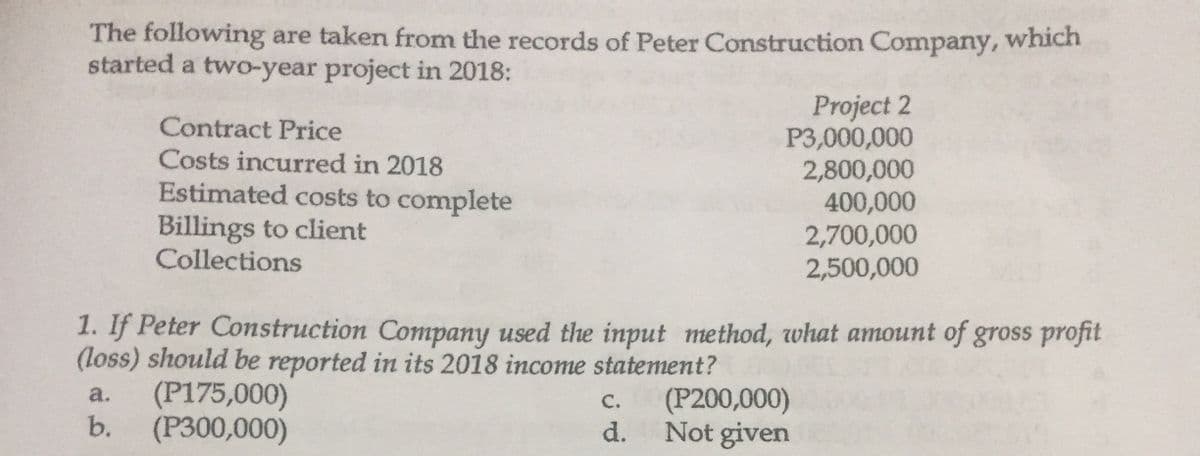

The following are taken from the records of Peter Construction Company, which started a two-year project in 2018: Contract Price Costs incurred in 2018 Estimated costs to complete Billings to client Collections Project 2 P3,000,000 2,800,000 400,000 2,700,000 2,500,000 1. If Peter Construction Company used the input method, what amount of gross profit (loss) should be reported in its 2018 income statement?

The following are taken from the records of Peter Construction Company, which started a two-year project in 2018: Contract Price Costs incurred in 2018 Estimated costs to complete Billings to client Collections Project 2 P3,000,000 2,800,000 400,000 2,700,000 2,500,000 1. If Peter Construction Company used the input method, what amount of gross profit (loss) should be reported in its 2018 income statement?

Financial Accounting Intro Concepts Meth/Uses

14th Edition

ISBN:9781285595047

Author:Weil

Publisher:Weil

Chapter8: Revenue Recognition, Receivables, And Advances From Customers

Section: Chapter Questions

Problem 34E

Related questions

Question

Transcribed Image Text:The following are taken from the records of Peter Construction Company, which

started a two-year project in 2018:

Project 2

P3,000,000

2,800,000

400,000

2,700,000

2,500,000

Contract Price

Costs incurred in 2018

Estimated costs to complete

Billings to client

Collections

1. If Peter Construction Company used the input method, what amount of gross profit

(loss) should be reported in its 2018 income statement?

(P175,000)

b.

a.

(P200,000)

с.

(P300,000)

d.

Not given

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT