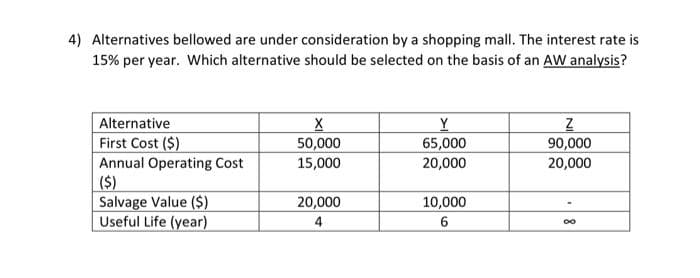

4) Alternatives bellowed are under consideration by a shopping mall. The interest rate is 15% per year. Which alternative should be selected on the basis of an AW analysis? Alternative First Cost ($) Annual Operating Cost ($) Salvage Value ($) Useful Life (year) X 50,000 15,000 20,000 Y 65,000 20,000 10,000 6 Z 90,000 20,000

Q: Ceteris paribus, a change in which of the following would be LEAST likely to cause a shift in the…

A: The sweater market, like every other market, has buyers as well as sellers. Consumers are either…

Q: Ming lives in Seattle and recently bought a $125 ticket to attend a Seattle Seahawks game. He is a…

A: Opportunity cost is the value of the next best option that is lost or given up when a choice is made…

Q: Year Government Purchases Government Taxes Real GDP 1 317 238 5,658 2 382 207 5,697 Suppose there…

A: The public deficit refers to the excess of government expenditure over its revenue. Public deficit…

Q: How might the price of corn affect the supply of wheat?

A: The price of corn can potentially have an impact on the supply of wheat through diverse mechanisms,…

Q: Q5. A bicycle manufacturer in China currently employs 40 production workers and five supervisors and…

A: Marginal product:- When additional output created one more unit of an input is added to the…

Q: Natural monopolies, externalities, and imperfect information are all examples of: Antitrust…

A: Monopoly markets are generally considered inefficient from a social welfare perspective because they…

Q: 1) Show that the firms risk preferences exhibit constant absolute risk aversion (CARA) 2) When 0-0.1…

A: Absolute risk aversion is a measure of how much a person dislikes risk, and it is calculated as the…

Q: Balance of Payments Exports of goods Imports of goods Exports of services Imports of services Net…

A: The difference between the valuation of exports and imports in an economy over a specific period,…

Q: Suppose the economy is initially in long-run equilibrium. The Fed decides to increase the required…

A: In economics, long-run equilibrium refers to a state in which a market or an economy has reached a…

Q: In equilibrium U′(Yt)qe t = δEt[U′(Yt+1)(qe t+1 + ˜ Yt+1)] holds. Assume the following: .…

A: Dynamic stochastic general equilibrium (DSGE) is a framework used in…

Q: P* Pw Pdump better off worse off better off worse off a b d DC 1 Q Germans are able to buy steel on…

A: Dumping, in the field of economics, refers to the act of selling products in a foreign market at a…

Q: E (4000, 0) 4000 5000 1000 2000 3000 Other Goods (units per year) a. If as much health care as…

A: Opportunity cost describes the forgone of potential benefit when choosing one option over the other…

Q: 1.1 Does the money demand curve have a positive slope or a negative slope? Why does it have this…

A: The Money Demand Curve is a graphical representation of the relationship between money demanded in…

Q: How does the plastic pollute the environment in Bangladesh during the year 2018-2022. Detail…

A: Plastic Pollution: refers to the environmental issue caused by the accumulation of plastics waste in…

Q: What is the value of actual GDP? What is the value of the GDP deflator? Assume that people and…

A: Since you have posted a question with multiple sub-parts, we will provide the solution to only the…

Q: During the droughts that periodically plague California, farmers in that state are able to purchase…

A: In California, during periods of drought, farmers are allowed to purchase subsidized water for…

Q: Hook Look at the tables below. Person Bob Barb Bill Bart Brent Betty Maximum Price Willing to Pay…

A: The utmost price a buyer will pay for a product is known as their maximum willingness to pay.…

Q: for the unique equilibrium (r",Y). You should also assume that f' (Y) = (0, 1) (Why?). Find dr/d Mo…

A: This question is about the IS-LM model, which is a macroeconomic model that represents the…

Q: 4. The equation representing debt dynamics for an economy can be written as follows. Gt-Tt Yt b₁ = a…

A: Debt dynamic equation : bt = a + (r -g)*bt-1Where , a = (Gt - Tt)/Yt , bt = Debt to GDP ratio For…

Q: The following table presents the price and aggregate quantity of some goods in an economy in 2016…

A: CPI is a measure of the average price level of goods and services consumed by households or…

Q: Consider Bernard \ Mary Left Center Right Top 0,5 1,0 2,2 Bottom 1,0 0,3 2,2 The first number in a…

A: Nash equilibrium is the point where best response of both players intersect

Q: What would your decision be if the following rules are applied? (show your calculation) Maximax…

A: Finding:MaximaxMaximinLa PlaceMinimax-regret

Q: Suppose you are about to borrow $15,000 for four years to buy a new car. Briefly explain which of…

A: Interest rate is the price of the loanable funds in the market.It can be in real and nominal terms.…

Q: the only aim of the economy is to keep the equilibrium output level at the level of potential output…

A: IS curve represents the product market output-interest rate combinations where the aggregate demand…

Q: Company A has fixed expenses of $15,000 per year and each unit of product has a $0.20 variable cost.…

A: Break even is the point where the cost of producing by one is equal to the cost of producing by…

Q: Consider the following extensive form game. The Subgame Perfect Equilibrium (SPE) of the game is (2)…

A: Subgame perfect equilibrium is a solution concept in game theory that refines the concept of Nash…

Q: Other things remain unchanged, a country's Aggregate Demand is made up of $100 billion of…

A: Aggregate demand (ad) is the total spending in an economy, consisting of consumption (C), investment…

Q: The Return of Detroit City: Enpar manufactures engine parts for Ford using steel as an input. Enpar…

A: The technological relationship between factors of production, such as labor, capital, and raw…

Q: Expected growth in real GDP = -2%; inflation = 1%

A: Here, the GDP implies the value of all the commodities and services provided in the economy by the…

Q: Give only typing answer with explanation and conclusion The elasticity of the house value with…

A: elasticity of the house value with respect to the concentration level of PM10= (% change in the…

Q: 2. Real versus nominal GDP Consider a simple economy that produces two goods: plastic cups and…

A: Nominal GDP = Current year quantity * current year pricesReal GDP = Current year quantity * base…

Q: Tables 1 and 2 below are drawn from the article by Bunn P., Ellis C., (2012), "Examining the…

A: Inflation refers to the rise in the general price level that affects the buying power of consumers…

Q: With the help of appropriate diagram, explain the effect of an increase in specific tax on…

A: A specific tax is an indirect tax charged at a fixed rate on sales of a good or service.

Q: Suppose that the economy is characterized by the following behavioral equations: C = 180 +0.6YD…

A: Aggregate demand refers to the total demand for different goods and services raised by all the…

Q: E. Cerive the intertemporal optimality condition. Hint: What is the MRS = MU/MUC? (a) Hint 1: A…

A:

Q: Using the information below compute the M2 money supply. The M2 money supply is $ Category Currency…

A: M2 money supply describes the measure of money which includes cash, checking deposits, savings…

Q: what is one function of the government other than correcting externalities?

A: An externality refers to the impact of economic activity on parties that are not directly involved…

Q: The market for burritos in a college town is shown to the right. Due to concern about the…

A: Consumption in economics means to the utilization or expenditure of goods and services by…

Q: In the basic Keynesian model, fiscal policy should not cause an increase in the public debt.…

A: In the basic Keynesian model, fiscal policy is designed to stimulate the economy during times of…

Q: If nominal money demand is proportional to nominal income, by how much will real money demand…

A: To calculate the increase in real money demand when real income rises by 10%, we need to consider…

Q: Let F be the fixed cost of production, let VC be the variable cost of production, C be the total…

A: A tabular representation or a chart that outlines the relationship between the level of output or…

Q: . Explain insightful interpretations of the data, connecting it to the broader context of the issue…

A: Poverty is a state or condition where individuals come up short on monetary assets and basics for a…

Q: What are the differences between less and more economically developed countries in relation to…

A: Sustainability alludes to the act of addressing the necessities of the current generation without…

Q: 1. Individual Problems 17-1 Malaysia You're the manager of global opportunities for a U.S.…

A: To calculate the expected number of units sold and expected profit for each market, we need to…

Q: 2. Looking at the January 2020 yield curve, which of the following is true? a Investors expect an…

A: A yield curve is a graphical representation of the interest rates (or yields) of fixed-income…

Q: xplain fully how the AS/AD model is an update of the Keynesian model. Provide a graph of the…

A: This question is asking about the relationship between the AS/AD model and the Keynesian model, and…

Q: Suppose the economy is initially in long-run equilibrium. The government enacts a policy to decrease…

A: Keynesian theory developed by the economist John Maynard Keynes, proposes the government's…

Q: In a monopolistically competitive market, as new firms continue to enter, the demand that a typical…

A: A monopolistic market is a market structure characterized by a single firm or seller dominating the…

Q: Why study economics to be an informed citizen

A: A social science that examines how individuals, firms, governments, and societies make choices…

Q: Suppose that the central bank for this economy has decided that inflation is too high and thus wants…

A: Suppose that the central Bank for this economy decided that the inflation is too high and thus wants…

Give typing answer with explanation and conclusion

Step by step

Solved in 3 steps

- Municipal Engineer wants to evaluate three alternatives for supplementing the water supply. 1st alternative – continue deep well pumping at an annual cost of $10,500 2nd alternative – install a 10” pipeline from a surface reservoir. First cost is $25,000 and annual pumping cost is $7,000 3rd alternative – install a 20” pipeline from the reservoir. First cost of $34,000 and annual pumping cost of $5,000. Life of all alternatives is 20 years. For the second and third alternatives, salvage value is 10% of first cost. With interest at 8%, which alternative should the engineer recommend? Use present worth analysis PW (deepwell) = ? PW (10”pipeline) = ? PW (20”pipeline) = ?Consider these two alternatives.Alternative A Alternative BCapital investment OMR 6000 7500Annual revenues OMR 1800 2250Annual expenses OMR 500 750Estimated market valueOMR1200 1600Useful life 10 10MARR 12% 1. Recommend which alternative should be selected.2. How much capital investment of the expensive alternative have to vary so that theinitial decision would be reversed.For these two AW relations, the breakeven point QBE in miles per year is closest to:AW1=-23,000(A/P,10%,10) + 4000(A/F,10%, 10) - 5000 - 4QBEAW2 =-8000(A/P,10%,4) - 2000 - 6QBEa. 1984b. 1224c. 1090d. 655

- ENGINNERING ECONOMICS A school building requires repainting. The surface area to be repainted is 1, 744 sq. mtrs. Two kinds of paint are available whose brands are A and B. Paint A cost ₱40 per sq. m. but needs renewal at the end of 4 yrs., while paint B cost ₱265 per sq. m. If money is worth 12% effective, how often should paint B be renewed so that it will be economical as paint A?(engineering economic) A contractor gets a large project that is expected to last for 10 years, during which the project takes a special tool that he does not have. There are two offers of tools to the contractor, both of which can meet their needs, namely: Determine which tool is more profitable to buy based on i = 15% by using: a. Annual Value Analysis with repeatability assumption b. Annual Value Analysis with the purchase price of alternative X at the time of replacement there is an increase of 20%Fitzgerald, Ivy, Garcia, Nichols, Eudy, Williams, Thomas, Owens, and Nagy (FIGNEWTON) Inc. must replace its fig - crushing equipment. The alternatives under consideration are presented below. Alternative First Cost Net Annual Benefits Useful Life A $170, 500 $14, 675 5 years B 205,000 17,000 7 years C 242,500 16, 350 8 years D 290,000 14,825 10 years a) Which anlaysis method should be used to select the alternative? b) Why should that analysis method be used? c) if FIGNEWTON uses a MARR of 8%, what alternative should be chosen? d) if FIGNEWTON uses a MARR of 18%, what alternative should be chosen? Submit one excel file with answers a), b), c) and d) highlighted clearly.

- Engineering economy - ENGR 3322 The International Parcel Service has installed a new radio frequency identification system to help reduce the number of packages that are incorrectly delivered. The capital investment in the system is $65,000, and the projected annual savings are tabled below. The system’s market value at the EOY five is negligible, and the MARR is 18% per year. Calculate the present worth of the project. a. $ 35,730 b. $ 36,730 c. $ 37,730 d. None of the choicesPlz, solve this question Economic Engineering There are two alternatives for purchasing a concrete mixer. Both the alternatives have same useful life. The cash flow details of alternative are as follows; Alternative 1: Initial Purchase Cost= Rs3,00,000, annual operating and maintenance cost = Rs20,000, Annual revenue= Rs50000, Expected salvage value = Rs125,000; useful life = 5 years. Alternative 2: Initial Purchase Cost = Rs2,00,000, annual operating and maintenance cost = Rs35,000, Annual revenue= Rs45000, Expected salvage value = Rs70,000, useful life = 5 years. Use Present Worth method to evaluate the alternatives and recommend the best option, if the rate of interest is 10% per yearA contractor has a 4-year concrete mixer whose first cost was $6,000, having 3 more years to live before being scrapped and sold at $801. Itcould now be sold for $11,922. It has an annual cost for operation and maintenance of $9,352. Its replacement is being proposed with a newmachine whose first cost will be $8,000 having a life of 9 years and salvage value $1,600. It has an operating cost of $800 per year andmaintenance cost of $320 per year. Ifthe interest is 20% cpd-a, what is the Annual Equivalent Cost of the Old Machine? 14,792

- It is proposed to place a cable on existing pole line along the shore of a lake to connect two points on opposite sides. Which is more economical? Compare alternatives using the following methods:a) ROR on Additional Investment Methodb) Annual Cost Methodc) Equivalent Uniform Annual Cost Methodd) Present Worth Cost Method Show complete manual solutionΔRoR for the first increment (Alt. C-Alt. A) is ___________________. Alt. A Alt. B Alt. C Initial cost $5,000 9,000 7,500 Annual benefits $1,457 2,518 2,133 RoR 14% 12.4% 13% Life in years 5 Group of answer choices 10.12% 11.00 11.85% 9.38%If produced by Method A, a product’s initial capital cost will be $100,000, its annual operating cost will be $20,000, and its salvage value after 3 years will be $20,000. With Method B there is a first cost of $150,000, an annual operating cost of $10,000, and a $50,000 salvage value after its 3-year life. Based on a present worth analysis at a 15% interest rate, which method should be used?