4) HOTELLING PRICES: MOVIE TICKETS Movie theatre firms F1 and F2 are showing the same movie and have located at L1=0 and L2=1, the two ends of a one-mile-long street. On this street there are signposts every 1/5th mile (at 0, 0.2, 0.4, 0.6, 0.8, and 1), and there are 100 movie fans unevenly distributed as shown in the diagram below. Each group of fans sits halfway between two adjacent signposts, so there are 10 fans at 0.1, 30 at 0.3, and so on. Each movie fan will buy a ticket from the nearest theatre, but only if the following buying condition holds: v≥p+ tlx – yl, where v is the customer's valuation (or willingness to pay), x is the customer's location, y is a theatre's location, and t/x – y/ is a measure of the physical travel cost from x to y. If both theatres are within a fan group's acceptable travel distance, the fans choose the theatre that maximizes consumer surplus: CS = v − p − t|x − y| = valuation - total cost. Assume that v = 10, t = 10, and F2's price is P2 = 5 in this Hotelling pricing model (that has fixed locations). Assume prices are integers between 3 and 7: Pi = {3,4,5,6,7}, for i = 1,2. a) Find F1's profit (revenue) if it undercuts F2's price by setting price P1 = 3. b) Find F1's profit if it matches F2's price by setting P1 = 5. Find F1's profit if it sets a relatively high price of P1 = 7. - Of the three prices we tested in parts (a)-(c), what is P1*, F1's best response to its rival's price of P2 = 5? We have only analyzed F1's choices of this market. Does F2 charge P2 = 5 in a Nash Equilibrium? HINT: For (P1=7, P2=5) to be a Nash Equilibrium, each price must be a best response to the other. Clearly show that P2=5 generates higher revenue for F2 than the other prices (or that it does not!). 10 fans at 0.1 30 fans at 0.3 20 fans at 0.5 30 fans 10 fans at 0.7 at 0.9 0 0.2 0.4 0.6 0.8 8:0 L1=0 1 L2=1

4) HOTELLING PRICES: MOVIE TICKETS Movie theatre firms F1 and F2 are showing the same movie and have located at L1=0 and L2=1, the two ends of a one-mile-long street. On this street there are signposts every 1/5th mile (at 0, 0.2, 0.4, 0.6, 0.8, and 1), and there are 100 movie fans unevenly distributed as shown in the diagram below. Each group of fans sits halfway between two adjacent signposts, so there are 10 fans at 0.1, 30 at 0.3, and so on. Each movie fan will buy a ticket from the nearest theatre, but only if the following buying condition holds: v≥p+ tlx – yl, where v is the customer's valuation (or willingness to pay), x is the customer's location, y is a theatre's location, and t/x – y/ is a measure of the physical travel cost from x to y. If both theatres are within a fan group's acceptable travel distance, the fans choose the theatre that maximizes consumer surplus: CS = v − p − t|x − y| = valuation - total cost. Assume that v = 10, t = 10, and F2's price is P2 = 5 in this Hotelling pricing model (that has fixed locations). Assume prices are integers between 3 and 7: Pi = {3,4,5,6,7}, for i = 1,2. a) Find F1's profit (revenue) if it undercuts F2's price by setting price P1 = 3. b) Find F1's profit if it matches F2's price by setting P1 = 5. Find F1's profit if it sets a relatively high price of P1 = 7. - Of the three prices we tested in parts (a)-(c), what is P1*, F1's best response to its rival's price of P2 = 5? We have only analyzed F1's choices of this market. Does F2 charge P2 = 5 in a Nash Equilibrium? HINT: For (P1=7, P2=5) to be a Nash Equilibrium, each price must be a best response to the other. Clearly show that P2=5 generates higher revenue for F2 than the other prices (or that it does not!). 10 fans at 0.1 30 fans at 0.3 20 fans at 0.5 30 fans 10 fans at 0.7 at 0.9 0 0.2 0.4 0.6 0.8 8:0 L1=0 1 L2=1

