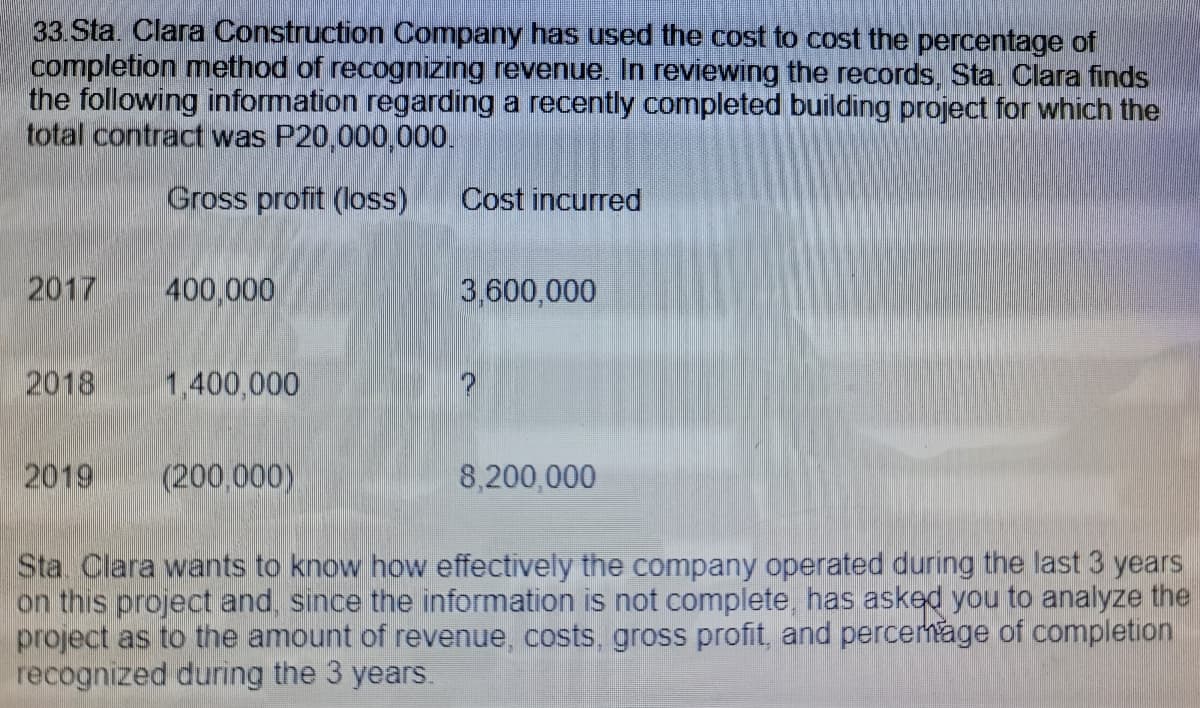

33.Sta. Clara Construction Company has used the cost to cost the percentage of completion method of recognizing revenue. In reviewing the records, Sta. Clara finds the following information regarding a recently completed building project for which the total contract was P20,000,000. Gross profit (loss) Cost incurred 2017 400,000 3,600,000 2018 1,400,000 2019 (200,000) 8,200,000 Sta. Clara wants to know how effectively the company operated during the last 3 years on this project and, since the information is not complete, has asked you to analyze the project as to the amount of revenue, costs, gross profit, and percermage of completion recognized during the 3 years.

33.Sta. Clara Construction Company has used the cost to cost the percentage of completion method of recognizing revenue. In reviewing the records, Sta. Clara finds the following information regarding a recently completed building project for which the total contract was P20,000,000. Gross profit (loss) Cost incurred 2017 400,000 3,600,000 2018 1,400,000 2019 (200,000) 8,200,000 Sta. Clara wants to know how effectively the company operated during the last 3 years on this project and, since the information is not complete, has asked you to analyze the project as to the amount of revenue, costs, gross profit, and percermage of completion recognized during the 3 years.

Chapter16: Accounting Periods And Methods

Section: Chapter Questions

Problem 40P

Related questions

Question

CHAIN PROBLEM

1. What is the percentage of completion in 2017?

2. How much is the cost incurred in 2018?

3. What is the percentage of completion in 2018?

4. How much is the total estimated cost to complete in 2018?

5. How much is the total estimated gross profit in 2018?

Please refer to the picture below to answer the question.

Transcribed Image Text:33.Sta. Clara Construction Company has used the cost to cost the percentage of

completion method of recognizing revenue. In reviewing the records, Sta. Clara finds

the following information regarding a recently completed building project for which the

total contract was P20,000,000.

Gross profit (loss)

Cost incurred

2017

400,000

3,600,000

2018

1,400,000

2019

(200,000)

8,200,000

Sta Clara wants to know how effectively the company operated during the last 3 years

on this project and, since the information is not complete, has asked you to analyze the

project as to the amount of revenue, costs, gross profit, and percemage of completion

recognized during the 3 years.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 3 images

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT