, rounded to the nearest dollar. Consider the following pair ...

A: Here, Mortgage Amount (P) is $130,000 Compounding Period (n) is Monthly i.e 12 Details of Mortgage A...

Q: Determine the exact simple interest on P 5,000.00 for the period from June 10 2015 to November 21, 2...

A: Simple Interest is calculated using the following formula: = Principal * Rate * Time

Q: or the hat would have been made to sete the bils For maks your answer) shoud be rounded to the neore...

A: Companies gives credit to customers to increase the sales and also give discounts to customers to pa...

Q: A corporation issues 100 sinking fund bonds of P1,000 face value, redeemable at par in 15 years, wit...

A: Given: Number of bonds = 100 Face Value = P1000 number of periods "n" = 15*2 = 30 Semiannual coupon ...

Q: Carol wants to Invest money in a 6% CD that compounds semiannualy Caral would like the account to ha...

A: We need to use Future value table to solve this problem. PV =FV/FV factor Where PV =present value FV...

Q: 9. A retailer buys an item for RM 700. The operating expense are RM120, and the gross profit is 50% ...

A: The selling price decided by a seller for the product is known as the retail price. It is calculated...

Q: Wine and Roses, Incorporated, offers a bond with a coupon of 8.0 percent with semiannual payments an...

A: Face value (FV) = $1000 Coupon rate = 8.0% Semi annual coupon amount (C) = 1000*0.08/2 = $40 Years t...

Q: Microsoft Inc.is currently being sold at $235.75 per share. Rose Gardens found out that last year th...

A: The fair value of stock is equal to the present value of all future dividends to be earned or expect...

Q: A. Assume that you have completed your plans and proformas for the next year of operations. The upco...

A: A: Meaning of :: Weighted average cost of capital (WACC) - It is a calculation of firm's cost of cap...

Q: What is the project's IRR?

A: Internal Rate of Return (IRR) is defined as the minimum rate of return that gives zero valuation to ...

Q: Find the accumulated amount of R538 invested at 9% pa for 5 years.

A: Investment (PV) = R538 Interest rate (r) = 9% Period (n) = 5 Years

Q: Saving cash in the bank is not as attractive as it was in the past, and Big Rock is looking to inves...

A: Markowitz Portfolio Theory was propounded by American Economist Harry Markowitz in the year 1952 in ...

Q: The generator set requires no maintenance until the end of 2 years when P60,000 will be needed for r...

A: Here, At the end of year 2 , maintenance cost is P60,000 From Year 3 to Year 7, Maintenance Cost is ...

Q: How many years are required for Php 1000 to increase by Php 4000 if interest rate is pegged at 15% c...

A: Future value: It represents the future worth of the present sum amount. Future value can be compute...

Q: Jim has an annual income of $300,000. Jim is looking to buy a house with monthly property taxes of $...

A: Here, To Find: Maximum monthly mortgage payment =?

Q: The real risk-free rate is 2.25%. Inflation is expected to be 2.5% this year and 4.25% during the ne...

A: The yield on treasury securities is the rate of return or interest that is paid by the government to...

Q: 1. Compute the cost of equity for this project 2. Compute the relevant cost of debt for this projec...

A: Weighted average cost of capital (WACC) refers to the combined cost of company's capital from all th...

Q: With a required rate of return of 17%, the IRR of a standard capital budgeting project is equal to 1...

A: Internal rate of return is the rate which the NPV of the project is zero. Net present value is the d...

Q: Consider a project with inflows of $20,000 and outflows of $13,000. If the tax rate is 33%, and if t...

A: Annual inflow (A) = $20000 Annual outflow (O) = $13000 Tax rate (T) = 33% Let D = Depreciation

Q: Small businesses use approach(es) like it/they entail(s) minimal investment & risk. * ; due to that ...

A: Since you have asked multiple question, we will solve the first question for you. If you want any sp...

Q: Name the departments, offices, or agencies that were created by the Dodd–Frank legislation.

A: he Dodd-Frank legislation officially became a law in year 2010 that aimed to put restrictions on the...

Q: Jazz World Inc. is considering a project that has the following cash flow and WACC data. What is the...

A: Net Present Value(NPV) is one of the modern techniques of capital budgeting which considers the time...

Q: How did the recession of 2007–2009 compare with other recessions since the Great Depression in terms...

A: The recession of 2007-2009 was a long and deepest recession. During this recession, gross domestic p...

Q: Use to determine the regular payment amount, rounded to the nearest dollar. Consider the following p...

A: The cost of mortgage is equal to the sum of the total cost of interest, closing cost and the cost of...

Q: Yukihira paid a 10% down payment of P200,000 for a restaurant and agreed to pay the balance of month...

A: We need to use the following equation to calculate monthly payment PMT =P*i1-1(1+i)n where PMT=month...

Q: Which of the following is a reason a borrower may want to refinance? O A. The borrower's house value...

A: Credit Score of the borrower is the score which defines credit paying quality of the individual. It ...

Q: Suppose you plan to go on a dream vacation for your anniversary in 7 years from today and you plan t...

A: We need to use future value of ordinary annuity formula to calculate monthly payment to reach goal. ...

Q: to determine the regular payment amount, rounded to the nearest dollar. Consider the following pair ...

A: Mortgage is a value which is taken from external sources for a specific period. This amount is repai...

Q: Find the present value of an annuity P20,000 payable annually for 8 years, with the first payment at...

A: Present Value: The present value is the value of cash flow stream or the fixed lump sum amount at t...

Q: How long will it take for an investment to fivefold its amount if money is worth 14% compounded cont...

A: Interest rate (r) = 14% e = 2.7182818284590452353602874713527 Period = t Future value factor (FVF) =...

Q: Frank plans to set aside money for his young daughter's college tuition. He will deposit money in an...

A: This is a case of ordinary annuity. It means that deposits are being made at the end of the relevant...

Q: a. What will be the principal component of the sixteenth payment? Principal $ b. What will be the in...

A: Loan amortization refers to a schedule which is prepared to shows the periodic loan payments, amount...

Q: ) McGloire Construction is analyzing its capital expenditure proposals for the purchase of equipment...

A: Here, To Find: Payback Period =? NPV =?

Step by step

Solved in 2 steps with 2 images

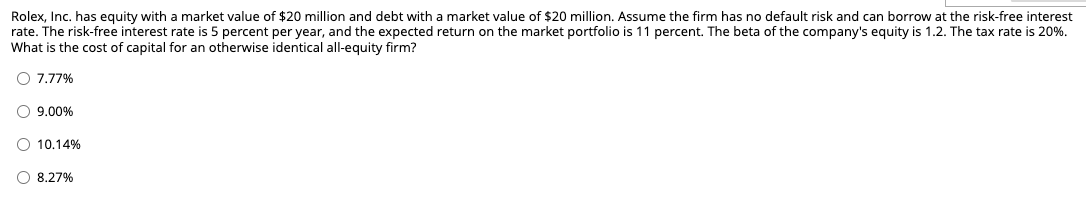

- Ogier Incorporated currently has $800 million in sales, which are projected to grow by 10% in Year 1 and by 5% in Year 2. Its operating profitability ratio (OP) is 10%, and its capital requirement ratio (CR) is 80%? What are the projected sales in Years 1 and 2? What are the projected amounts of net operating profit after taxes (NOPAT) for Years 1 and 2? What are the projected amounts of total net operating capital (OpCap) for Years 1 and 2? What is the projected FCF for Year 2?Liu Industries is a highly levered firm. Suppose there is a large probability that Liu will default on its debt. The value of Lius operations is 4 million. The firms debt consists of 1-year, zero coupon bonds with a face value of 2 million. Lius volatility, , is 0.60, and the risk-free rate rRF is 6%. Because Lius debt is risky, its equity is like a call option and can be valued with the Black-Scholes Option Pricing Model (OPM). (See Chapter 8 for details of the OPM.) (1) What are the values of Lius stock and debt? What is the yield on the debt? (2) What are the values of Lius stock and debt for volatilities of 0.40 and 0.80? What are yields on the debt? (3) What incentives might the manager of Liu have if she understands the relationship between equity value and volatility? What might debtholders do in response?Rolex, Inc. has equity with a market value of $20 million and debt with a market value of $10 million. Assume the firm has no default risk and can borrow at the risk-free interest rate. The risk-free interest rate is 5 percent per year, and the expected return on the market portfolio is 11 percent. The beta of the company's equity is 1.2. The tax rate is 20%. What is the cost of capital for an otherwise identical all-equity firm?

- Rolex, Inc. has equity with a market value of $20 million and debt with a market value of $10million. Assume the firm has no default risk and can borrow at the risk-free interest rate. Therisk-free interest rate is 5 percent per year, and the expected return on the market portfolio is11 percent. The beta of the company's equity is 1.2. The tax rate is 20%. What is the cost ofcapital for an otherwise identical all-equity firm?Rolex, Inc. has equity with a market value of $20 million and debt with a market value of $10million. Assume the firm has no default risk and can borrow at the risk-free interest rate. Therisk-free interest rate is 5 percent per year, and the expected return on the market portfolio is11 percent. The beta of the company's equity is 1.2. The tax rate is 20%. What is the cost ofcapital for an otherwise identical all-equity firm? handwrite please