Chapter1: Making Economics Decisions

Section: Chapter Questions

Problem 1QTC

Question

Transcribed Image Text:4) HOTELLING PRICES: MOVIE TICKETS

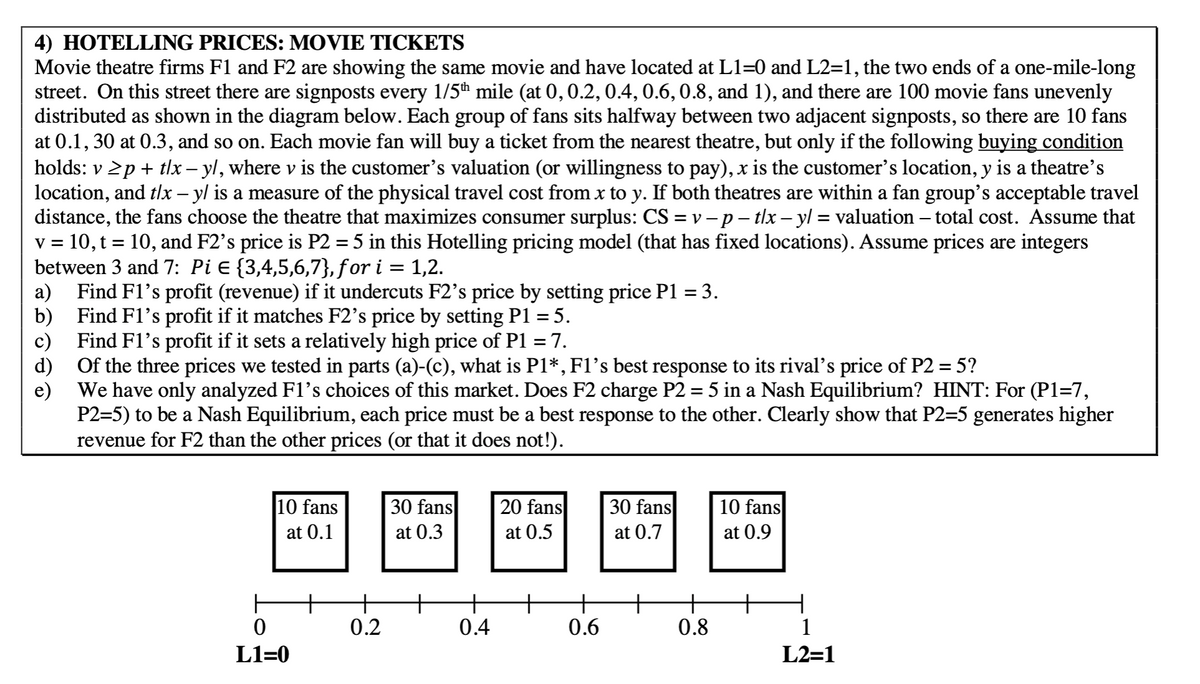

Movie theatre firms F1 and F2 are showing the same movie and have located at L1=0 and L2=1, the two ends of a one-mile-long

street. On this street there are signposts every 1/5th mile (at 0, 0.2, 0.4, 0.6, 0.8, and 1), and there are 100 movie fans unevenly

distributed as shown in the diagram below. Each group of fans sits halfway between two adjacent signposts, so there are 10 fans

at 0.1, 30 at 0.3, and so on. Each movie fan will buy a ticket from the nearest theatre, but only if the following buying condition

holds: v≥p+ tlx – yl, where v is the customer's valuation (or willingness to pay), x is the customer's location, y is a theatre's

location, and t/x – y/ is a measure of the physical travel cost from x to y. If both theatres are within a fan group's acceptable travel

distance, the fans choose the theatre that maximizes consumer surplus: CS = v − p − t|x − y| = valuation - total cost. Assume that

v = 10, t = 10, and F2's price is P2 = 5 in this Hotelling pricing model (that has fixed locations). Assume prices are integers

between 3 and 7: Pi = {3,4,5,6,7}, for i = 1,2.

a)

Find F1's profit (revenue) if it undercuts F2's price by setting price P1 = 3.

b) Find F1's profit if it matches F2's price by setting P1 = 5.

Find F1's profit if it sets a relatively high price of P1 = 7.

-

Of the three prices we tested in parts (a)-(c), what is P1*, F1's best response to its rival's price of P2 = 5?

We have only analyzed F1's choices of this market. Does F2 charge P2 = 5 in a Nash Equilibrium? HINT: For (P1=7,

P2=5) to be a Nash Equilibrium, each price must be a best response to the other. Clearly show that P2=5 generates higher

revenue for F2 than the other prices (or that it does not!).

10 fans

at 0.1

30 fans

at 0.3

20 fans

at 0.5

30 fans

10 fans

at 0.7

at 0.9

0

0.2

0.4

0.6

0.8

8:0

L1=0

1

L2=1

AI-Generated Solution

Unlock instant AI solutions

Tap the button

to generate a solution

Recommended textbooks for you

Principles of Economics (12th Edition)

Economics

ISBN:

9780134078779

Author:

Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:

PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:

9780134870069

Author:

William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:

PEARSON

Principles of Economics (12th Edition)

Economics

ISBN:

9780134078779

Author:

Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:

PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:

9780134870069

Author:

William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:

PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:

9781305585126

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:

9781337106665

Author:

Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:

Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-…

Economics

ISBN:

9781259290619

Author:

Michael Baye, Jeff Prince

Publisher:

McGraw-Hill Education