4. A large corporation has invested $1 million in certificate of de- posits (CD). The CDs py 8% per year compounded semiannu- ally. How much will the CDs be worth in 8 years? 5. Jerry would like to purchase a new car in 4 years. He deposits $3,500 in an account that pays 7% per year compounded monthly. How much will he have towards the purchase of the car in 4 years?

4. A large corporation has invested $1 million in certificate of de- posits (CD). The CDs py 8% per year compounded semiannu- ally. How much will the CDs be worth in 8 years? 5. Jerry would like to purchase a new car in 4 years. He deposits $3,500 in an account that pays 7% per year compounded monthly. How much will he have towards the purchase of the car in 4 years?

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter9: Current Liabilities, Contingencies, And The Time Value Of Money

Section: Chapter Questions

Problem 9.19E

Related questions

Question

4 and 5 please

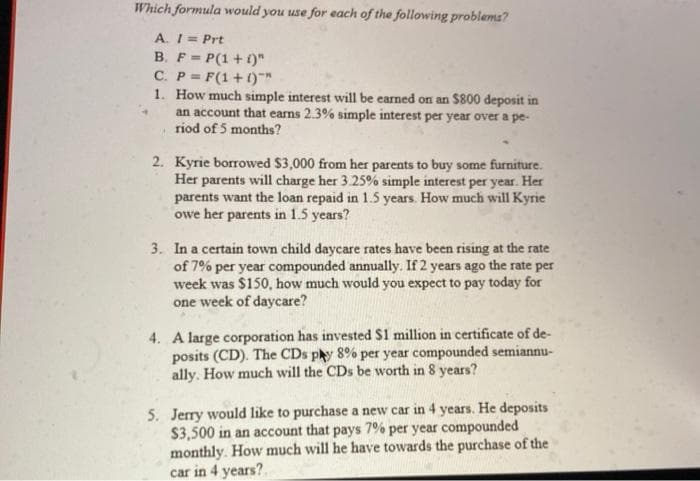

Transcribed Image Text:Which formula would you use for each of the following problems?

A. I= Prt

B. F= P(1 +1)"

!!

C. P= F(1+1)*

1. How much simple interest will be earned on an $800 deposit in

an account that earns 2.3% simple interest per year over a pe-

riod of 5 months?

2. Kyrie borrowed $3,000 from her parents to buy some furniture.

Her parents will charge her 3.25% simple interest per year. Her

parents want the loan repaid in 1.5 years. How much will Kyrie

owe her parents in 1.5 years?

3. In a certain town child daycare rates have been rising at the rate

of 7% per year compounded annually. If 2 years ago the rate per

week was $150, how much would you expect to pay today for

one week of daycare?

4. A large corporation has invested $1 million in certificate of de-

posits (CD). The CDs py 8% per year compounded semiannu-

ally. How much will the CDs be worth in 8 years?

5. Jerry would like to purchase a new car in 4 years. He deposits

$3,500 in an account that pays 7% per year compounded

monthly. How much will he have towards the purchase of the

car in 4 years?.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning